Housing in the United Kingdom

Housing in the United Kingdom represents the largest non-financial asset class in the UK; its overall net value passed the £5 trillion mark in 2014.[1] Housing includes modern and traditional styles. About 30% of homes are owned outright by their occupants, and a further 40% are owner-occupied on a mortgage. About 18% are social housing of some kind, and the remaining 12% are privately rented.[2]

The UK ranks in the top half in Europe with regard to rooms per person, amenities, and quality of housing.[3][4] However, the cost of housing as a proportion of income is higher than average among EU countries,[3] and the increasing cost of housing in the UK may constitute a housing crisis for some, especially in as London.[5][6][7]

Housing is the jurisdiction of the Minister of State for Housing and Planning.[8]

History

Victorian era

Rapid population growth took place in the nineteenth century, particularly in cities. The new homes were arranged and funded via building societies that dealt directly with large contracting firms.[9][10] Private renting from housing landlords was the dominant tenure. People moved in so rapidly that there was not enough capital to build adequate housing for everyone, so low-income newcomers squeezed into increasingly overcrowded slums. Clean water, sanitation, and public health facilities were inadequate; the death rate was high, especially infant mortality, and tuberculosis among young adults.[11][12][13]

1900–1939

The rapid expansion of housing was a major success story of the interwar years, 1919–1939, standing in sharp contrast to the United States, where the construction of new housing practically collapsed after 1929. The total housing stock in England and Wales was 7,600,000 in 1911; 8,000,000 in 1921; 9,400,000 in 1931; and 11,300,000 in 1939.[14]

Renting during 1900–1939

The private rent market provided 90% of the housing before the war. Now it came under heavy pressure, regarding rent controls, and the inability of owners to evict tenants, except for non-payment of rent. The tenants had a friend in Liberal Prime Minister, David Lloyd George, and especially in the increasingly powerful Labour Party. The private rent sector went into a prolonged decline and never recovered; by 1938, it covered only 58% of the housing stock.[15]

A decisive change in policy was marked by the Tudor Walters Report of 1918; it set the standards for council house design and location for the next ninety years.[16][17] It recommended housing in short terraces, spaced at 70 feet (21 m) at a density of twelve to the acre.[18] With the Housing, Town Planning, &c. Act 1919 David Lloyd George set up a system of government housing that followed his 1918 election campaign promises of "homes fit for heroes." It required local authorities to survey their housing needs, and start building houses to replace slums. The treasury subsidised the low rents. The immediate impact was the prevalence of the three-bedroom house, with kitchen, bathroom, parlour, electric lighting, and gas cooking, often built as subsidised council housing. Major cities such as London and Birmingham built large-scale housing estates – one in Birmingham had a population of 30,000 residents. The houses were built in blocks of two or four using brick or stucco, with two storeys. They were set back from curving streets; each had a long garden. Shopping centres, churches and pubs sprang up nearby. Eventually, the city would provide a community hall, schools, and a public library. The residents typically were the upper fifth stratum of the working-class. The largest of these two communities was Becontree in the outer suburbs of London, where construction began in 1921, and by 1932 there were 22,000 houses holding 103,000 residents.[19] Slum clearance now moved from being a public health issue, to a matter of town planning.[20]

Liberal MP Tudor Walters was inspired by the garden city movement, calling for spacious low-density developments and semi-detached houses built to a high construction standard. Older women could now vote. Local politicians consulted with them and in response put more emphasis on such amenities as communal laundromats, extra bedrooms, indoor lavatories, running hot water, separate parlours to demonstrate their respectability, and practical vegetable gardens rather than manicured yards. The housewives had had their fill of chamber pots.[21][22] Progress was not automatic, as shown by the troubles of rural Norfolk. Many dreams were shattered as local authorities had to renege on promises they could not fulfill due to undue haste, impossible national deadlines, debilitating bureaucracy, lack of lumber, rising costs, and the unaffordability of rents by the rural poor.[23]

In England and Wales, 214,000 multi-unit council buildings were built by 1939; making the Ministry of Health largely a ministry of housing.[24] Council housing accounted for 10% of the housing stock in the UK by 1938, peaking at 32% in 1980, and dropping to 18% by 1996, where it held steady for the next two decades.[25][26][27][28]

