Financialization

Financialization (or financialisation in British English) is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

Financialization describes an economic process by which exchange is facilitated through the intermediation of financial instruments. Financialization may permit real goods, services, and risks to be readily exchangeable for currency, and thus make it easier for people to rationalize their assets and income flows.

Financialization is tied to the transition from an industrial economy to a service economy, as financial services belong to the tertiary sector of the economy.

Specific academic approaches

Various definitions, focusing on specific aspects and interpretations, have been used:

- Greta Krippner of the University of Michigan writes that financialization refers to a "pattern of accumulation in which profit making occurs increasingly through financial channels rather than through trade and commodity production."[2] In the introduction to the 2005 book Financialization and the World Economy, editor Gerald A. Epstein wrote that some scholars have insisted on a much narrower use of the term: the ascendancy of shareholder value as a mode of corporate governance, or the growing dominance of capital market financial systems over bank-based financial systems. Pierre-Yves Gomez and Harry Korine, in their 2008 book Entrepreneurs and Democracy: A Political Theory of Corporate Governance, have identified a long-term trend in the evolution of corporate governance of large corporations and have shown that financialization is one step in this process.

- Thomas Marois, looking at the big emerging markets, defines "emerging finance capitalism" as the current phase of accumulation, characterized by "the fusion of the interests of domestic and foreign financial capital in the state apparatus as the institutionalized priorities and overarching social logic guiding the actions of state managers and government elites, often to the detriment of labor."[3]

- According to Gerald A. Epstein, "Financialization refers to the increasing importance of financial markets, financial motives, financial institutions, and financial elites in the operation of the economy and its governing institutions, both at the national and international levels."[4]

- Financialization may be defined as "the increasing dominance of the finance industry in the sum total of economic activity, of financial controllers in the management of corporations, of financial assets among total assets, of marketized securities and particularly equities among financial assets, of the stock market as a market for corporate control in determining corporate strategies, and of fluctuations in the stock market as a determinant of business cycles" (Dore 2002).

- More popularly, however, financialization is understood to mean the vastly expanded role of financial motives, financial markets, financial actors, and financial institutions in the operation of domestic and international economies.

- Sociological and political interpretations have also been made. In his 2006 book, American Theocracy: The Peril and Politics of Radical Religion, Oil, and Borrowed Money in the 21st Century, American writer and commentator Kevin Phillips presents financialization as "a process whereby financial services, broadly construed, take over the dominant economic, cultural, and political role in a national economy" (268). Phillips considers that the financialization of the US economy follows the same pattern that marked the beginning of the decline of Habsburg Spain in the 16th century, the Dutch trading empire in the 18th century, and the British Empire in the 19th century (it is also worth pointing out that the true final step in each of these historical economies was collapse):

- ... the leading economic powers have followed an evolutionary progression: first, agriculture, fishing, and the like, next commerce and industry, and finally finance. Several historians have elaborated this point. Brooks Adams contended that "as societies consolidate, they pass through a profound intellectual change. Energy ceases to vent through the imagination and takes the form of capital."

Jean Cushen explores how the workplace outcomes associated with financialization render employees insecure and angry.[5]

Roots

In the American experience, increased financialization occurred concomitant with the rise of neoliberalism and the free-market doctrines of Milton Friedman and the Chicago School of Economics in the late twentieth century. Various academic economists of that period worked out ideological and theoretical rationalizations and analytical approaches to facilitate the increased deregulation of financial systems and banking.

In a 1998 article, Michael Hudson discussed previous economists who saw the problems that result from financialization.[6] Problems were identified by John A. Hobson (financialization enabled Britain's imperialism), Thorstein Veblen (it acts in opposition to rational engineers), Herbert Somerton Foxwell (Britain was not using finance for industry as well as Europe), and Rudolf Hilferding (Germany was surpassing Britain and the United States in banking that supports industry).

At the same 1998 conference in Oslo, Erik S. Reinert and Arno Mong Daastøl in "Production Capitalism vs. Financial Capitalism" provided an extensive bibliography on past writings, and prophetically asked[7]

In the United States, probably more money has been made through the appreciation of real estate than in any other way. What are the long-term consequences if an increasing percentage of savings and wealth, as it now seems, is used to inflate the prices of already existing assets - real estate and stocks - instead of to create new production and innovation?

