Single Supervisory Mechanism

The Single Supervisory Mechanism (SSM) is the first pillar of the European banking union and is the legislative and institutional framework that grants the European Central Bank (ECB) a leading supervisory role over banks in the EU. The ECB directly supervises the larger banks while it does it indirectly for the smaller ones. Eurozone countries are required to participate, while participation is voluntary for non-eurozone EU member states. In October 2020, two non-Eurozone countries joined the European banking supervision mechanism through a process known as close cooperation: Bulgaria and Croatia. As of early 2021, the SSM directly supervises 115 banks across the Union, representing almost 82% of banking assets of these countries. The SSM, along with the Single Resolution Mechanism are the two central components of the European banking union.

| European Union regulation | |

| |

| Title | Conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions |

|---|---|

| Applicability | All EU member states. However, only eurozone states and EU member states with "close cooperation agreements" (collectively referred to as participating SSM members), will become subject to the supervision tasks conferred to ECB. |

| Made by | Council of the European Union |

| Made under | Article 127(6) of the TFEU. |

| Journal reference | OJ L287, 29.10.2013, p.63–89 |

| History | |

| Date made | 15 October 2013 |

| Came into force | 3 November 2013 |

| Implementation date | 4 November 2014. |

| Current legislation | |

Genesis

The question of supervising the European banking system arose long before the financial crisis of 2007-2008. Shortly after the creation of the monetary union in 1999, a number of observers and policy-makers warned that the new monetary architecture would be incomplete, and therefore fragile, without at least some coordination of supervisory policies among euro members.[1]

The first supervisory measure put in place at the EU level was the creation of the Lamfalussy Process in March 2001.[2] It involved the creation of a number of committees in charge of overseeing regulations in the financial sector. The primary goal of these committees was to accelerate the integration of the EU securities market.[3]

This approach was not binding for the European banking sector and had therefore little influence on the supervision of European banks. This can be explained by the fact that the European treaties did not allow the EU, at the time, to have real decision-making power on these matters. The idea of having to modify the treaties and of engaging in a vast debate on the Member States’ loss of sovereignty cooled down the ambitions of the Lamfalussy process. The financial and economic crisis of 2008 and its consequences in the European Union incentivized European leaders to adopt a supranational mechanism of banking supervision.[4]

The main objective of the new supervisory mechanism was to restore confidence in financial markets. The idea was also to avoid having to bail out banks with public money in case of future economic crises.[5]

To implement this new system of supervision, the President of the European Commission in 2008, José Manuel Barroso, asked a working group of the think tank Eurofi to look at how the EU could best regulate the European banking market. This group was led by Jacques de Larosière, a French senior officer who held, until 1978, the position of Director General of the Treasury in France. He was also President of the International Monetary Fund from 1978 to 1987, President of the “Banque de France” from 1987 to 1993 and President of the European Bank for Reconstruction and Development from 1993.[6] On a more controversial stance, Jacques de Larosière has also been a close advisor of BNP Paribas.[7]

This group led by de Larosière delivered a report highlighting the major failure of European banking supervision pre-2008.[4] Based on this report, the European institutions have set up in 2011 “The European System of Financial Supervision” (ESFS). Its primary objective was:

"to ensure that the rules applicable to the financial sector are adequately implemented, to preserve financial stability and ensure confidence in the financial system as a whole”.[8]

The ESFC brought together, in an unconventional manner, the European and the national supervisory authorities.[9]

Despite the creation of this new mechanism, the European Commission considered that, having a single currency, the EU needed to go further in the integration of its banking supervision practices. The idea was that the mere collaboration of national and European supervisory authorities was not enough and that the EU needed a single supervisory authority. The European Commission therefore suggested the creation of the Single Supervisory Mechanism.[4]

This proposal was debated at the Eurozone summit that took place in Brussels on the 28th and 29th of June 2012. Herman Van Rompuy, who was President of the European Council at the time, had worked upstream with the President of the Commission, the President of the Central Bank and of the Eurogroup on a preliminary report used as a basis for discussions at the summit.[10] In compliance with the decisions made then, the European Commission published a proposal for a Council Regulation establishing the SSM in September 2012.[11]

The European Central Bank welcomed the proposal.[12] Chancellor of Germany Angela Merkel questioned "the capacity of the ECB to monitor 6,000 banks". The Vice-President of the European Commission at the time, Olli Rehn, responded to that concern that the majority of European banks would still be monitored by national supervisory bodies, while the ECB "would assume ultimate responsibility for the supervision, in order to prevent banking crises from escalating".[13]

The European Parliament voted in favour of the SSM proposal on the 12th of September 2013.[14] The Council of the European Union gave its own approval on the 15th of October 2013.[15] The SSM Regulation entered into force on the 4th of November 2014.

The fact that the SSM is formulated as a regulation and not a directive is important. Indeed, a regulation is legally binding and Member States do not have the choice, unlike for directives, of how to transpose it under national law.[16]

Organization

SSM at the ECB

The European Central Bank (ECB) has the leadership in European banking supervision. [17] A strict administrative separation is foreseen between the ECB's monetary and supervisory tasks. However, final decision-making on both matters takes place in the same body: the Governing Council.

The Governing Council is the main decision-making entity of the ECB. It comprises the members of the Executive Board of the European Central Bank and the governors of all national central banks of the Eurozone's member states. The Governing council is in charge, based on the opinion drafted by the Supervisory Board, of taking formal decisions with regards to its supervisory mandate.