Debates on high-rise housing

The fierce debates over high-rise housing that took place after 1945 were presaged by an acrimonious debate in the 1920s and 1930s in London. On the political left there was firm opposition to what were denounced as "barracks for the working-classes". Reformers on the right called for multi-storey solutions to overcrowding and high rents. There were attempts at compromise by developing new solutions to urban living, focused especially on slum clearance and redevelopment schemes. The compromises generally sought to replace inhospitable slums with high-rise blocks served by lifts. In the Metropolitan Borough of Stepney they included John Scurr House (built 1936–1937), Riverside Mansions (1925–1928) and the Limehouse Fields project (1925 but never built).[29]

Ownership

Increasingly the British ideal was home ownership, even among the working class. Rates of home ownership rose steadily from 15 percent of people owning their own home before 1914, to 32 percent by 1938, and 67 percent by 1996. The construction industry sold the idea of home ownership to upscale renters. The mortgage lost its old stigma of a millstone round your neck to instead be seen as a smart long-term investment in suburbanized Britain. It appealed to aspirations of upward mobility and made possible the fastest rate of growth in working-class owner-occupation during the 20th century.[30][31] The boom was largely financed by the savings ordinary Britons put into their building societies. Starting in the 1920s favourable tax policies encouraged substantial investment in the societies, creating huge reserves for lending. Beginning in 1927, the societies encouraged borrowing through gradual liberalization of mortgage terms.[32]

Post War

Housing was a critical shortage in the post-war era. Air raids had destroyed half a million housing units; repairs and maintenance on undamaged homes had been postponed. 3,000,000 new dwellings were needed. The government aimed for 300,000 to be built annually, compared to the maximum pre-war rate of 350,000. However, there were shortages of builders, materials, and funding. The Ministry of Works undertook the publication of a set of Post War Building Studies, that established technical guidelines for the use of new or modernised building materials. Not counting 150,000 temporary prefabricated units, the nation was still 1,500,000 units short by 1951. Legislation kept rents down, but did not affect purchased houses. The ambitions of the New Towns Act 1946 project were idealistic, but did not provide enough urgently needed units. When the Conservative Party returned to power in 1951, they made housing a high priority and oversaw 2,500,000 new units, two-thirds of them through local councils. Haste made for dubious quality, and policy increasingly shifted toward renovation rather than new builds. Slums were cleared, opening the way for gentrification in the inner cities.[33]

Working-class families proved eager to purchase their council homes when the Thatcher ministry introduced the "Right to Buy" scheme in 1980, alongside restricting the construction of new council houses.[34]

According to a 2018 study in the Economic History Review, the ‘stop-go’ macroeconomic policy framework adopted by the Treasury and the Bank of England from the mid-1950s to the early 1980s restricted house-building during the period.[35]

Demography

There are approximately 23 million dwellings in England and some 27 million across the UK. In 2009, about 30% of homes were owned outright by their occupants, and a further 40% were owner-occupied on a mortgage. About 18% are social housing of some kind, and the remaining 12% are privately rented.[2] The overall mean number of bedrooms is approximately 2.8. Just under 40% of households have at least two spare bedrooms.[36] 20% of dwellings were built before 1919 and 15% were built post 1990.[36] 29% of all dwellings are terraced, 42% are detached or semi-detached, and the remaining 29% are bungalows or flats. The mean floor area is 95 square metres.[36] Approximately 4% of all dwellings were vacant.[36] Approximately 385,000 households reported a fire between 2012 and 2014, the majority of which were caused by cooking.[37] In 2014 2.6 million households moved dwelling, the majority of which (74%) were renters.[36]

Supply and construction

The Labour government suspected that there might be supply-side problems in the construction sector, and in 2006 commissioned the Callcutt Review of House Building Delivery,[39] which was published in 2007. The Callcutt report noted the failure of the home building industry to increase the supply in response to price signals.[40] There was a fall in the numbers of house completions after the 2008 recession, but by 2015 it was back up to 169,000.[41]

According to the Centre for Ageing Better 21% of homes in the UK were built before 1919, 38% before 1946, and only 7% after 2000, making the British housing stock older than any European Union countries.[42]

Local planning authorities are required to continuously maintain sufficient land to meet housing needs for five years.[43] It is estimated 250,000 new homes are needed each year just to keep up with the demand of the UK's continually growing population.[44]

