Orphan wells

Orphan, orphaned or abandoned wells are oil or gas wells that have been abandoned by fossil fuel extraction industries. These wells may have been deactivated because of economic viability, failure to transfer ownerships (especially at bankruptcy of companies), or neglect and thus no longer have legal owners responsible for their care. Decommissioning wells effectively can be expensive, costing millions of dollars,[1] and economic incentives for businesses generally encourage abandonment. This process leaves the wells the burden of government agencies or landowners when a business entity can no longer be held responsible. As climate change mitigation reduces demand and usage of oil and gas, its expected that more wells will be abandoned as stranded assets.[2]

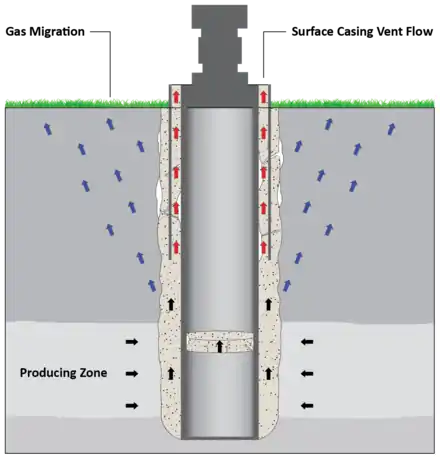

Orphan wells are a potent contributor of greenhouse gas emissions, such as methane emissions, causing climate change. Much of this leakage can be attributed to broken plugs, or failure to plug properly. A 2020 estimate of US abandoned wells alone was that methane emissions released from abandoned wells produced greenhouse gas impacts equivalent of 3 weeks of US oil consumption each year.[2] The scale of leaking abandoned wells are well understood in the US and Canada because of public data and regulation; however, a Reuters investigation in 2020 could not find good estimates for Russia, Saudi Arabia and China—the next biggest oil and gas producers.[2] However, they estimate there are 29 million abandoned wells internationally.[2][3]

Abandoned wells also have the potential to contaminate land, air and water around wells, potentially harming ecosystems, wildlife, livestock, and humans.[2][4] For example, many wells in the United States are situated on farmland, and if not maintained could contaminate important sources of soil and groundwater with toxic contaminants.[2]

Economic limits

A well is said to reach an "economic limit" when its most efficient production rate does not cover the operating expenses, including taxes.[5] When the economic limit is raised, the life of the well is shortened and proven oil reserves are lost. Conversely, when the financial limit is lowered, the life of the well is lengthened.[6] When the economic limit is reached, the well becomes a liability and is abandoned.

At the economic limit, a significant amount of unrecoverable oil is often left in the reservoir. It might be tempting to defer physical abandonment for an extended period, hoping that the oil price will increase or that new supplemental recovery techniques will be perfected. In these cases, temporary plugs will be placed downhole, and locks will be attached to the wellhead to prevent tampering. There are thousands of "abandoned" wells throughout North America, waiting to see what the market will do before permanent abandonment. Often, lease provisions and governmental regulations usually require quick abandonment; liability and tax concerns also may favor abandonment.[7]

Theoretically, an abandoned well can be reinstated and re-entered to production (or converted to injection service for supplemental recovery or downhole hydrocarbon storage), but reentry is often difficult mechanically and expensive. Traditionally elastomer and cement plugs have been used with varying degrees of success and reliability. Over time, they may deteriorate, particularly in corrosive environments, due to the materials from which they are manufactured. New tools have been developed that make re-entry easier; these tools offer higher expansion ratios than conventional bridge plugs and higher differential pressure ratings than inflatable packers, all while providing a V0-rated, gas-tight seal that cement cannot provide.[8]

Reclaim and reuse

Some abandoned wells are subsequently plugged and the site is reclaimed; however, the cost of such efforts can be in the millions of dollars.[9] In this process, tubing is removed from the well, and sections of wellbore are filled with concrete to isolate the flow path between gas and water zones from each other, as well as the surface. The surface around the wellhead is then excavated, and the wellhead and casing are cut off, a cap is welded in place and then buried.

Plugging

The primary method of plugging wells is through elastomer and cement plugs.[8] Government-led campaigns to plug wells are expensive but often facilitated by oil and gas taxes, bonds, or other fees applied to production.[4] Environmental non-profit organizations, such as the Well Done Foundation, also carry out well-plugging projects and develop programs alongside government entities.

Plug bonds

Oil and gas companies on public land in the United States must post financial assurance to cover the cost of plugging wells if they go bankrupt or cannot plug the well themselves. The current financial assurance requirement, which has been in place for 60 years, is $10,000 per well. This is significantly less than the cost of plugging a well, ranging from $92,000 to $400,000. As a result, 99% of federal oil and gas leases have a bond that cannot cover the cost of cleanup.

