X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 14 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 41,304 times.

Having an emergency fund readily available at all times is invariably a good idea. It can protect you in a time of job loss or during a natural disaster period that directly impacts your living arrangements. Experts recommend having three to six months of expenses put aside so that you can rely on these savings to buffer you in an emergency.[1] Take these steps to start preparing your emergency fund.

Steps

Part 1

Part 1 of 3:

Determining the Budget for an Emergency Fund

-

1Do some number crunching and planning. Some questions you should answer:

- How much do I save? How much do I spend? Create an income statement and balance sheet so that you know how much money is coming and going from your bank account.

- How much do I make per month? This is the amount of money you get after all the taxes have been taken out.

- Am I saving for retirement? You could ask your company HR to take some money out of your paycheck and save in a retirement savings account and then give you your paycheck. You will have one less thing to worry about.

- How big do I want my emergency fund? It is usually recommended in various websites and books to save for about 3-6 months of your monthly expenses. This is very important because your decision will define your budget.

-

2Create a budget. Once you know how much you want to or you feel you need to save, you have to plan to save it.

- For example: You have monthly expenses of about $1500/month and you want to save for 3 months. That would mean that you need to save $4500 (1500x3). However, you will have to take into account your expenses to determine how long it will take you to save that much money. If you find that there is no money left after at the end of the month to put into the savings account - you pay yourself first.

-

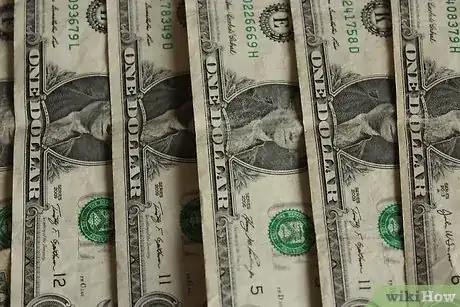

3Make a change in your account. If you don't have a savings account, create one. Then start small. It takes time to accumulate enough money for 3-6 months of expenses.

- Look for the highest yielding interest account you can find that doesn't penalize you for early withdrawal of savings funds. Remember that the purpose of having an emergency fund is liquidity: the ability to use your fund at any time.

- Online banks often have higher savings rates than ones with shopfronts. Be sure to shop around and if you can take advantage of a bank that is paying you to open an account with them, jump for it.

-

4Ask the bank to take out a set amount of money every month on a specific day (automatic transfer). Start by what you can do...if you could only put aside $10/week, do it. The important thing is to save consistently and diligently. Regular transfers will slowly build a fund.

-

5Set up automatic payments into your savings account. Have a certain amount of each paycheck going into savings. Doing this makes it harder for you to spend the money and you'll feel reticent to reduce it when you know it's earmarked for your emergency fund.

-

6Increase the additions to the fund. As you decrease your spending habits, you might consider increasing the amount you are transferring to your savings account. Could you increase the amount to $15 or more per week?

- If you have a term deposit, consider breaking it into smaller amounts and staggering their end dates, so that if an emergency arises, you only have to break one of your longer-term investments and only lose interest on that investment and not the others.

Part 2

Part 2 of 3:

Finding the Money for the Emergency Fund

-

1Increase your take home pay. This can be done in various ways:

- If you are paying into a 401k (superannuation in the USA) or other retirement savings program, as well as any other voluntary pay deductions, temporarily cease or decrease those contributions until you have built up your emergency fund. As soon as you have built up enough savings, restore the contributions.

- If you usually get a tax refund, ask your employer to decrease the amount of taxes you have withheld from your paycheck.

- If available, consider working some overtime or doing some freelance work. If it's not too tiring or conflicting with your day job, you might also consider a little weekend or holiday work doing something else you're good at, such as working with a local retailer.

-

2Attempt to live on less. If you are already accomplished at doing this, in the event of a disaster, your expenses will be lower already, and you will only need a smaller emergency fund.

- Cook more food at home instead of eating out. This can help you save money and eat more healthfully.

- Grow as much of your own food as possible by dedicating one portion of your garden to edible plants. If you're not a keen gardener or you have small space, grow easy plants like tomatoes and summer squash in containers.