Purchase price of a dwelling

After adjusting for inflation, the average cost of a home increased by a factor of 3.4 between 1950 and 2012.[45]

In September 2015 the average house price was £286,000, and affordability of housing as measured by price to earnings ratio was 5.3.[46] The UK's home dwelling cost per type in July 2018 was on average:[47]

- Detached: £378,473

- Semi-detached: £230,284

- Terraced: £200,889

- Flat/maisonette: £230,603

London is ranked as the top city in the world in terms of the number of ultra high net worth individuals who are resident in a city.[48] The consequence of this is seen in the high price for top-end dwellings. The most expensive home ever sold in the UK was 2–8a Rutland Gate, Hyde Park, which sold for £280 million in 2015.[49] The most expensive street in the UK is Kensington Palace Gardens, London, where the average price of a home is approximately £42 million.[50]

A report for Wandsworth Borough Council found that overseas investors had a positive effect on housing affordability, both in bringing forward new homes in general and allowing the affordable housing part of schemes to be brought forward more quickly. They also found that there was very little evidence of housing being left empty.[51] Dwellings represent the largest non-financial asset in the British balance sheet, with a net worth of £5.1 trillion (2014).[1] In the national statistics rising house prices are regarded as adding to GDP and thus a cause of economic growth.

Renting

Nearly two out of five households rent their home.[52] However, the supply of rental properties has been declining since 2016 when the taxation treatment of rental property turned against landlords.[53] Nearly all dwellings are let using Assured shorthold tenancy agreements.[54] For the initial period, typically six months or a year, neither side can terminate the agreement. After this period, landlords can terminate the agreement at two months' notice.

Council Tax is paid by the occupier of the home unless it is a house in multiple occupation (HMO) when the landlord is liable. In London, rents are double the national average, meaning that living in London has become a luxury good. People on median incomes who work in central London often live in the outer suburbs of London and the commuting towns of South East England.[55]

Renters Reform Bill

The Renters Reform Bill will impact on both the 11 million private renters and 2.3 million landlords in England. The Renters Reform Bill will:[56]

- Abolish section 21 ‘no fault’ evictions and move to a tenancy structure where all assured tenancies are periodic;

- Introduce more comprehensive possession grounds so landlords can still recover their property (including where they wish to sell their property or move in close family) and to make it easier to repossess properties where tenants are at fault, for example in cases of anti-social behaviour and repeat rent arrears;

- Provide stronger protections against eviction by ensuring tenants are able to appeal excessively above-market rents which are purely designed to force them out. As now, landlords will still be able to increase rents to market price for their properties and an independent tribunal will make a judgement on this, if needed. To avoid fettering the freedom of the judiciary, the tribunal will continue to be able to determine the actual market rent of a property;

- Introduce a new Private Rented Sector Ombudsman which will provide fair, impartial, and binding resolution to many issues and prove quicker, cheaper, and less adversarial than the court system;

- Create a Privately Rented Property Portal to help landlords understand their legal obligations and demonstrate compliance (giving good landlords confidence in their position), alongside providing better information to tenants to make informed decisions when entering into a tenancy agreement. It will also support local councils – helping them target enforcement activity where it is needed most;

- Give tenants the right to request a pet in the property, which the landlord must consider and cannot unreasonably refuse. To support this, landlords will be able to require pet insurance to cover any damage to their property.

Homelessness

In June 2015 there were approximately 67,000 households in England in temporary accommodation.[57] In autumn 2014 there were around 2,400 rough sleepers in England, 27% of which were in London.[58][59] In 2018, around 320,000 people were homeless in the United Kingdom, both adults and children.[60]

Housing quality

The United Kingdom ranks highly in Europe with regard to rooms per person, amenities, and quality of housing.[3][4]

The consequence of the housing shortage manifests itself in overcrowding rather than In homelessness, The problem of over crowding is especially acute in London.[61] In 2011 it was estimated that there were 391,000 children in London living in overcrowded conditions.[62] Between 1995-1996 to 2013-2014 overcrowding, as measured by the bedroom standard increased from 63,000 households to 218,000 households.[63] The bedroom standard understates overcrowding. It does not include potential household units forced to live in the same dwelling. For example, divorced couples living in the same dwelling, adult children being unable to form own household but having to live with their parents.[64] A report issued in 2004 reviewed the evidence that overcrowding, in addition to the known impacts on physical health, adversely affects mental health and child development.[65]