New rules related to the Infrastructure Investment and Jobs Act will increase the financial assurance requirement to a minimum of $150,000 per well. This will help ensure that oil and gas companies have the financial resources to plug wells if they can no longer do so themselves.[10]

CO2 injection

Unused wells, especially from natural gas might be used for carbon capture or storage. However, if not sealed properly, or the storage site is not sufficiently sealed, there is a possibility of leakage.[11]

Environmental impacts

Hydraulic fracturing

Hydraulic fracturing, also known as fracking, is the process of fracturing bedrock with pressurized liquids. This process creates cracks in well-formed rock formations to allow natural gas, petroleum, and brine to move more effortlessly. When hydraulic fracturing is done in nearby geographies to an orphaned well it can cause breaches of poorly sealed or unsealed abandoned wells further contaminating local ecosystems.[4] These orphaned wells can allow gas and oil to contaminate groundwater due to improper sealing.

By context

Alberta, Canada

Orphan wells in Alberta, Canada are inactive oil or gas well sites that have no solvent owner that can be held legally or financially accountable for the decommissioning and reclamation obligations to ensure public safety and to address environmental liabilities.[15][16][17]

The 100% industry-funded Alberta Energy Regulator (AER)—the sole regulator of the province's energy sector—manages licensing and enforcement related to the full lifecycle of oil and gas wells based on Alberta Environment Ministry requirements, including orphaned and abandoned wells.[18][19][20] Oil and gas licensees are liable for the responsible and safe closure and clean-up of their oil and gas well sites under the Polluter Pays Principle (PPP)[21] as a legal asset retirement obligation (ARO).[18][19][22][23] An operator's liability for surface reclamation issues continues for 25 years following the issuance of a site reclamation certificate. There is also a lifelong liability in case of contamination.[24][25]

Once the current environmental legislation was in place, and the industry-led and industry-funded Orphan Wells Association (OWA), was established in 2002, some orphan wells became the OWA's responsibility.[26] OWA's Inventory does not include legacy wells[27] which are more complex, time-intensive and costly to remediate.[28] Following the 2014 downturn in the global price of oil, there was a "tsunami" of orphaned wells, facilities, and pipelines resulting from bankruptcies.[29]

As of March 2023, oil and gas companies owe rural municipalities $268 million in unpaid taxes;[30] they owe landowners "tens of millions in unpaid lease payments".[31] Original owners of what are now orphan wells "failed to fulfill their responsibility for costly end-of-life decommissioning and restoration work"; some sold these wells "strategically to insolvent operators".[31] Landowners suffer both "environmental and economic consequences" of having these wells on their property.[31] OWA funding is underfunded by at least several hundred million.[31] The total estimate for cleaning up all existing sites is as much as $260 billion. Remediation is paid for through federal and provincial bailouts, a PPP violation.[31]

United States

.jpg.webp)

Though different jurisdictions have varying criteria for what exactly qualifies as an orphaned or abandoned oil well, generally speaking, an oil well is considered abandoned when it has been permanently taken out of production. Similarly, orphaned wells may have different legal definitions across different jurisdictions, but can be thought of as wells whose legal owner it is not possible to determine.[32]

Once a well is abandoned, it can be a source of toxic emissions and pollution contaminating groundwater and releasing methane, making orphan wells a significant contributor to national greenhouse gas emissions.[33] For this reason, several state and federal programs have been initiated to plug wells; however, many of these programs are under capacity.[33] In states like Texas and New Mexico, these programs do not have enough funding or staff to fully evaluate and implement mitigation programs.[33]

North Dakota dedicated $66 million of its CARES Act pandemic relief funds for plugging and reclaiming abandoned and orphaned wells.[34]

According to the Government Accountability Office, the 2.1 million unplugged abandoned wells in the United States could cost as much as $300 billion.[33] A joint Grist and The Texas Observer investigation in 2021 highlighted how government estimates of abandoned wells in Texas and New Mexico were likely underestimated and that market forces might have reduced prices so much creating peak oil conditions that would lead to more abandonment.[33] Advocates of programs like the Green New Deal and broader climate change mitigation policy in the United States have advocated for funding plugging programs that would address stranded assets and provide a Just Transition for skilled oil and gas workers.[35]

The REGROW Act, which is part of the Infrastructure Investment and Jobs Act, includes $4.7 billion in funds for plugging and maintaining orphaned wells.[34] The Interior Department has documented the existence of 130,000 orphaned wells nationwide. An EPA study estimated that there are as many as two to three million wells across the nation.