Financial turnover compared to gross domestic product

Other financial markets exhibited similarly explosive growth. Trading in US equity (stock) markets grew from $136.0 billion (or 13.1% of US GDP) in 1970 to $1.671 trillion (or 28.8% of U.S. GDP) in 1990. In 2000, trading in US equity markets was $14.222 trillion (144.9% of GDP). Most of the growth in stock trading has been directly attributed to the introduction and spread of program trading. (footnote required)

According to the March 2007 Quarterly Report from the Bank for International Settlements (see page 24.):

Trading on the international derivatives exchanges slowed in the fourth quarter of 2006. Combined turnover of interest rate, currency and stock index derivatives fell by 7% to $431 trillion between October and December 2006.

Thus, derivatives trading—mostly futures contracts on interest rates, foreign currencies, Treasury bonds, and the like—had reached a level of $1,200 trillion, or $1.2 quadrillion, a year. By comparison, US GDP in 2006 was $12.456 trillion.

Futures markets

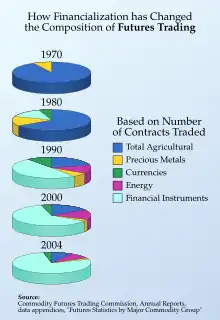

The data for turnover in the futures markets in 1970, 1980, and 1990 is based on the number of contracts traded, which is reported by the organized exchanges, such as the Chicago Board of Trade, the Chicago Mercantile Exchange, and the New York Commodity Exchange, and compiled in data appendices of the Annual Reports of the U.S. Commodity Futures Trading Commission. The pie charts below show the dramatic shift in the types of futures contracts traded from 1970 to 2004.

For a century after organized futures exchanges were founded in the mid-19th century, all futures trading was solely based on agricultural commodities. But after the end of the gold-backed fixed-exchange rate system in 1971, contracts based on foreign currencies began to be traded. After the deregulation of interest rates by the Bank of England and then the US Federal Reserve in the late 1970s, futures contracts based on various bonds and interest rates began to be traded. The result was that financial futures contracts—based on such things as interest rates, currencies, or equity indices—came to dominate the futures markets.

The dollar value of turnover in the futures markets is found by multiplying the number of contracts traded by the average value per contract for 1978 to 1980, which was calculated in research by the American Council of Life Insurers (ACLI) in 1981. The figures for earlier years were estimated on computer-generated exponential fit of data from 1960 to 1970, with 1960 set at $165 billion, half the 1970 figure, on the basis of a graph accompanying the ACLI data, which showed that the number of futures contracts traded in 1961 and earlier years was about half the number traded in 1970.

According to the ALCI data, the average value of interest-rate contracts is around ten times that of agricultural and other commodities, while the average value of currency contracts is twice that of agricultural and other commodities. (Beginning in mid-1993, the Chicago Mercantile Exchange itself began to release figures of the nominal value of contracts traded at the CME each month. In November 1993, the CME boasted that it had set a new monthly record of 13.466 million contracts traded, representing a dollar value of $8.8 trillion. By late 1994, this monthly value had doubled. On January 3, 1995, the CME boasted that its total volume for 1994 had jumped by 54%, to 226.3 million contracts traded, worth nearly $200 trillion. Soon thereafter, the CME ceased to provide a figure for the dollar value of contracts traded.)

Futures contracts are a "contract to buy or sell a very common homogeneous item at a future date for a specific price." The nominal value of a futures contract is wildly different from the risk involved in engaging in that contract. Consider two parties who engage in a contract to exchange 5,000 bushels of wheat at $8.89 per bushel on December 17, 2012. The nominal value of the contract would be $44,450 (5,000 bushels x $8.89). But what is the risk? For the buyer. the risk is that the seller will not be able to deliver the wheat on the stated date. This means the buyer must purchase the wheat from someone else; this is known as the "spot market." Assume that the spot price for wheat on December 17, 2012, is $10 per bushel. This means the cost of purchasing the wheat is $50,000 (5,000 bushels x $10). So the buyer would have lost $5,550 ($50,000 less $44,450), or the difference in the cost between the contract price and the spot price. Furthermore, futures are traded via exchanges, which guarantee that if one party reneges on its end of the bargain, (1) that party is blacklisted from entering into such contracts in the future and (2) the injured party is insured against the loss by the exchange. If the loss is so large that the exchange cannot cover it, then the members of the exchange make up the loss. Another mitigating factor to consider is that a commonly traded liquid asset, such as gold, wheat, or the S&P 500 stock index, is extremely unlikely to have a future value of $0; thus the counter-party risk is limited to something substantially less than the nominal value.