It is useful to consider housing quality under two sub headings physical and social. In the era of Beveridge Consensus there were large scale slum clearance projects. Council environmental health officers inspected dwellings in a borough and those which failed to meet standards were compulsorily purchased for a nominal sum and demolished.[66] New dwellings were built to rehouse the slum dwellers. Slum clearance significantly improved the physical quality of the British housing stock. But in a seminal study Family and Kinship in East London it was found that although the physical quality of the housing had improved, its social quality had deteriorated. The residents of apartments in tower blocks appreciated their clean, warm, bright new apartments, but missed the supportive community networks of the slums.

The overall quality of English housing stock has improved over the last thirty years, however, the quality of housing for new households varies.[67]

The Building Better, Building Beautiful Commission was an independent body that advised the Ministry of Housing, Communities and Local Government on how to promote and increase the use of high-quality design for new build homes and neighbourhoods in the United Kingdom. The research was conducted on behalf of the Commission, and the findings have informed the recommendations in the report. It supports the creation of more beautiful, greener communities. The commission had 3 primary aims:[68]

- To promote better design and style of homes, villages, towns and high streets, to reflect what communities want, building on the knowledge and tradition of what they know works for their area.

- To explore how new settlements can be developed with greater community consent.

- To make the planning system work in support of better design and style, not against it.

Energy efficiency

There is a particular problem with dwellings built before World War I (1914-1918), which are now over hundred years old.[69] The terraced houses of this period, built for sale to the buy-to-let investors of the time, are particular difficult to insulate. These dwellings were built for heating by open coal fires, and had large drafty windows to allow the fire to draw. They have very small rooms and have solid walls with a single leaf of bricks. This structure makes wall insulation expensive and in many cases impractical.[70] Many of the dwellings of this type were replaced by council houses in the post war slum clearance program, but with the ending of public sector building of dwellings this route for improving the energy efficient of the housing stock ended.

There also insulation problems in the pre-1914 large houses built for the top decile of the time. These houses were built with servant quarters in the roof space. Most such houses have been converted into blocks of flats and sold to buy to let investors.[71] These flats are difficult to insulate, especial the top floor flat in the roof space.[72] The expense of insulation means that it is not often not cost effective for the landlord to insulate such dwellings. This is especially true in London, where due to the housing crisis, landlords can let a property in poor condition, and consequently improving the energy efficiency of a dwelling is not a priority for buy to let investors.

The Green Deal provided low interest loans for energy efficiency improvements to the energy bills of the properties the upgrades are performed on.[73] These debts are passed onto new occupiers when they take over the payment of energy bills. The costs of the loan repayments should be less than the savings on the bills from the upgrades, however this will be a guideline and not legally enforceable guarantee. It is believed that tying repayment to energy bills will give investors a secure return. The Green Deal for the domestic property market was launched in October 2012. The Commercial Green Deal was launched in January 2012 and released in a series of stages to help with the varying needs and requirements of commercial properties.

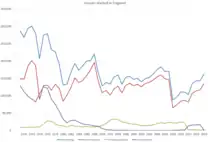

Empty homes

According to official statistics, in October 2015, there were 600,179 vacant dwellings in England, a decline from the 610,123 from a year earlier. Of these vacant dwellings, 203,596 were vacant for more than six months.[75] This, it is believed, is mainly due to financial reasons, such as the owner being unable to sell the house or raise enough money to renovate the property.[76] In November 2017, the government allowed councils to charge a 100% council tax premium on empty homes.[77]

According to official statistics, the percentage of empty homes in England fell from 3.5% in 2008 to 2.6% in 2014.[78] One explanation for this housing transactions have picked up since the financial crisis, and because of government efforts to reduce the number of empty homes. An alternative explanation is that before April 2013 there was an incentive for property owners to report a property as empty, as there was a rebate on council tax for vacant property. And when this incentive was removed, property owners ceased informing the council that their property was empty, and this led to an apparent fall in empty homes reported by official statistics.[78]

