Direct finance

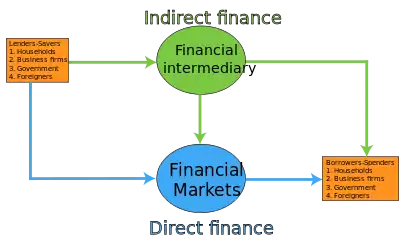

Direct finance is a method of financing where borrowers borrow funds directly from the financial market without using a third party service, such as a financial intermediary. This is different from indirect financing where a financial intermediary takes the money from the lender with an interest rate and lends it to a borrower with a higher interest rate. Direct financing is usually done by borrowers that sell securities and/or shares to raise money and circumvent the high interest rate of financial intermediary (banks).[1] We may regard transactions as direct finance, even when a financial intermediary is included, in case no asset transformation has taken place. An example is a household which buys a newly issued government bond through the services of a broker, when the bond is sold by the broker in its original state. [2] Another good example for direct finance is a business which directly buys newly issued commercial papers from another business entity[3]

See also

References

- Mishkin, Frederic (2012). The Economics of Money, Banking and Financial Markets (Global, Tenth ed.). Pearson Education Limited. p. 68. ISBN 978-0273765738.

- "Notes on Mishkin Chapter 2: Part B (Econ 353, Tesfatsion)".

- "Notes on Mishkin Chapter 2: Part B (Econ 353, Tesfatsion)".