Accelerated growth of the finance sector

The financial sector is a key industry in developed economies, in which it represents a sizable share of the GDP and an important source of employment. Financial services (banking, insurance, investment, etc.) have been for a long time a powerful sector of the economy in many economically developed countries. Those activities have also played a key role in facilitating economic globalization.

Early 20th century history in the United States

As early as the beginning of the 20th Century, a small number of financial sector firms have controlled the lion's share of wealth and power of the financial sector. The notion of an American "financial oligarchy" was discussed as early as 1913. In an article entitled "Our Financial Oligarchy," Louis Brandeis, who in 1913 was appointed to the United States Supreme Court, wrote that "We believe that no methods of regulation ever have been or can be devised to remove the menace inherent in private monopoly and overwhelming commercial power" that is vested in U.S. finance sector firms.[8] There were early investigations of the concentration of the economic power of the U.S. finance sector, such as the Pujo Committee of the U.S. House of Representatives, which in 1912 found that control of credit in America was concentrated in the hands of a small group of Wall Street firms that were using their positions to accumulate vast economic power.[9] When in 1911 Standard Oil was broken up as an illegal monopoly by the U.S. government, the concentration of power in the U.S. financial sector was unaltered.[10]

Key players of financial sector firms also had a seat at the table in devising the central bank of the United States. In November 1910 the five heads of the country's most powerful finance sector firms gathered for a secret meeting on Jekyll Island with U.S. Senator Nelson W. Aldrich and Assistant Secretary of the U.S. Treasury Department A. Piatt Andrew and laid the plans for the U.S. Federal Reserve System.[11]

Deregulation and accelerated growth

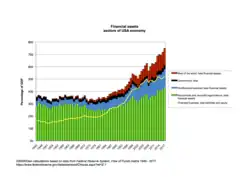

In the 1970s, the financial sector comprised slightly more than 3% of total Gross Domestic Product (GDP) of the U.S. economy,[12] while total financial assets of all investment banks (that is, securities broker-dealers) made up less than 2% of U.S. GDP.[13] The period from the New Deal through the 1970s has been referred to as the era of "boring banking" because banks that took deposits and made loans to individuals were prohibited from engaging in investments involving creative financial engineering and investment banking.[14]

U.S. federal deregulation in the 1980s of many types of banking practices paved the way for the rapid growth in the size, profitability and political power of the financial sector. Such financial sector practices included creating private mortgage-backed securities,[15] and more speculative approaches to creating and trading derivatives based on new quantitative models of risk and value,.[16] Wall Street ramped up pressure on the United States Congress for more deregulation, including for the repeal of Glass-Steagall, a New Deal law that, among other things, prohibits a bank that accepts deposits from functioning as an investment bank since the latter entails greater risks.[17]

As a result of this rapid financialization, the financial sector scaled up vastly in the span of a few decades. In 1978, the financial sector comprised 3.5% of the American economy (that is, it made up 3.5% of U.S. GDP), but by 2007 it had reached 5.9%. Profits in the American financial sector in 2009 were six times higher on average than in 1980, compared with non-financial sector profits, which on average were just over twice what they were in 1980. Financial sector profits grew by 800%, adjusted for inflation, from 1980 to 2005. In comparison with the rest of the economy, U.S. nonfinancial sector profits grew by 250% during the same period. For context, financial sector profits from the 1930s until 1980 grew at the same rate as the rest of the American economy.[18]

By way of illustration of the increased power of the financial sector over the economy, in 1978 commercial banks held $1.2 trillion (million million) in assets, which is equivalent to 53% of the GDP of the United States. By year's end 2007, commercial banks held $11.8 trillion in assets, which is equivalent to 84% of U.S. GDP. Investment banks (securities broker-dealers) held $33 billion (thousand million) in assets in 1978 (equivalent to 1.3% of U.S. GDP), but held $3.1 trillion in assets (equivalent to 22% U.S. GDP) in 2007. The securities that were so instrumental in triggering the financial crisis of 2007-2008, asset-backed securities, including collateralized debt obligations (CDOs) were practically non-existent in 1978. By 2007, they comprised $4.5 trillion in assets, equivalent to 32% of U.S. GDP.[19]

The development of leverage and financial derivatives

One of the most notable features of financialization has been the development of overleverage (more borrowed capital and less own capital) and, as a related tool, financial derivatives: financial instruments, the price or value of which is derived from the price or value of another, underlying financial instrument. Those instruments, whose initial purpose was hedging and risk management, have become widely traded financial assets in their own right. The most common types of derivatives are futures contracts, swaps, and options. In the early 1990s, a number of central banks around the world began to survey the amount of derivative market activity and report the results to the Bank for International Settlements.