The number of empty homes includes homes where the previous occupier is in prison, in care, in hospital or recently deceased.[78] The charity Empty Homes argued that empty homes were helping contribute to the housing crisis, saying in a report "The longer a property is empty the more our housing assets are being wasted. Also, the longer a property lies empty, the more likely it is to deteriorate; the more it is likely to cost to bring back into use; and the more it is likely to be seen as a blight by the neighbours."[78]

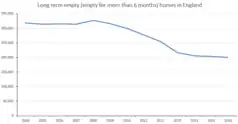

Long-term empty homes

In 2016, there were around 200,000 empty homes in the UK, down from 300,000 in 2010.[77] Empty Dwelling Management Orders (EMDOs) allow councils to take over the management of long-term empty properties but these are generally seen as a last resort and only 43 EDMOs were successful from 2006 to 2011. Government statistics show that long-term empty homes are generally concentrated post-industrial areas, in the North of England and in seaside towns, where property prices are generally lower, with the lowest percentage in London, which had 20,795 long-term empty properties, with the highest in Barrow-in Furness, Burley and Blackburn.[76][77][79]

As of 2015, around 1.7% of. homes in London are empty, which is a historically low level. The vacancy rate is much lower for London's private sector housing compared to the rest of the country, whereas the rates for affordable housing are "broadly similar".[80] Research by Islington Council revealed that nearly a third of new dwellings built did not have anyone on the electoral register after six years, although this may exclude students and foreign tenants.[81] The Observer reported on what has been termed 'lights out London' .. 'where absentee owners push up property prices without contributing to the local economy'.[82] According to a local restaurateur 'my original customers [have sold to ] non-doms who do not live in their [property]. In some apartment blocks 20% were unoccupied... It makes a big difference [to my business]'.[83]

Research by the London School of Economics for the Mayor of London found that there was almost no evidence of new build units being left empty, "certainly less than 1%" and that the "vast majority" of overseas buyers intended to live in the property or rent it out.[84]

See also

References

- "National Balance Sheet - Office for National Statistics". www.ONS.gov.uk. Retrieved 7 July 2017.

- Diaz, R. "Housing Tenure Factsheet" (PDF). shelter.org. Retrieved 7 August 2019.

- "OECD Better Life Index". www.OECDBetterLifeIndex.org. Retrieved 7 July 2017.

- "First European Quality of Life Survey: Social dimensions of housing" (PDF). Europa.eu. Retrieved 7 July 2017.

- "350,000 UK households will be unable to rent or buy without help by 2020". Independent.co.uk. 16 November 2015. Retrieved 7 July 2017.

- "Housing crisis overtakes transport as biggest concern for Londoners". Evening Standard. 15 April 2014. Retrieved 15 January 2016.

- "The human cost of Britain's housing crisis". The Guardian. 13 October 2015. ISSN 0261-3077. Retrieved 15 January 2016.

- "Minister of State (Housing and Planning) - GOV.UK". www.gov.uk. Retrieved 19 September 2023.

- H.J. Dyos, "The speculative builders and developers of Victorian London." Victorian Studies 11 (1968): 641–690. in JSTOR

- Christopher Powell, The British building industry since 1800: An economic history (Taylor & Francis, 1996).

- H.J. Dyos, "The Slums of Victorian London." Victorian Studies 11.1 (1967): 5-40. in JSTOR

- Anthony S. Wohl, The eternal slum: housing and social policy in Victorian London (1977).

- Martin J. Daunton, House and home in the Victorian city: working class housing, 1850-1914 (1983).

- William D. Rubinstein (2003). Twentieth-Century Britain: A Political History. Macmillan Education UK. p. 122. ISBN 9780230629134.

- Martin Pugh, We Danced All Night: A Social History of Britain Between the Wars (2009), p 60

- Burnett, A social history of housing: 1815-1985 (1986) pp 226–34.

- John Stephenson, British society 1914 – 45 (1984) pp 221-42.

- John Burnett, A Social History of Housing : 1815-1985 (2nd ed. 1986) pp 222-26.

- Charles Loch Mowat, Britain between the wars 1918-1940 (1955) pp 229-30.

- Paul Wilding, "The Housing and Town Planning Act 1919—A Study in the Making of Social Policy." Journal of Social Policy 2#4 (1973): 317-334.

- Pugh, We Danced All Night (2009), p 61.