New York State is expecting to receive $70 million from the Act in 2022 which will be used to plug orphaned wells. The state has 6,809 orphaned wells, and the NYSDEC estimates it will cost $248 million to plug them all. The NYSDEC uses a fleet of drones carrying magnetometers to find orphaned wells.[36]

In 2023, state governments in Pennsylvania, Ohio, and California reported a shortage of trained staff necessary to implement federally funded well capping programs. Qualified oil field workers were also in short supply in Pennsylvania and Ohio. Federally funded well plugging contracts are required to meet Davis-Bacon Act standards for prevailing wages, in order to ensure that the training of new oil field workers will contribute to local economic development in rural areas.[37]Notes

- The oil and gas industry uses the counter-intuitive term "abandoned" to refer to plugged wells, which has led to "countless confusing headlines."[14]

References

- Kaiser MJ (2019). Decommissioning forecasting and operating cost estimation : Gulf of Mexico well trends, structure inventory and forecast models. Cambridge, MA: Gulf Professional Publishing. doi:10.1016/C2018-0-02728-0. ISBN 978-0-12-818113-3. S2CID 239358078.

- Groom N (2020-06-17). "Special Report: Millions of abandoned oil wells are leaking methane, a climate menace". Reuters. Retrieved 2021-04-07.

- Geller D (13 July 2020). "More Exposures from Abandoned Oil and Gas Wells Come Into Focus". Verisk.

- Allison E, Mandler B (14 May 2018). "Abandoned Wells. What happens to oil and gas wells when they are no longer productive?". Petroleum and Environment. American Geosciences Institute.

- Mian MA (1992). Petroleum Engineering Handbook for the Practicing Engineer. Tulsa, Okla.: PennWell. p. 447. ISBN 9780878143702.

- Petrogav International Oil & Gas Training Center (2 July 2020). The technological process on Offshore Drilling Rigs for fresher candidates. Petrogav International.

- Frosch D, Gold R (26 February 2015). "How 'Orphan' Wells Leave States Holding the Cleanup Bag". Wall Street Journal. Retrieved 26 February 2015.

- "Rigless Well Abandonment for the Oil & Gas Industry". BiSN.

- Bloom M (6 September 2019). "Cleaning Up Abandoned Wells Proves Costly To Gas And Oil Producing States" (Audio). All Things Considered. National Public Radio. Retrieved 4 November 2019.

- Bowlin, Nick (2023-07-21). "New public-land drilling rules would overhaul the Western oil industry". High Country News. Retrieved 2023-07-24.

- Stephenson M (2013-01-01). "Chapter 5 - Will It Leak?". In Stephenson M (ed.). Returning Coal and Carbon to Nature. Boston: Elsevier. pp. 103–120. doi:10.1016/B978-0-12-407671-6.00005-7. ISBN 978-0-12-407671-6.

- Cheng WL, Li TT, Nian YL, Xie K (January 2014). "An analysis of insulation of abandoned oil wells reused for geothermal power generation". Energy Procedia. 61: 607–10. doi:10.1016/j.egypro.2014.11.1181.

- Mehmood A, Yao J, Fan D, Bongole K, Liu J, Zhang X (2019-08-06). "Potential for heat production by retrofitting abandoned gas wells into geothermal wells". PLOS ONE. 14 (8): e0220128. Bibcode:2019PLoSO..1420128M. doi:10.1371/journal.pone.0220128. PMC 6684097. PMID 31386664.

- Riley 2019.

- OWA 2019.

- OWA homepage 2023.

- PBO 2022.

- AER "Who We Are" n.d.

- McClure 2019.

- AER 2021.

- Imperial Oil v Quebec 2003.

- AER 2013.

- EPEA 2000.

- Morgan 2021.

- AER 2014.

- OWA Annual Report 2017/18 2018, p. 2.

- OWA Inventory 2023.

- Morgan 2019.

- Johnson 2019.

- Weber 2023b.

- Cosbey 2022.

- Mitchell, Austin L.; Casman, Elizabeth A. (2011-11-15). "Economic Incentives and Regulatory Framework for Shale Gas Well Site Reclamation in Pennsylvania". Environmental Science & Technology. 45 (22): 9506–9514. doi:10.1021/es2021796. ISSN 0013-936X. PMID 21985662.

- Aldern, Clayton; Collins, Christopher; Sadasivam, Naveena (April 2021). "Waves of Abandonment". Grist. Retrieved 2021-04-06.

- Jean, Renée (2021-08-16). "Bakken Restart is among energy priorities sandwiched in bipartisan infrastructure deal". Williston Herald. Retrieved 2021-09-15.

- Marcacci, Silvio. "Plugging Abandoned Oil Wells Is One 'Green New Deal' Aspect Loved By Both Republicans And Democrats". Forbes. Retrieved 2021-04-06.

- Schoenbaum, Hannah; Miller, Isabel (February 10, 2022). "New York to receive $70M in federal grants to plug abandoned oil, gas wells". www.timesunion.com. Retrieved February 10, 2022.

- Peischel, Will (2023-09-28). "Inside the rough-and-tumble race to clean up America's abandoned oil wells". Grist. Retrieved 2023-10-01.