This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 9,810 times.

When you want to receive money via wire transfer, there are a few different ways to do it. The most traditional method is to receive a transfer from the sender’s bank to your bank account. Another easy way is to use a service with brick-and-mortar offices to get money transferred for cash pick-up or directly into your bank account. Finally, there are also many online services and apps that you can use to send and receive money quickly. Whatever you choose, make sure it’s something both you and the sender can do from where you are located.

Steps

Receiving a Bank-to-Bank Wire Transfer

-

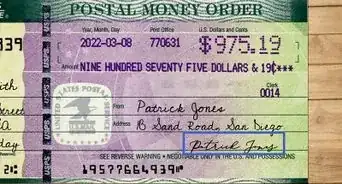

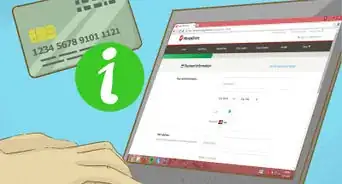

1Collect the info you need to receive a domestic wire transfer at your bank. Call your bank or check the bank’s website to find out the exact details you need to give to the person you want to receive a domestic wire transfer from. You will need at least all of the following details: your full account number, your name exactly how it appears on your account, the name of your bank, the address of your bank branch, and a wire routing transfer number.[1]

- A wire routing transit number is also known as an American Banking Association (ABA) number in the United States or as a Bank Transit Number (BTN). It is a 9-digit number that you can usually look up on your bank’s website or in the bottom left-hand corner of your checkbook.

Tip: Keep in mind that your bank might have fees and limits for wire transfers, so make sure you know what these are as well before you go ahead with the process. If you are receiving an international transfer, you can also ask what exchange rate your bank will use for the currency you plan to receive.

-

2Gather the info you need in order to receive an international wire transfer. The requirements for receiving an international wire transfer are slightly different than for receiving a domestic wire transfer. You will also need at least a SWIFT code in addition to all the other information.[2]

- SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. You can usually look up your bank’s SWIFT code on the bank’s website or ask an employee over the phone or in person.

- In countries outside of the United States, such as in Europe, you might need an International Bank Account Number (IBAN) and a Bank Identifier Code (BIC).

Advertisement -

3Send all the required details to the person you want to receive a transfer from. Double-check all the details before you send them to make sure you have all the numbers right. Pass the information along via email or text so the sender can easily refer to it..[3]

- If there are fees for sending or receiving the wire transfer, make sure to come to an agreement with the sender about who will pay these. It’s typically expected that the sender will pay any sending fees at the bank on their end and that you will accept any fees from your bank for receiving the transfer.

-

4Wait up to 5 business days for the money to appear in your account. The time it takes for the money to appear in your bank after the sender wires it varies from bank to bank. Usually it arrives in 1-2 days and doesn’t typically take longer than 5 days.[4]

- You can ask the sender to check on their end or ask your bank for a specific estimate of how many days it will take for the money to show up in your account.

- Remember that weekends and holidays do not count as business days for banks, so a weekend or holiday will delay your transfer.

Getting Money Sent via In-Office Wire Transfers

-

1Choose a service that is available where both you and the sender are located. There are many services that allow someone to send money domestically or internationally from a local office in one location to a receiver in another location. The most common are Western Union and MoneyGram.[5]

- Many countries also have smaller services for making domestic transfers. However, the big services like Western Union and MoneyGram offer both domestic and international transfer services.

Tip: You can find all the information about their services and make transfers online via Western Union and MoneyGram on their websites here: https://www.westernunion.com/us/en/home.html, and here: http://global.moneygram.com/en/.

-

2Ensure the service’s money delivery method is appropriate. Make sure that there is a convenient office for you to pick up cash or that you can get it deposited directly into your bank account. Verify whether the sender has to take money to a physical office or if they can send you money via the service’s website. Be sure that the available methods work for both you and the sender.[6]

- For example, Western Union allows senders in most countries to send money via the website that the receiver can pick up in cash at a local office. In some countries, the receiver can also get the money deposited directly into their bank or a mobile wallet.