In the past few years, the number and types of financial derivatives have grown enormously. In November 2007, commenting on the financial crisis sparked by the subprime mortgage collapse in the United States, Doug Noland's Credit Bubble Bulletin, on Asia Times Online, noted,

The scale of the Credit "insurance" problem is astounding. According to the Bank of International Settlements, the OTC market for Credit default swaps (CDS) jumped from $4.7 TN at the end of 2004 to $22.6 TN to end 2006. From the International Swaps and Derivatives Association we know that the total notional volume of credit derivatives jumped about 30% during the first half to $45.5 TN. And from the Comptroller of the Currency, total U.S. commercial bank Credit derivative positions ballooned from $492bn to begin 2003 to $11.8 TN as of this past June....

A major unknown regarding derivatives is the actual amount of cash behind a transaction. A derivatives contract with a notional value of millions of dollars may actually only cost a few thousand dollars. For example, an interest rate swap might be based on exchanging the interest payments on $100 million in US Treasury bonds at a fixed interest of 4.5%, for the floating interest rate of $100 million in credit card receivables. This contract would involve at least $4.5 million in interest payments, though the notional value may be reported as $100 million. However, the actual "cost" of the swap contract would be some small fraction of the minimal $4.5 million in interest payments. The difficulty of determining exactly how much this swap contract is worth, when accounted for on a financial institution's books, is typical of the worries of many experts and regulators over the explosive growth of these types of instruments.

Contrary to common belief in the United States, the largest financial center for derivatives (and for foreign exchange) is London. According to MarketWatch on December 7, 2006,

The global foreign exchange market, easily the largest financial market, is dominated by London. More than half of the trades in the derivatives market are handled in London, which straddles the time zones between Asia and the U.S. And the trading rooms in the Square Mile, as the City of London financial district is known, are responsible for almost three-quarters of the trades in the secondary fixed-income markets.

Effects on the economy

In the wake of the 2007-2010 financial crisis, a number of economists and others began to argue that financial services had become too large a sector of the US economy, with no real benefit to society accruing from the activities of increased financialization.[20]

In February 2009, white-collar criminologist and former senior financial regulator William K. Black listed the ways in which the financial sector harms the real economy. Black wrote, "The financial sector functions as the sharp canines that the predator state uses to rend the nation. In addition to siphoning off capital for its own benefit, the finance sector misallocates the remaining capital in ways that harm the real economy in order to reward already-rich financial elites harming the nation."[21]

Emerging countries have also tried to develop their financial sector, as an engine of economic development. A typical aspect is the growth of microfinance or microcredit, as part of financial inclusion.[22]

Bruce Bartlett summarized several studies in a 2013 article indicating that financialization has adversely affected economic growth and contributes to income inequality and wage stagnation for the middle class.[23]

Cause of financial crises

On 15 February 2010, Adair Turner, the head of Britain's Financial Services Authority, said financialization was correlated with the 2007–2010 financial crisis. In a speech before the Reserve Bank of India, Turner said that the Asian financial crisis of 1997–98 was similar to the 2008–9 crisis in that "both were rooted in, or at least followed after, sustained increases in the relative importance of financial activity relative to real non-financial economic activity, an increasing 'financialisation' of the economy."[24]

Effects on political system

Some, such as former International Monetary Fund chief economist Simon Johnson, have argued that the increased power and influence of the financial services sector had fundamentally transformed American politics, endangering representative democracy itself through undue influence on the political system and regulatory capture by the financial oligarchy.[25]

