Goldback

The Goldback is a family of local currencies operating in five U.S. states and launched by Goldback, Inc. in Utah in 2019. Goldbacks contain a thin layer of gold within a polymer coating.

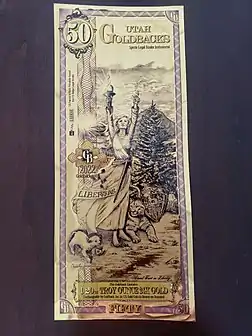

2022 Utah 50 GB note | |

| Unit | |

|---|---|

| Symbol | GB or Goldback |

| Demographics | |

| User(s) | Private use in the United States, local to the state of issue primarily |

| Issuance | |

| Issuing authority | Goldback, inc. |

| Website | goldback |

| Mint | Valaurum |

| Website | valaurum |

| Valuation | |

| Pegged with | 1 troy ounce of gold = 1000 goldbacks |

Overview

Goldbacks are shaped like regular currency notes but contain 24K pure gold. The gold is safely contained between two layers of clear polyester, which add artistic elements to the fractional gold bullion they contain. The term Goldback refers to each unit of the currency and is 1/1000 of an ounce of pure gold. The Goldbacks are issued in denominations of 1, 5, 10, 25, and 50, each containing proportionally larger amounts of gold.[1][2][3] The notes are minted by Valaurum, a regulated and certified private mint which mints gold products for various governments across the world. Valaurum uses a proprietary and patented vacuum deposition process to fuse gold atomically together into thin sheets encased in a plastic film designed to hold the gold.[1][4] Since the launch of the Goldback, the company also sells a leather wallet designed for Goldbacks. Initially funded by a lease of Gold from the United Precious Metals Association, with approximately US$1,000,000 in gold, demand has grown from $100k per month, to over a million USD per month in sales. More than US$20 million worth of Goldbacks have been manufactured and circulated, although an up-to-date market cap is not published. While it is sold as a local currency only in four regions, they have been purchased as a gold product, or for their collector's value, worldwide.

The Utah goldback was launched in 2019, with series for Nevada, New Hampshire, and Wyoming launching in 2020, 2021, and 2022, respectively.[5]South Dakota launched the goldback in 2023, becoming the fifth U.S. state to introduce the currency.

.jpg.webp) Front side of a single (one) New Hampshire edition Goldback

Front side of a single (one) New Hampshire edition Goldback.jpg.webp) Back side of a single (one) New Hampshire edition Goldback

Back side of a single (one) New Hampshire edition Goldback

Reported use

KSL 5 TV, the NBC affiliate of Salt Lake City, reported local businesses seeing a surge of people using Goldbacks in everyday transactions.[3] Reuters has reported as of 2022 that as many as "a quarter to half of small businesses in Utah will accept the [Goldback] notes".[6] Meanwhile, Nevada has seen some buyers purchasing Goldbacks as part of an inflation hedge investment vehicle.[7]

In association with members of the libertarian Free State Project in New Hampshire, widespread use has been reported of people spending Goldbacks on various goods and services within the state.[8]

Design

Each Goldback features a feminine figure, symbolically representing a cardinal virtue. Which virtues are represented and how they are represented varies according to the state series and region it serves. While each series is different in design, they are all interchangeable and contain the same amount of gold.[9] The size and shape of each bill can also tell part of the story of money. The 1GB is the same size and shape as some Early American currency, The 25GB note is identical in size to a Federal Reserve note, with the 50GB note the size of an old Gold certificate. The 5GB and 10GB notes are proportionally larger than the one and smaller than the 25. This enables most wallets to comfortably hold Goldbacks.

The Utah series depicts the virtues of Liberty, Victory, Justice, Truth, and Prudence.[9][1] The Nevada series depicts the virtues of Liberty, Fortitude, Justice, Wisdom, and Charity, while the New Hampshire series depicts the virtues of Liberty, Fortitude, Foresight, Truth, and Grace (or Gratitude). All three Series also feature animals and plants native to the states.

Legal status

The Legal status of the Goldback varies from state to state, as local currencies are not addressed by federal law. The creation of the Utah Goldback was inspired by the Passage of the Utah Legal Tender Act which provides for the adoption of gold and silver as legal tender by the state. The Utah Goldback has not been formally adopted by the state government and is privately issued, but the proponents of the currency claim that as a form of gold bullion produced by a recognized and regulated private mint it falls under the legal tender provisions of the act. This seems to have been affirmed by the Utah Legislature on March 25, 2022. The Utah State Legislature expanded on the definition of legalized gold for legal tender—explicitly making gold with a "polymer holder" or "coating" is not subject to the state sales tax—specifically any metal that, "...has a gold, silver, or platinum metallic content of 50% or more, exclusive of any transparent polymer holder, coating, or encasement..."[10] Future legislation or litigation may be necessary to establish the legal limits of Goldback as state legal tender. The Goldback also serves as a note or bill for redemption in U.S. Minted Legal tender Gold coins at the vaults of the United Precious Metals Association, and is therefore backed by Legal Tender money under state and federal law, regardless of its independent status as gold money.