-

3Provide the sender with the information they need to send you money. They will need your full name as it appears on your ID and your location if you will pick up the cash at a physical office. They will need your bank name and account number if they are depositing it into your bank account.[7]

- Usually this is all you need to give the sender, but double-check by calling the service you plan to use or looking up the exact requirements on their website.

-

4Get the reference number from the sender after they make the transfer. The sender will get either a digital or physical receipt with a confirmation number, depending on how they made the transfer. Have them share this number with you so you can track the status of the transfer.[8]

- If you are picking up cash, you can usually do so within minutes or sometimes the next day. If you are receiving money to your bank account, it takes 2-5 days to appear.

-

5Take your ID to an office to pick up cash if you are receiving money that way. Take a government-issued photo ID to a local office once your cash is available. Fill out a form with the required details at the office, present your ID, and pick up the cash.[9]

- If you are receiving money to your bank account or a mobile wallet, you don’t need to do anything. Just wait for the money to appear.

Using Online Services and Apps to Receive Money

-

1Pick an online service or app that is available to both you and the sender. There are dozens of online services and apps that can be used to easily transfer money between parties. Make sure that whichever one you choose is available both where you are located and where the sender is based.[10]

- One of the most common and reputable online services is PayPal. Other popular options include Google Pay, Venmo, and Stripe, to name a few. You can do an online search with a term like “PayPal alternatives” if you want to see some longer lists of options.

Tip: Keep in mind that every online service and app has different fees or requirements for sending and receiving money. Make sure you research what these are and then agree with the sender on what service works best for both of you.

-

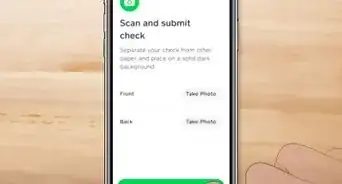

2Give the sender your email or account info to receive money. For many services, including PayPal, all the sender needs to transfer money to you is the email associated with your account. Make sure you provide them with the correct email.[11]

- With many online services and apps, you can also send payment requests to the sender’s email. This way, all they have to do is accept your payment request to transfer you money.

-

3Open your account to check when the money arrives. You will usually get an email notification when someone transfers you money via an online service or app. Log in to your account after you receive a notification to double-check that the money is there.[12]

- Depending on what service you used, you can transfer the money to a bank account or leave it there to use another way later on. For example, you can keep a balance in PayPal and use it to make online payments or send transfers to other people. Remember that if you want to transfer a balance to your bank account it usually takes 2-5 days to go through.

Expert Q&A

-

QuestionHow can I send money to myself between banks?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant Use a service like Western Union! Let's say that you need money out of a certain bank account, but that bank is closed. There might be a Western Union in your grocery store that's open late, which allows you to transfer money from one bank account to the next.

Use a service like Western Union! Let's say that you need money out of a certain bank account, but that bank is closed. There might be a Western Union in your grocery store that's open late, which allows you to transfer money from one bank account to the next.

Expert Interview

Thanks for reading our article! If you'd like to learn more about wire transfers, check out our in-depth interview with Gina D'Amore.

References

- ↑ https://www.nerdwallet.com/blog/banking/how-to-wire-money/

- ↑ https://www.businessinsider.com/how-to-wire-money-send-receive-cash-immediately

- ↑ https://www.nerdwallet.com/blog/banking/how-to-wire-money/

- ↑ https://www.finder.com/how-to-receive-a-wire-transfer

- ↑ https://www.finder.com/how-to-receive-a-wire-transfer

- ↑ https://www.finder.com/how-to-receive-a-wire-transfer

- ↑ https://www.finder.com/how-to-receive-a-wire-transfer

- ↑ https://www.nerdwallet.com/blog/banking/how-to-wire-money/

- ↑ https://www.finder.com/how-to-receive-a-wire-transfer