Supervisory Board

_1.png.webp)

The Supervisory board is organised by article 26 of the SSM regulation (Council regulation (EU) No 1024/2013).[18] It is composed of all national supervisors participating in the SSM, a chair, vice-chair and four ECB representatives. These members meet every three weeks in order to draft supervisory decisions then submitted to the Governing Council.[19]

The composition of the Supervisory Board has been, over time, the following one:

- Chair:

- Danièle Nouy (1 January 2014 - 31 December 2018)

- Andrea Enria (1 January 2019 - 31 December 2023)

- Claudia Buch (since 1 January 2024)

- Vice Chair:

- Sabine Lautenschläger (11 February 2014 - 11 February 2019)

- Yves Mersch (7 October 2019 - 14 December 2020)

- Frank Elderson (since February 2021)

- ECB appointees:

- Ignazio Angeloni (2014-2019)

- Sirkka Hämäläinen (2014-2016)

- Julie Dickson (2014-2017)

- Luc Coene (2015-2017)

- Pentti Hakkarainen (2017-present)

- Edouard Fernandez-Bollo (2019-present)

- Kerstin af Jochnick (2019-present)

- Elizabeth McCaul (2019-present)

The other members are representatives of the respective national banking supervisors, known in SSM-speak as National Competent Authorities.

The Supervisory Board is assisted in the preparation of its meetings by a Steering Committee. This committee gathers the Chair and the Vice-Chair of the Supervisory Board, an ECB representative (Edouard Fernandez-Bollo since 2019) as well as five deputies of national supervisors.[19]

Joint supervisory teams

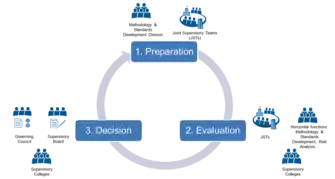

Joint Supervisory Teams (JST), composed of members of the ECB's staff, national competent supervisors and experts in the banking field, make the link between the national and supranational levels. There is a JST for each significant banking institution. They act as supporting bodies, responsible mainly for the coordination, control and evaluation of supervisory missions.[20]

Division of labour

A division of labour has been established between the ECB and national supervisors. Banks deemed significant will be supervised directly by the ECB. Even though the ECB has the authority to take over the direct supervision of any bank, smaller banks will usually continue to be monitored directly by their national authorities.[14] A total of 115 banks are currently being supervised by the ECB;[21] all other banks are supervised by their national supervisor.

A bank is considered significant when it meets any of the following criteria:[14]

- The value of its assets exceeds €30 billion;

- The value of its assets exceeds both €5 billion and 20% of the GDP of the member state in which it is located;

- The bank is among the three most significant banks of the country in which it is located;

- The bank has large cross-border activities;

- The bank receives, or has applied for, assistance from eurozone bailout funds (i.e., the European Stability Mechanism or European Financial Stability Facility).

This significance status is subject to change due to, for example, mergers and acquisitions. In 2020, two additional banks (LP Group B.V. in the Netherlands and Agri Europe Cyprus in Slovenia) have joined the list of banks supervised by the ECB.[22][21]

Membership

All 20 eurozone member states automatically participate in the SSM.[23] Croatia, being the latest country to join the Eurozone on 1 January 2023, was accordingly added to the scope of application of the SSM.

Under the European Treaties, non-Eurozone countries do not have the right to vote in the ECB's Governing Council and, in return, are not bound by its decisions. As a result, non-Eurozone countries cannot become full members of the SSM (i.e., they cannot have the same rights and obligations as Eurozone SSM members). However, non-Eurozone EU member states can enter into a "close cooperation agreement" with the ECB. This procedure is organised by article 7 of the SSM regulation (Council regulation (EU) No 1024/2013) and the ECB decision 2014/510.[24] In effect, these agreements imply the supervision of banks in these signatory countries by the ECB.[25] A close cooperation agreement can be ended either by the ECB or by the participating non-Eurozone member state.[14] Bulgaria, which is in the process of adopting the euro currency, signed a close cooperation agreement with the ECB in 2020.[26] Croatia likewise had a close cooperation agreement with the ECB prior to joining the eurozone.

Monitoring Mechanism

As part of the SSM, the ECB is, according to Regulation 1024/2013, Art. 4, in charge of:[18]

- Conducting supervisory reviews (Supervisory Review and Evaluation Process)

- Assessing banks’ acquisition of qualifying holdings (Mergers and Acquisitions)

Supervisory Review and Evaluation Process

The Supervisory Review and Evaluation Process, also known as ‘SREP’, is a periodic assessment of the risks taken by European banks. This process, undertaken annually by supervisors from the ECB and Joint Supervisory Teams, is an essential element of the implementation of the Single Supervisory Mechanism. The aim of the SREP is to make sure that banks remain safe and reliable; that any factors that could affect their capital and liquidity are under control.[27] Today, the capital and liquidity levels of banks are then directly subject to an ECB monitoring system while beforehand it was heterogeneously done at a national level.[28]

This evaluation is based on the monitoring of four different areas:[27]

- Business Model - assessment of the bank’s strategy and its main activities;

- Internal Governance - examination of the organizational structure and the management;

- Risks to capital - close analysis of risks linked to credits, markets, interest rates, and operations;

- Risks to liquidity - zoom on whether the banks have sufficient cash to cover their short-term needs.