The first Goldbacks were made for Utah, partly as a result of the legalization of gold and silver as legal tender in Utah in 2011 as part of the Utah Legal Tender Act, and partly because the founder and first employees were based out of Utah, which has a strong culture[11] of precious metals collecting and appreciation.[12]

.jpg.webp) "For Circulation in New Hampshire" text found on a common Goldback in the "One" denomination

"For Circulation in New Hampshire" text found on a common Goldback in the "One" denomination.jpg.webp) "Voluntary Negotiable Instrument" text found on a common Goldback in the "One" denomination

"Voluntary Negotiable Instrument" text found on a common Goldback in the "One" denomination.jpg.webp) "Privately Issued, Not U.S. Dollar Legal Tender. US & International Patents Pending" text found on a common Goldback in the "One" denomination

"Privately Issued, Not U.S. Dollar Legal Tender. US & International Patents Pending" text found on a common Goldback in the "One" denomination "U.S. Patent 10781520. Privately Issued. Not US Dollar Legal Tender" detail from a 2022 Utah 50 Goldback note

"U.S. Patent 10781520. Privately Issued. Not US Dollar Legal Tender" detail from a 2022 Utah 50 Goldback note Specie Legal Tender Instrument

Specie Legal Tender Instrument "Exchangeable by Goldback Inc. in U.S. Gold Coin to Bearer on Demand"

"Exchangeable by Goldback Inc. in U.S. Gold Coin to Bearer on Demand"

In contrast to prior concepts and attempts at achieving a gold or silver common medium of exchange, such as the Liberty dollar,[13][14][15] the Goldback considered the possibility of legal issues[13] from its inception. With this in mind, the company behind the Goldback built-in features to ensure that Goldbacks cannot be confused with government issued legal tender, such as the United States dollar. One effort the company also took in order to avoid issues with Federal counterfeit laws or being perceived as a threat to dollar hegemony was to print terms on each Goldback such as, "Voluntary negotiable instrument" and "For circulation in Utah", "For circulation in New Hampshire", or "For circulation" specific to whichever state the particular Goldback in question was 'printed' for. Also, the text "Privately Issued, Not U.S. Dollar Legal Tender. US & International Patents Pending" appears on each Goldback (of all denominations and states of issue).[5]

The makers of the Goldback contract with another firm, Oregon-based Valaurum, to manufacture the Goldback. Valaurum says of the above concern:

Over the years, many entrepreneurs have run afoul of the U.S. Treasury Department trying to create their own money. But [Adam] Trexler [founder and owner of Valaurum] is adamant that’s not what they’re doing — goldbacks are simply small amounts of gold that, he hopes, might one day sit in your wallet right next to paper bills and whatever else the future holds.[16]

Criticism

Some commentators have stated that one potential downside of the Goldback is the premium that each Goldback costs over the spot price of gold embedded within each note.[16] Currently the premium to the gold price is around 100%.

The Goldback introduced to the world a new premium know as "utility."

There are the four premiums within Silver/Gold/Goldback space.

1. Premium - "unrealized gain," the price to acquire or the price over gold’s spot price

2. Premium - "loss/gain," part of selling. When selling back to a LCS (Local Coin Shop) the shop owner, being in control of the position, decides what he/she will purchase at thus the seller either has a loss or a gain from his/her original purchase.

3. Premium - "utility," included in a sale and passes on or stays with each note that is in commerce

4. Premium - "management," fee from an advisor

Premium "utility," has the following values included in its premium: fungibility, fractionalization, bankability, barterability, borrowability, exchangability, givability, investability, leasability, spendability, tipability, tradability, transferability, vautalility, salability and charitable giving.

Melting a Goldback destroys all these "utility premiums" and is never advised.

This Premium is more valuable when compared to other premiums that are lost when "selling" or "melting" one's precious metals holdings.

If commerce is your goal, which is the purpose of holding Goldbacks, then having some Goldbacks would be a beneficial item to include to one’s stack.

See also

References

- Gozenput, Eric. "The Goldback: An Alternative to Fiat Currency?". valuewalk.com. Value Walk. Retrieved May 18, 2022.

- White, Patrick. "There are places where gold is paid today". vezess.hu. Vezess. Retrieved May 18, 2022.

- Rascon, Matt. "Local 'Goldback' currency gaining traction during pandemic". www.ksl.com. KSL 5 TV. Retrieved March 18, 2022.

- Moore, Kim. "Gold Rush". oregonbusiness.com. Oregon Business. Retrieved May 18, 2022.

- Cordon, Jeremy. "A Brief History of the Goldback". goldback.com. Goldback®. Retrieved March 17, 2022.

- Brettell, Karen. "With inflation, gold notes and cards find their way into America's wallet". www.reuters.com. Reuters. Retrieved April 27, 2022.

- name="Las Vegas Coin Company - Las Vegas Morning Blend"|url=https://www.ktnv.com/morningblend/las-vegas-coin-company-2-16-22"

- Stoll, Shira; King, Alison; Ferrigan, Dan. "Life, Liberty and the Pursuit of New Hampshire: An NBC10 Boston Original". www.nbcboston.com. NBC Boston. Retrieved February 25, 2023.

- Sharma, Neha. "Goldbacks, world's first currency with pure gold in its bills (and its spendable)". luxurylaunches.com. Retrieved May 20, 2022.

- Brammer, Rep. Brady; Bramble, Sen. Curtis S. "H.B. 268 Sales and Income Tax Amendments". le.utah.gov. Utah State Legislature. Retrieved April 3, 2022.

- "United Precious Metals Association". upma.org. United Precious Metals Association. Retrieved March 18, 2022.

- Galvez, Brad J. "First Substitute H.B. 317". le.utah.gov. Utah State Legislature. Retrieved March 17, 2022.

- Leef, George. "Protecting Us From A 'Terrorist' Who Made Pure Silver Coins: The Bernard von NotHaus Case". Forbes. Retrieved April 3, 2022.

- Goldstein, Joseph. "'Spectacular Trial' Is Seen in Case of Liberty Dollar". www.nysun.com. The New York Sun. Retrieved April 3, 2022.

- "Liberty Dollars Not Legal Tender, United States Mint Warns Consumers". www.usmint.gov. United States Mint. Retrieved April 3, 2022.

- Foden-Vencil, Kristian. "Oregon entrepreneur aims to create a new way of trading with gold". www.opb.org. Oregon Public Broadcasting. Retrieved March 19, 2022.