In the 1990s vast monetary resources flowing to a few "megabanks," enabled the financial oligarchy to achieve greater political power in the United States. Wall Street firms largely succeeded in getting the American political system and regulators to accept the ideology of financial deregulation and the legalization of more novel financial instruments.[26] Political power was achieved by contributions to political campaigns, by financial industry lobbying, and through a revolving door that positioned financial industry leaders in key politically appointed policy making and regulatory roles and that rewarded sympathetic senior government officials with super high-paying Wall Street jobs after their government service.[27] The financial sector was the leading contributor to political campaigns since at least the 1990s, contributing more than $150 million in 2006. (This far exceeded the second largest political contributing industry, the healthcare industry, which contributed $100 million in 2006.) From 1990 to 2006, the securities and investment industry increased its political contributions six-fold, from an annual $12 to $72 million. The financial sector contributed $1.7 billion to political campaigns from 1998 to 2006, and spent an additional $3.4 billion on political lobbying, according to one estimate.[28]

Policy makers such as Chairman of the Federal Reserve Alan Greenspan called for self-regulation.

See also

Notes

- Thomas Philippon (Finance Department of the New York University Stern of Business at New York University). The future of the financial industry. Stern on Finance, November 6, 2008.

- Krippner, G. R. (May 1, 2005). "The financialization of the American economy". Socio-Economic Review. 3 (2): 173–208. doi:10.1093/SER/mwi008. Retrieved November 22, 2022.

- Marois, Thomas (2012). States, Banks and Crisis: Emerging Finance Capitalism in Mexico and Turkey. Edward Elgar Publishing.

- Gerald Epstein Financialization, Rentier Interests, and Central Bank Policy. December, 2001 (this version, June, 2002 )

- Cushen, J. (2013). Financialization in the workplace: Hegemonic narratives, performative interventions and the angry knowledge worker. Accounting, Organizations and Society, Volume 38, Issue 4, May 2013, pp 314–331.

- Hudson, Michael (September 1998). Financial Capitalism v. Industrial Capitalism (Contribution to The Other Canon Conference on Production Capitalism vs. Financial Capitalism Oslo, September 3-4, 1998 ). Retrieved March 12, 2009.

- Reinert, Erik S.; Daastøl, Arno Mong (2011). Production Capitalism vs.Financial Capitalism - Symbiosis and Parasitism. An Evolutionary Perspective and Bibliography (PDF). Working Papers in Technology Governance and Economic Dynamics no. 36. The Other Canon Foundation, Norway. Tallinn University of Technology, Tallinn.

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), pp. 28-29

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 28

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 26

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 27

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 61

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 63

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 60-63

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 76

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), pp. 78-81

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), pp. 82-83, 95

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 60

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 59

- Megan McCardle. The Quiet Coup. The Atlantic Monthly, May 2009

- William K. Black. How the Servant Became a Predator: Finance's Five Fatal Flaws. The Huffington Post, February 19, 2010.

- Mader, P. (2016). Microfinance and Financial Inclusion. The Oxford Handbook of the Social Science of Poverty, Ch. 37, pp 843-865.

- Bruce Bartlett. Financialization as a Cause of Economic Malaise. NY Times, June 11, 2013.

- Reserve Bank of India. "After the Crises: Assessing the Costs and Benefits of Financial Liberalisation". Speech delivered by Lord Adair Turner, Chairman, Financial Services Authority, United Kingdom, at the Fourteenth C. D. Deshmukh Memorial Lecture on February 15, 2010 at Mumbai.

- Megan McCardle. The Quiet Coup. The Atlantic Monthly, May 2009

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 89

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 90

- Simon Johnson and James Kwak, "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown," (New York: Pantheon Books, 2010), p. 91

Further reading

- Baker, A (2005). IPE, Corporate Governance and the New Politics of Financialisation: Issues Raised by Sarbanes-Oxley

- Hein, E., Dodig, N., & Budyldina, N. (2014). Financial, economic and social systems: French Regulation School, Social Structures of Accumulation and Post-Keynesian approaches compared (No. 34/2014). Working Paper, Institute for International Political Economy Berlin.

- Lavoie, Marc (Winter 2012–2013). "Financialization, neo-liberalism, and securitization". Journal of Post Keynesian Economics. 35 (2): 215–233. doi:10.2753/pke0160-3477350203. JSTOR 23469991. S2CID 153927517.

- Martin, Randy (2002). Financialization Of Daily Life. Labor in Crisis. Philadelphia: Temple University Press. ISBN 978-1566399883.