In addition, each year, the European Central Bank is, under European Union law,[29] obliged to perform at least one stress test on all supervised banks. This test will be part of the annual SREP cycle.[30] Stress tests are computer-simulated techniques which evaluate the capacity of banks to cope with potential financial and economic shocks.[31] Annual SREP cycles are based on data from the previous year and after each cycle, there is an individual evaluation.[27]

Based on these assessments and simulations, supervisors write a report on the vulnerability of European banks, with a score ranging from 1 (low risk) to 4 (high risks), and list concrete measures for these banks to take. These measures can be quantitative - related to capital or liquidity, or qualitative (e.g., a change in the management structure or the need of holding more capital especially in times of financial crisis).[27] These actions shall normally be fulfilled by the following year. In case of non-compliance with these requirements, the ECB can charge a fine up to the double of the profits (or losses) which have been generated (or caused) by the breach and that can amount up to 10% of these banks’ annual turnover.[18] The ECB can also request national authorities to open proceedings against these banks.[18] In the worst case scenario, when a bank is likely to fail, the second pillar of the European Banking Union, the Single Resolution Mechanism, enters into play. Eventually, even though the methodology and the timeframe are identical for banks, the actions to take can significantly differ among them[33] as well as the sanctions.[34]

Capital requirements

As banks can take considerable risks, holding capital is essential to absorb potential losses, avoid bankruptcies and secure people’s deposits. The amount of capital banks should hold is proportional to the risks they take.[35] This is closely monitored by the supervisory authorities.

Since 2016, if the results of the SREP for a bank do not reflect a proper coverage of the risks, the ECB may impose additional capital requirements to those required by the Basel agreement. This agreement provides a minimum capital requirement (called Pillar 1 requirement) of 8% of banks’ risk-weighted assets. Since Basel II, extra requirements (called Pillar 2 requirements) can be set in order to cover additional risks.[36] This second category of requirements is divided in two:

- Pillar 2 Requirement (P2R): requirements in terms of risk sensitivity and flexibility that must be fulfilled at all times;

- Pillar 2 Guidance (P2G): identification of the levels of capital to be maintained by banks in the longer run.

Finally, Basel III provides additional capital buffers covering more specific risks.

Non-performing loans

The SSM has been actively involved in the making of Non-Performing Loans action plans. In the ECB guidance recommendations, the SSM, along with the European Banking Authority (EBA), have introduced a new definition of Non-Performing Loans (NPLs) that relates to the optimisation of the disposal of the NPLs by the banks. The main purpose is to integrate the multidimensional framework that the banks use in their evaluation process in the comprehensive assessment by the Supervisory Authority.[37]

A bank loan is non-performing when the 90-day period is exceeded without the borrower paying the due amount or the agreed interest.[37] If customers do not follow the agreed upon repayment terms for 90 days or more, the bank must further protect itself by increasing its equity reserve in the event the loan is not paid. The purpose of this procedure is to increase the bank's resilience to shocks by sharing the risk with the private sector. In other words, addressing the problems associated with PNPs in the future is paramount to consolidating the banking union, while developing lending activity.

The new provisions put in place a "prudential backstop," or minimum common loss guarantee for the reserve funds that banks set up to deal with losses from future non-performing loans. If a bank fails to meet this agreed minimum level, deductions are made directly from its capital.[38]

SSM in banking consolidation

Before the financial crisis of 2008, an increasing number of banks were merging across Europe.[39] This trend stopped as a result of the crisis: between 2008 and 2017, while we saw a decline in the number of cross-border M&As,[40][39] domestic consolidations (i.e., between two national institutions) rose.[41] In 2016, there were about 6 000 banks in the Eurozone, most of which with a clear focus on their domestic market.[42] Today, the European banking landscape is composed of banks with a smaller market share at the EU level than what can be observed in the United States.[42] As a result, the European market is said to be more fragmented and therefore less competitive than in the US or Asia.[39][43]

Cross-border mergers in banking would help banks to diversify their portfolio and, therefore, better recover from localized shocks in the economy.[42][44] On the other hand, spreading risks across different geographies could also be a threat to the stability of financial markets: one might, indeed, worry of a potential effect of contagion between regions.[41][45] Such transactions could also lead to the creation of groups regarded as “Too big to fail”, which, in case of systemic crises, would require significant support from the public purse.[44] Following the terrible consequences of the Lehman Brothers’ fall in 2008, public authorities seem committed to avoid the collapse of other systemic banks.[46] One of the side effects of these public guarantees is to encourage moral hazard: protected by a public net, these financial institutions are incentivized to adopt riskier behaviors.[47] As this opposition of opinions illustrates, if cross-border mergers might have the potential of reducing the exposure of individual firms to localized shocks, studies[47] show that they also increase systemic risks on financial markets.

In the attempt to mitigate those risks, the ECB is, since 2013, responsible (as part of the Single Monitoring Mechanism), with the European Commission, for assessing the soundness of banking mergers (Council Regulation No 1024/2013, Art. 4).[18] While the European Commission is in charge of checking the impacts such transactions will have on competition and, therefore, on consumers, the ECB is tasked to monitor the risks entailed by the suggested consolidations. If a transaction includes the acquisition of more than 10% of a bank’s shares or voting rights (i.e., a qualifying holding – Regulation 575/2013, Art. 4(1)36),[48] it must be reported to the national competent authority of the Member State in which the bank is established. This national authority must then conduct an assessment of the deal and forward its conclusions to the ECB, which is the final decision-maker, validating (with or without conditions) or refusing the transaction (Council Regulation No 1024/2013, Art. 15).[18]

In 2020, the ECB published a document aiming to clarify the way they were assessing such transactions, with the objective of being more transparent and predictable.[36] Even though transactions are assessed on a case-to-case basis, the supervision process of these deals follow the same three stages:

- The preliminary stage: the ECB advises companies to contact them early in order to get feedback on their transaction project;

- The formal application stage: the project is officially sent for approval to the ECB;

- The implementation phase: if approved, the project and its developments are closely monitored by the ECB.