-

3Know the value of having insurance as a standard means for protecting yourself against uncertainty but never overextend your finances by paying too much either. Shop around for the best insurance rates and check for better deals regularly. There is no need to feel loyal to one insurance provider over another; keep your own interests at the forefront.

- Have house insurance, contents insurance, and car insurance. Although good, you can pass on life insurance if you can't afford it currently but keep it in mind for later. Income protection insurance is another good consideration alongside your emergency fund. And if you are in a country where health care is expensive and your employer isn't funding health insurance, you'll need this as well.

- Lower your insurance rates by raising your deductibles, the amount you pay out of pocket before your insurance kicks in. Higher deductibles mean lower monthly premiums.

- Also consider whether you're insured for things that are no longer relevant; staying updated is important, such as when you change cars or houses.

-

4Consider selling valuables you no longer want through online classifieds sites. Sites like Craigslist and auction sites like eBay and Trademe can be great ways to get rid of stuff you don't need anymore and to turn it into emergency fund cash.

- Consider opening an account that is solely meant for direct payments into it from auction and online sales, whether by direct debit from customers or via Paypal.

- Don't forget the yard or garage sale. These can often be better for large items you're not prepared to ship, like lawnmowers, lounge suites, and bulk clothing.

Part 3

Part 3 of 3:

Keeping the Emergency Fund Intact

-

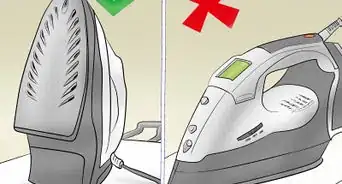

1Avoid touching your savings account until you are in a real emergency. This part is important because you need to define what an emergency actually is and is not. An emergency is not that last pair ever of your most favorite shoes on sale nor is it when a friend comes telling you a tale of financial woe. This is about your emergency savings that will protect you, not your wardrobe or your friends. An emergency is:

- A natural disaster that causes you to have to leave your living arrangements temporarily or permanently

- Job loss or a massive cut-back in hours

- A sudden immediate family illness for which you're responsible for meeting payment costs

- Invasion (war), or civil unrest, especially if you need to vacate or stockpile, and so forth.

-

2Aim to have a plan for an increasing level of savings in place at all times. After you have developed an emergency fund, work on reducing your sense of fear and worry that you're only a few steps away from destitution. Some of the things you can do include:

- Deal with your emotional issues around money, especially if you over-spend or hide money from your spouse.

- Get used to using a budget; this cannot be over-stressed!

- Do not spend more than what you earn. Having more stuff that causes you to go into debt is a very poor plan for living a fulfilled and worry-free life.

- Put your savings ahead of your splurging. If you feel a sense of financial deprivation, again you'll need to deal with your emotional issues.

Warnings

- Reducing your 401k contributions will usually lead to higher tax obligations. Be sure to be consider these in your planning.⧼thumbs_response⧽

- Don't create an emergency fund at the expense of increasing your credit debt. Put aside what you can afford and do not go into debt even further.⧼thumbs_response⧽

- There are no quick schemes...do not put your money into anything that you don't understand. If you don't understand the stock market, don't invest in the stock market. Knowing how your money is being saved will help you sleep better at night.⧼thumbs_response⧽

- You can't afford to not have an emergency fund, even during college years.[3]⧼thumbs_response⧽

- Money earned through side-work or moonlighting is taxable income. Know the rules regarding your tax liabilities (including potentially having to pay an amount to your government quarterly) on money earned through such work. Talk to a CPA or other Tax Advisor if you are unsure about the laws where you live.⧼thumbs_response⧽

Things You'll Need

- Savings account

- Small bills tucked away for a natural disaster or health scare emergency

References

- ↑ JD Roth, How and why to start an emergency fund, http://www.getrichslowly.org/blog/2006/09/08/how-to-start-an-emergency-fund/

- ↑ Kathy Harrison, Just in case: How to be self-sufficient when the unexpected happens, p. 99, (2008), ISBN 978-1-60342-035-8

- ↑ JD Roth, How and why to start an emergency fund, http://www.getrichslowly.org/blog/2006/09/08/how-to-start-an-emergency-fund/