- Orhangazi, O (2008). "Financialization and the US Economy", Edward Elgar Publishing.

- Orhangazi, O. 2008. "Financialization and Capital Accumulation in the Nonfinancial Corporate Sector: A Theoretical and Empirical Investigation on the US Economy, 1973-2003" Cambridge Journal of Economics, 32(6): 863–886.

- Gomez P.-Y. & Korine H.,(2008), Entrepreneurs and Democracy: A political Theory of Corporate Governance,Cambridge university Press: Cambridge UK, ISBN 978-0-521-85638-6

- Marois, Thomas (2012) 'Finance, Finance Capital, and Financialisation.' In: Fine, Ben and Saad Filho, Alfredo, (eds.), The Elgar Companion to Marxist Economics. Cheltenham: Edward Elgar.

External links

- Blackburn, Robin (March–April 2008). "Subprime crisis". New Left Review. New Left Review. 50.

- Bresser-Pereira, Luiz Carlos (May 2010). The global financial crisis and a new capitalism? (paper 592) (PDF). Levy Economics Institute.

- Cushen, Jean (May 2013). "Financialization in the workplace: Hegemonic narratives, performative interventions and the angry knowledge worker" (PDF). Accounting, Organizations and Society. ScienceDirect. 38 (4): 314–331. doi:10.1016/j.aos.2013.06.001.

- Epstein, Gerald A. (2005), "Introduction: Financialization and the World Economy", in Epstein, Gerald A. (ed.), Financialization and the world economy, Cheltenham, U.K. Northampton, Massachusetts: Edward Elgar Pub, pp. 3–16, ISBN 9781845429652. Pdf.

- Foster, John Bellamy (December 2006). "Monopoly-finance capital". Monthly Review. Monthly Review Foundation. 58 (7): 1. doi:10.14452/MR-058-07-2006-11_1.

- Foster, John Bellamy (April 2007). "The financialization of capitalism". Monthly Review. Monthly Review Foundation. 58 (11): 1. doi:10.14452/MR-058-11-2007-04_1.

- Foster, John Bellamy (April 2008). "The financialization of capital and the crisis". Monthly Review. Monthly Review Foundation. 59 (11): 1. doi:10.14452/MR-059-11-2008-04_1.

- Krippner, Greta R. (May 2005). "The financialization of the American economy". Socio-Economic Review. Oxford Journals. 3 (2): 173–208. doi:10.1093/SER/mwi008. S2CID 53957580.

- Moyers, Bill (host); Bogle, John (guest) (September 28, 2007). "Bill Moyers talks with John Bogle". Bill Moyers Journal. PBS.

- John Bogle, founder and retired CEO of The Vanguard Group of mutual funds, discusses how the financial system has overwhelmed the productive system, on Bill Moyers Journal

- Orhangazi, Özgür (October 2007). Financialization and capital accumulation in the non-financial corporate sector: a theoretical and empirical investigation of the U.S. economy: 1973-2003 (PDF). Political Economy Research Institute (PERI). Working paper no. 149.

- Orhangazi, Özgür (2008). Financialization and the US economy. Cheltenham, UK Northampton, Massachusetts: Edward Elgar. ISBN 9781848440166. Preview.

- Palley, Thomas I. (November 2007). Financialization: what it is and why it matters (paper 525) (PDF). Levy Economics Institute.

- Scholte, Jan Aart (June 5, 2013). "World Financial Crisis and Civil Society: Implications for Global Democracy (lecture)".

- DRadio Wissen Hörsaal (introduction in German, lecture in English)

- Thomson, Frances; Dutta, Sahil (January 2016). Financialisation: A Primer. Transnational Institute.

- Tori, Daniele; Onaran, Özlem (January 2018). "The effects of financialization on investment: evidence from firm-level data for the UK" (PDF). Cambridge Journal of Economics. Cambridge Journal of Economics (OUP). 42 (5): 1393–1416. doi:10.1093/cje/bex085. S2CID 11904353.

- Tori, Daniele; Onaran, Özlem (December 2018). "Financialisation, financial development, and investment. Evidence from European non-financial corporations" (PDF). Socio-Economic Review. Socio-Economic Review (OUP). 18 (3): 681–718. doi:10.1093/ser/mwy044.

- Vasudevan, Ramaa (November–December 2008). "Financialization: A Primer". Dollars & Sense magazine.