In phase two, the ECB pays particular attention to the sustainability of the suggested business model (e.g., under which assumptions it has been built, what has been planned in terms of IT integration, etc.) and to the governance mechanism at stake (e.g. what the skills and experiences of the leadership are). With this communication, the ECB also took the initiative to clarify how it was computing the capital requirements of the new entity and how it would assess the quality of this new body's assets.

According to two PwC analysts, the publication of this document by the ECB seems to indicate that it wishes to encourage banking consolidation.[43] This position from the ECB is not new. In November 2016, the ECB wrote in its Financial Stability Review the following sentence with regards to the banking sector:

“Consolidation could bring some profitability benefits at the sector level by increasing cost and revenue synergies without worsening the so-called “too-big-to-fail” problem” (ECB Financial Stability Review, Nov. 2016, p. 75)[49]

This positioning of the ECB, in favor of bigger and more competitive banks in Europe, translates a certain bias of this institution towards the financial industry.[50] This bias can be explained by different power mechanisms at stake:

- Instrumental power: central bankers have, through their interactions with expert groups and their past professional experiences, close relationships with professionals from the financial industry, framing their preferences in support of these firms.[46]

- Structural power: banks have today such a large influence on the European economy, employing many people and financing many organizations, that the ECB actually have incentives to protect this industry.[46][50]

- Infrastructural power: central bankers rely on the banking industry to transmit their policy’s objectives to the real economy. When setting its short-term interest rate, the central bank hopes to get an indirect influence, through private banks’ lending operations, on different macroeconomic variables (e.g., inflation).[51][50]

Because of these mechanisms, it is argued that the interests of central bankers can often be found aligned with the ones of the banking industry.[46] With regards to banking consolidation, the position of the ECB, in support of large competitive banks operating across Europe, tends to favor a situation of financial stability at short-term, at the expense of longer term consequences resulting from an increase in the European systemic risk.[50]

The centralization of banking supervision at the EU level and the harmonization of banking regulations in the EU has already been a way to foster consolidation in the financial industry.[40] Nevertheless, many obstacles to consolidation – economic (e.g., poor economic conditions in Europe), regulatory (e.g., national discrepancies in corporate law) and cultural (e.g., linguistic barriers) – remain.[42][44] Zooming on obstacles linked to regulatory and monitoring practices, despite efforts of harmonization, the fact that there remain some national inconsistencies in those practices has been identified as a barrier to consolidation (e.g., some countries assess subsidiaries as separate entities, others as part of a single group).[44] Another issue is the tendency of some EU member states, since the EU sovereign debt crisis, to impose minimum capital requirements to their national banks, hindering the free movement of capital across EU’s subsidiaries.[44] This reaction could be explained by the current incompleteness of the Banking Union: lacking a third – risk-sharing – pillar, national authorities would not be ready to drop their prerogatives.[41] To sum up, despite a willingness from the sector and authorities to boost the competitiveness of the European banking industry, obstacles remain in the way of a further integration of the European banking market.

Monitoring outcomes

The ECB published its first comprehensive assessment on 26 October 2014. This financial health check covered the 130 most significant credit institutions in the 19 Eurozone states representing assets worth €22 trillion (equal to 82% of total banking assets of the eurozone).

The supervision report included:

- The results of an Asset Quality Review (AQR) - assessing capital shortfalls (i.e., a failure to meet the minimum capital requirement) of each significant credit institution on 31 December 2013.

- Assessment of potential capital shortfalls when subject to a stress test based on the baseline scenario - being the latest economic forecast published by the Commission for the eurozone in 2014-16.

- Assessment of potential capital shortfalls when subject to a stress test based on an adverse scenario - which was developed by the European Systemic Risk Board in cooperation with the National Competent Authorities, the EBA and the ECB.

Based on these three criteria, the review found that a total of 105 out of the 130 assessed banks met all minimum capital requirements on 31 December 2013. A total of 25 banks were found to suffer from capital shortfalls on 31 December 2013, of which 12 managed to cover these capital shortfalls through raising extra capital in 2014. The remaining 13 banks were asked to submit a recapitalization plan for 2015.[52]

| SSM participating banks with a CET1 capital shortfall, as of the status of its assets on 31 December 2013 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Bank Name | State | CET1 ratio starting point |

CET1 ratio post AQR |

CET1 ratio baseline scenario |

CET1 ratio adverse scenario |

Capital shortfall on 31 Dec 2013 (€ billion) |

Net eligible capital raised during 2014 (€ billion) |

Capital shortfall post net capital raised (€ billion) |

| Eurobank¹ | Greece | 10.6% | 7.8% | 2.0% | -6.4% | 4.63 | 2.86 | 1.76 |

| Banca Monte dei Paschi di Siena | Italy | 10.2% | 7.0% | 6.0% | -0.1% | 4.25 | 2.14 | 2.11 |

| National Bank of Greece¹ | Greece | 10.7% | 7.5% | 5.7% | -0.4% | 3.43 | 2.50 | 0.93 |

| Banca Carige | Italy | 5.2% | 3.9% | 2.3% | -2.4% | 1.83 | 1.02 | 0.81 |

| Cooperative Central Bank Ltd | Cyprus | -3.7% | -3.7% | -3.2% | -8.0% | 1.17 | 1.50 | 0.00 |

| Portuguese Commercial Bank | Portugal | 12.2% | 10.3% | 8.8% | 3.0% | 1.14 | -0.01 | 1.15 |

| Bank of Cyprus | Cyprus | 10.4% | 7.3% | 7.7% | 1.5% | 0.92 | 1.00 | 0.00 |

| Oesterreichischer Volksbanken-Verbund | Austria | 11.5% | 10.3% | 7.2% | 2.1% | 0.86 | 0.00 | 0.86 |

| Permanent tsb | Ireland | 13.1% | 12.8% | 8.8% | 1.0% | 0.85 | 0.00 | 0.85 |

| Veneto Banca | Italy | 7.3% | 5.7% | 5.8% | 2.7% | 0.71 | 0.74 | 0.00 |

| Banco Popolare | Italy | 10.1% | 7.9% | 6.7% | 4.7% | 0.69 | 1.76 | 0.00 |

| Banca Popolare di Milano | Italy | 7.3% | 6.9% | 6.5% | 4.0% | 0.68 | 0.52 | 0.17 |

| Banca Popolare di Vicenza | Italy | 9.4% | 7.6% | 7.5% | 3.2% | 0.68 | 0.46 | 0.22 |

| Piraeus Bank | Greece | 13.7% | 10.0% | 9.0% | 4.4% | 0.66 | 1.00 | 0.00 |

| Credito Valtellinese | Italy | 8.8% | 7.5% | 6.9% | 3.5% | 0.38 | 0.42 | 0.00 |

| Dexia² | Belgium | 16.4% | 15.8% | 10.8% | 5.0% | 0.34 | 0.00 | 0.34 |

| Banca Popolare di Sondrio | Italy | 8.2% | 7.4% | 7.2% | 4.2% | 0.32 | 0.34 | 0.00 |

| Hellenic Bank | Cyprus | 7.6% | 5.2% | 6.2% | -0.5% | 0.28 | 0.10 | 0.18 |

| Münchener Hypothekenbank | Germany | 6.9% | 6.9% | 5.8% | 2.9% | 0.23 | 0.41 | 0.00 |

| AXA Bank Europe | Belgium | 15.2% | 14.7% | 12.7% | 3.4% | 0.20 | 0.20 | 0.00 |

| C.R.H. - Caisse de Refinancement de l’Habitat | France | 5.7% | 5.7% | 5.7% | 5.5% | 0.13 | 0.25 | 0.00 |

| Banca Popolare dell'Emilia Romagna | Italy | 9.2% | 8.4% | 8.3% | 5.2% | 0.13 | 0.76 | 0.00 |

| Nova Ljubljanska banka3 | Slovenia | 16.1% | 14.6% | 12.8% | 5.0% | 0.03 | 0.00 | 0.03 |

| Liberbank | Spain | 8.7% | 7.8% | 8.5% | 5.6% | 0.03 | 0.64 | 0.00 |

| Nova Kreditna Banka Maribor3 | Slovenia | 19.6% | 15.7% | 12.8% | 4.4% | 0.03 | 0.00 | 0.03 |

| Total | - | 10.0% | 8.4% | 7.2% | 2.1% | 24.62 | 18.59 | 9.47 |

Notes: ¹ These banks have a shortfall on a static balance sheet projection, but will have dynamic balance sheet projections taken into account in determining their final capital requirements. | ||||||||

This is the only time where a comprehensive assessment has been done for the 130 banks supervised by the ECB. Since 2014, only a few numbers of banks have been comprehensively assessed by the ECB: 13 in 2015, 4 in 2016 and 7 in 2019.[53] These comprehensive assessments are conducted either when a bank is recognized as significant or when deemed necessary (i.e., in case of exceptional circumstances or when a non-Eurozone country joins the mechanism). Comprehensive assessments require too much resources for them to be conducted annually.

Other supervision tools are therefore used on a more regular basis in order to assess how banks would cope with potential economic shocks. As required by EU law and as part of the SREP, the ECB carries out annual stress tests on supervised banks.[30] In 2016, a stress test was performed on 51 banks, covering 70% of EU banking assets. These banks entered the process with an average Common Equity Tier 1 (CET1, i.e., percentage of Tier 1 capital held by banks)[54] ratio of 13%, higher than the 11.2% of 2014. The test showed that, with one exception, all the assessed banks exceeded the benchmark used in 2014 in terms of CET1 capital level (5.5%). The results of this stress test show that, in 2016, EU banks had a better potential of resilience and shock absorption than in 2014.[55] In 2018, two types of stress tests were performed: an EBA stress test for 33 banks and a SSM SREP stress test for 54 banks. The aggregate results of those tests show that, in 2018, both sets of banks had again strengthened their capital base compared to 2016, increasing their potential of resistance to financial shocks.[56] Due to the coronavirus pandemic, the 2020 stress test has been postponed to 2021. The results of this test should be published by the end of June 2021.[57]

Limitations and critics

The SSM has been, over time, criticised regarding its methodology and scope. This institutional scheme has also suffered from some controversies.

Methodological limits

Stress tests are an integral part of the supervisory activities of the ECB.[58] Methodological flaws related to these stress tests have been identified and corrected throughout the years in order for these assessments to properly reflect the actual risk status of the banks.[59] In the 2014 stress tests, the capital strength of banks was assessed according to the Basel III approach that uses Common Equity Tier 1 as the only capital buffer. This methodology has been the subject of criticism by many scholars and organisations for its failure to provide good estimates of the actual solvency of banks. This method was deemed to favour investment banks that were less exposed to credit risk as opposed to commercial banks.[60] Today, stress tests remain flawed: e.g., they do not take into account potential externalities and spillovers while these risks have been shown to have significant impacts in a time of crisis. Andrea Enria, the head of the European Banking Authority (EBA), also pointed out the fact that these tests do not take into account possible adjustments that a bank could make in reaction to an economic shock (i.e., stress tests assume that the bank will not react to the shock). Finally, he also emphasised that, while the methodology of stress tests is transparent, decisions taken by the supervisor as a result of these tests (e.g., increase its capital or decrease its dividend payments) are the result of a mutual agreement closed with the bank in a rather non-transparent manner.[61]

In their 2018 report, the European Court of Auditors (ECA) pointed out flaws in the Comprehensive Assessment process of the SSM. The main identified flaws by the ECA were the limited resources of the ECB to gather the necessary information to assess the assets' quality of banks and a lack of effective guidance on risk assessment.[62]

Institutional limits

A first limit to the SSM's scope of application is geographical: it does not cover all EU member states. This system hence contributes to what is known as the multi-speed Europe. Another limitation to the scope of application of the SSM is the fact that it only deals with the supervision of banks. Supervision of the rest of the financial sector (e.g., insurance firms) remains a national competence. The supervisory role of the ECB is restricted to individual banking institutions as they are defined in the Capital Requirements Directive IV.[63] This means that the ECB cannot conduct supervision on over-the-counter derivatives markets, wholesale debt securities markets and on the shadow banking industry. In addition, some aspects of bank supervision (e.g., consumer protection or money laundering monitoring[64]) continue to be dealt with at the national level.[65] Furthermore, while the ECB directly supervises the most significant banks of the Eurozone, the supervision of smaller banks remains under national realm. National authorities are also in charge of defining their own macro prudential policy, limiting the ability of the ECB to take a proactive stance on systemic and liquidity risks.[66] Finally, when the SSM was first launched, some economists were sceptical with regards to the composition of its Supervisory Board: they criticized the fact that a large majority of this board would be composed of national supervisors who "do not appreciate ECB interference in their daily national supervisory activities".[67]

The quality of the ECB’s banking supervision is dependent on the effectiveness of the Single Resolution Mechanism as well as on the creation of a deposit insurance scheme. In 2018, 17 economists published a paper calling for a reform of the banking union. These economists emphasised the necessity to consolidate the Single Resolution Mechanism, enabling the establishment of real risk-sharing mechanisms.[68] With regards to the deposit insurance scheme, it has been subject to a first proposal by the Commission in November 2015 but no tangible progress has been made since then to achieve its implementation.[69]

Thirdly, as laid down in articles 130 and 282 of the TFEU, the independence of the ECB from political actors should be guaranteed. However, the ECB has to rely on the European Parliament and the Council to take decisions regarding the reporting of its supervisory activities and the appointment of its members.[70] The perceived need of democratic legitimacy that is at the basis of these procedures can be thought to create a shift of accountability from the ECB to the institutions – or member states – of the Union.

A final important question arises when prudential supervision and monetary policy are at stake, as it is the case at the ECB: as these two areas are intertwined, how to avoid potential conflicts of interest?[66][71] The Supervisory Board is theoretically in charge of preventing these issues from happening. In practice, the ECB has already interfered with the solvency assessments of its supervised banks by, for example, purchasing asset-backed securities issued by these same banks.[72]

Controversies

In 2017, Banca Monte dei Paschi di Siena, an Italian bank, was subject to a national insolvency procedure following multiple unsuccessful recapitalisations.[73] Later that year however, the ECB declared the bank to be solvent on the basis of the stress tests performed by the EBA in 2016, which was a requirement for the bank to benefit from a precautionary recapitalisation by the Italian government.[74][75] Many member states such as Germany criticised the ECB's methodology and considered it as vague and non-transparent.[73]

In 2019, the European Commission concluded a contract with the American asset management company BlackRock.[76] The company has been mandated to advise the Commission on prudential risk matters to implement sustainability in the banking regulation ecosystem.[77] This is not the first time that the ECB has been working with BlackRock: in the aftermath of the Eurozone debt crisis, in 2014, the private firm already helped the ECB conduct its comprehensive assessment of the European banking market.[78] Concerns over potential conflicts of interests have been raised regarding the choice of a private company because of the potential influence on the rulemaking of the ECB, as well as on the credibility of BlackRock to perform such a task. The Commission and BlackRock rejected any wrongdoings and respectively invoked independence and transparency.[79]

The health crisis and its impacts on banking supervision

The COVID-19 crisis has highlighted new limitations concerning the methodology of stress tests. During the first half of 2020, financial markets underwent unprecedented fluctuations far from what had been considered in the most severe forecasts (e.g., in the most adverse scenarios of the EBA, oil would lose 15% of its value whereas oil price actually fell by 60% at the peak of the crisis in 2020). This Covid-19 crisis could actually be considered as a real-life stress test whose macroeconomic factors could later be used to readjust the EBA-ECB most severe scenario in their subsequent evaluations. This health crisis has also illustrated the dual role of the ECB: its actions during the crisis reflected a mix between its mandate as banking supervisor and its initiatives in support of the stability of financial markets.[80]

See also

References

- Smaghi, Lorenzo; Gros, Daniel (2000). Open issues in European central banking. New York: Palgrave.

- "Regulatory process in financial services". European Commission - European Commission. Retrieved 2021-03-29.

- Alford, Duncan (2006). "The Lamfalussy Process and EU Bank Regulation: Another Step on the Road to Pan-European Bank Regulation?". Annual Review of Banking & Finance Law. 25: 389.

- Kermarec, Rodéric (2013). "Le Projet d'Union bancaire européenne : état des lieux et analyse critique". Université Paris II. Retrieved 2021-03-29.

- Wymeersch, Eddy (2014). "The Single Supervisory Mechanism or 'Ssm', Part One of the Banking Union". National Bank of Belgium Working Paper. 225. doi:10.2139/ssrn.2427577. hdl:10419/144467. S2CID 167815869.

- "Jacques de Larosière". Babelio. Retrieved 2021-03-29.

- Haar, Kenneth; Rowell, Andy; Vassalos, Yiorgos (2009). "Would you bank on them?" (PDF). Corporate Europe Observatory.

- "RÈGLEMENT (UE) No 1093/2010 DU PARLEMENT EUROPÉEN ET DU CONSEIL du 24 novembre 2010 instituant une Autorité européenne de surveillance (Autorité bancaire européenne), modifiant la décision no 716/2009/CE et abrogeant la décision 2009/78/CE de la Commission". 2010-10-24. Retrieved 2021-03-29.

- Nagy, Agnes; Stefan, Pete; Dézsi-Benyovszki, Annamaria; Szabó Tunde, Petra (2010). "The de Larosière Report Regarding the new Structure of European System of Financial Supervision" (PDF). Theoretical and Applied Economics. 11 (552).

- "Press corner". European Commission - European Commission. Retrieved 2021-04-10.

- "Commission proposes new ECB powers for banking supervision as part of a banking union" (Press release). Communication department of the European Commission. 12 September 2012. Retrieved 22 July 2013.

- "ECB welcomes Commission's proposal for a single supervisory mechanism", ECB press release, 12 September 2012

- "Rehn: Schedule for Single Supervisory Mechanism Feasible", Helsinki Times, 13 September 2012

- "Legislative package for banking supervision in the Eurozone – frequently asked questions". European Commission. 2013-09-12. Retrieved 2014-05-29.

- "Council approves single supervisory mechanism for banking". Council of the European Union. 2013-10-15. Retrieved 2014-05-29.

- "Difference between a Regulation, Directive and Decision". United States Mission to the European Union. Retrieved 2021-04-10.

- "Decision-making". European Central Bank - Banking Supervision. 29 July 2015. Retrieved 2021-04-09.

- The Council of the European Union. "Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions". eur-lex.europa.eu. Retrieved 2021-04-01.

- "Supervisory Board". European Central Bank - Banking Supervision. Retrieved 2021-04-09.

- "Joint Supervisory Teams". European Central Bank - Banking Supervision. 29 October 2014. Retrieved 2021-04-09.

- "List of supervised banks". European Central Bank - Banking Supervision. Retrieved 2021-04-09.

- "What makes a bank significant?". European Central Bank - Banking Supervision. 24 June 2019. Retrieved 2021-04-09.

- "Euro area 1999 – 2015". European Central Bank. Retrieved 3 December 2015.

- "Decision of the European Central Bank of 31 January 2014: On the close cooperation with the national competent authorities of participating Member States whose currency is not the euro (ECB/2014/5)" (PDF). European Central Bank. 31 January 2014.

- Council of the European Union (2013). "Council approves single supervisory mechanism for banking".

- European Commission (2020). "La Commission se félicite de l'entrée de la Bulgarie et de la Croatie dans le mécanisme de taux de change II". Retrieved 2021-04-09.

- European Central Bank (2021). "The Supervisory Review and Evaluation Process". European Central Bank - Banking Supervision. Retrieved 2021-04-09.

- European Central Bank (2019). "The Supervisory Review and Evaluation Process in 2015". European Central Bank - Banking Supervision. Retrieved 2021-03-28.

- The European Parliament and the Council. "DIRECTIVE 2013/36/EU OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC". eur-lex.europa.eu. Retrieved 2021-04-01.

- European Central Bank (2021). "Stress tests". European Central Bank - Banking Supervision. Retrieved 2021-03-28.

- Kenton, Will. "Stress Testing". Investopedia. Retrieved 2021-03-28.

- Bank, European Central (2021-01-28). "Supervisory methodology".

{{cite journal}}: Cite journal requires|journal=(help) - European Central Bank (2020). "What is the SREP?". European Central Bank - Banking Supervision. Retrieved 2021-03-28.

- European Central Bank (2021). "Supervisory sanctions". European Central Bank - Banking Supervision. Retrieved 2021-03-28.

- European Central Bank (2020). "Why do banks need to hold capital?". European Central Bank - Banking Supervision. Retrieved 2021-03-28.

- European Central Bank (2020). "Guide on the supervisory approach to consolidation in the banking sector" (PDF).

- European Central Bank (March 2017). "Guidance to banks on non-performing loans" (PDF). Retrieved 1 March 2021.

- Conseil de l’UE, « Prêts non performants: le Conseil approuve sa position sur les exigences de fonds propres pour les créances douteuses des banques », 31/10/2018, https://www.consilium.europa.eu/fr/press/press-releases/2018/10/31/non-performing-loans-council-approves-position-on-capital-requirements-for-banks-bad-loans/ Retrieved 2021-04-11.

- Heukmes, Joachim; Guionnet, Baptiste (2018). "M&A benefits for the banking sector consolidation" (PDF). Inside Magazine. Deloitte. 18 (3).

- Jackson, Olly (2018). "Consolidation and the EU banking sector". International Financial Law Review – via ProQuest.

- Gardella, Anna; Rimarchi, Massimiliano; Stroppa, Davide (2020). "Potential Regulatory Obstacles to Crossborder Mergers and Acquisitions in the EU Banking Sector" (PDF). EBA Staff Paper Series. European Banking Authority. 7.

- Schoenmaker, Dirk (2015). "The New Banking Union Landscape in Europe: Consolidation Ahead?". Journal of Financial Perspectives. 3. SSRN 3083603.

- Kruizinga, Anthony; de Haan, Martijn (2020). "Paving the way for European banking consolidation". PwC Netherlands.

- Boer, Martin; Portilla, Andrés (2020). Consolidation of the European banking industry: obstacles and policies. Fundación de Estudios Financieros and Fundación ICO. pp. 263–282. ISBN 978-84-09-19649-4.

- Wagner, Wolf (2010). "Diversification at financial institutions and systemic crises". Journal of Financial Intermediation. 19 (3): 373–386. doi:10.1016/j.jfi.2009.07.002. S2CID 117849202.

- Kalaitzake, Manolis (2019). "Central banking and financial political power: An investigation into the European Central Bank". Competition & Change. 23 (3): 221–244. doi:10.1177/1024529418812690. S2CID 158296967.

- Weiß, Gregor; Neumann, Sascha; Bostandzic, Denefa (2014). "Systemic risk and bank consolidation: International evidence". Journal of Banking & Finance. 40: 165–181. doi:10.1016/j.jbankfin.2013.11.032.

- The European Parliament and the Council. "Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 Text with EEA relevance". eur-lex.europa.eu. Retrieved 2021-04-01.

- European Central Bank (2016). "Financial Stability Review - Nov. 2016" (PDF). Financial Stability Review.

- Peter, Dietsch; Claveau, François; Fontan, Clément (2018). Do central banks serve the people?. John Wiley & Sons.

- Braun, Benjamin (2016). The Financial Consequences of Mr Draghi? Infrastructural Power and the Rise of Market-Based (Central) Banking. Brussels: Foundation for European Progressive Studies.

- European Central Bank (2014). "ECB's in-depth review shows banks need to take further action".

- European Central Bank. "Comprehensive assessments". European Central Bank - Banking Supervision. Retrieved 2021-03-28.

- Grant, Michel (2020). "Common Equity Tier 1 (CET1)". Investopedia. Retrieved 2021-03-28.

- European Central Bank (2016). "Stress test shows improved resilience of euro area banking system". European Central Bank - Banking Supervision.

- European Central Bank (2019). "ECB 2018 stress test analysis shows improved capital basis of significant euro area banks". European Central Bank - Banking Supervision.

- European Central Bank (2021). "ECB to stress test 38 euro area banks as part of the 2021 EU-wide stress test led by EBA". European Central Bank - Banking Supervision.

- Bank, European Central (2021-01-28). "2020 SREP aggregate results".

{{cite journal}}: Cite journal requires|journal=(help) - Arnould, Guillaume; Dehmej, Salim (2016-10-01). "Is the European banking system robust? An evaluation through the lens of the ECB׳s Comprehensive Assessment". International Economics. 147: 126–144. doi:10.1016/j.inteco.2016.04.002. ISSN 2110-7017.

- Steffen, Sascha. "Robustness, Validity and Significance of the ECB's AQR and Stress Test Exercise" (PDF). Retrieved 29 March 2021.

- Lederer, Edouard (2018). "Le régulateur des banques européennes critique les récents stress tests". Les Echos. Retrieved 2021-04-11.

- Guarascio, Francesco (2018-01-16). "Flaws in ECB supervision of failing banks, EU auditors warn". Reuters. Retrieved 2021-03-01.

- Schoenmaker, Dirk; Wierts, Peter (February 2016). "Macroprudential Supervision: From Theory to Policy" (PDF).

- Jones, Claire. "ECB lacks power to uncover money laundering — Nouy". Financial Times. Retrieved 5 July 2018.

- Verhelst, Stijn. "Assessing the Single Supervisory Mechanism: Passing the point of no return for Europe's Banking Union" (PDF). Egmont – Royal Institute for International Relations. Retrieved 12 June 2013.

- Kern, Alexander (2016). "The European Central Bank and Banking Supervision: The Regulatory Limits of the Single Supervisory Mechanism" (PDF). Retrieved 29 March 2021.

- Ivo, Arnold (2012). "First the Governance, Then the Guarantees". EconoMonitor.

- "Reconciling risk sharing with market discipline: A constructive approach to euro area reform | Bruegel". Retrieved 2021-03-29.

- Valero, Jorge (2020-12-07). "Commission eyes new proposal to unblock deposit insurance scheme". www.euractiv.com. Retrieved 2021-03-01.

- Fraccaroli, Nicolò; Giovannini, Alessandro; Jamet, Jean‑François (2018). "The evolution of the ECB's accountability practices during the crisis". European Central Bank. Retrieved 20 March 2021.

- Amorello, Luca (2018). Macroprudential Banking Supervision & Monetary Policy. London, UK: Palgrave Macmillan. pp. 338–339. doi:10.1007/978-3-319-94156-1. ISBN 978-3-319-94155-4.

- Hale, Thomas (8 February 2017). "How the ECB's purchases have changed European bond markets". The Financial Times. Retrieved 31 March 2021.

- Beroš, Marta Božina (2019-02-01). "The ECB's accountability within the SSM framework: Mind the (transparency) gap". Maastricht Journal of European and Comparative Law. 26 (1): 122–135. doi:10.1177/1023263X18822790. ISSN 1023-263X.

- "Monte dei Paschi: What's next?". economic-research.bnpparibas.com (in French). Retrieved 2021-04-26.

- Martinuzzi, Elisa. "Monte Paschi Bailout: What Did Draghi's ECB Not Tell Us?". Bloomberg.com. Retrieved 2021-04-26.

- Riding, Siobhan (2021-01-04). "EU lobbying by fund groups fuels fears over vested interest". www.ft.com. Retrieved 2021-03-29.

- "BlackRock to advise ECB on bond-buying plan". The Irish Times. Retrieved 2021-04-09.

- "Ces financiers qui dirigent le monde - BlackRock". ARTE. 2019.

- Temple-West, Patrick; Khan, Mehreen (13 April 2020). "BlackRock to advise EU on green regulation for bank". The Financial Times. Retrieved 29 March 2021.

- "Marchés financiers : le stress test EBA mis à l'épreuve de la crise du " COVID-19 ", ou pourquoi le stress test EBA 2020 est rapidement devenu obsolète". MPG Partners. 2020. Retrieved 2021-03-29.