- Noreen Branson, Britain in the Nineteen Twenties (1976) pp 103-17.

- Annette Martin, "Shattered hopes and unfulfilled dreams: council housing in neural Norfolk in the early 1920s, Local Historian (2005) 35#2 pp 107-119.

- Charles Loch Mowat, Britain between the Wars: 1918–1940 (1955) pp 43–46

- Pat Thane, Cassel's Companion to 20th Century Britain 2001) 195-96.

- Sean Glynn and John Oxborrow, Interwar Britain: A social and economic history (1976) pp 212-44.

- Noreen Branson and Margot Heinemann, Britain in the Nineteen Thirties (1971) pp 180 – 201.

- Martin Pugh, We Danced all Night: A social history of Britain between the Wars (2008), pp 57-75

- Simon Pepper and Peter Richmond, "Stepney and the Politics of High-Rise Housing: Limehouse Fields to John Scurr House, 1925–1937." London Journal 34.1 (2009): 33-54.

- Peter Scott, "Marketing mass home ownership and the creation of the modern working-class consumer in inter-war Britain." Business History 50#1 (2008): 4-25.

- Mark Swenarton and Sandra Taylor. "The scale and nature of the growth of owner‐occupation in Britain between the wars." Economic History Review 38#3 (1985): 373-392.

- Jane Humphries, "Inter-war house building, cheap money and building societies: The housing boom revisited." Business History 29.3 (1987): 325-345.

- Burnett, A social history of housing: 1815-1985 (1985) pp 278-330

- Norman Ginsburg, "The privatization of council housing." Critical Social Policy 25.1 (2005): 115-135.

- Scott, Peter M.; Walker, James T. (3 June 2018). "'Stop-go' policy and the restriction of postwar British house-building" (PDF). The Economic History Review. 72 (2): 716–737. doi:10.1111/ehr.12700. ISSN 0013-0117. S2CID 158890468.

- "English housing survey 2013 to 2014: headline report - GOV.UK". www.gov.uk. Retrieved 7 July 2017.

- "English housing survey 2013 to 2014: fire and fire safety report - GOV.UK". www.gov.uk. Retrieved 7 July 2017.

- "Live tables on house building: New build dwellings".

- "Callcutt Review of House Building Delivery" (PDF). NationalArchives.gov.uk. Archived from the original (PDF) on 19 September 2012. Retrieved 7 July 2017.

- "Callcutt Review of House Building Delivery" (PDF). HMSO. 1 November 2007. p. 214. Archived from the original (PDF) on 19 September 2012.

According to [neo classical economic theory], where there is an imbalance between supply and demand, prices will adjust until either supply increases or demand is choked of. Over recent years [the UK housing market] has continued to defy all predictions.

- "Live tables on house building - Statistical data sets - GOV.UK". www.gov.uk. Retrieved 5 September 2017.

- "More than 1 million over 55s living in hazardous homes, study finds". Homecare Insight. 9 May 2019. Retrieved 7 July 2019.

- Gov.UK https://www.gov.uk/guidance/housing-supply-and-delivery#year-housing-land-supply

- Westville Group https://www.westvillegroup.co.uk/commercial-industries-new-build-housing/

- "UK House Value vs UK House Affordability – December 2012". Retirement Investing Today. 22 December 2012. Retrieved 12 January 2016.

- "House Price Index- Office for National Statistics". www.ons.gov.uk. Retrieved 11 June 2016.

- "UK House Price Index for July 2018" (Press release). September 2018. Retrieved 24 January 2019.

- "Global Investment Cities | The Wealth Report". www.knightfrank.com. Retrieved 15 January 2016.

- "A Hyde Park mansion could become Britain's most expensive home after £280m bid". Independent.co.uk. 13 July 2015. Retrieved 7 July 2017.

- "On the elite streets of Britain: Our most expensive roads". Telegraph. 12 January 2016.

- "WANDSWORTH BOROUGH COUNCIL report" (PDF).

- "Dwelling Stock Estimates 2014 England" (PDF). National Statistics. 23 April 2015. Retrieved 10 January 2016.

- https://www.ft.com/content/33c6e7b4-3927-11e9-b72b-2c7f526ca5d0

- "Model agreement for a shorthold assured tenancy - Publications - GOV.UK". www.gov.uk. Retrieved 19 January 2016.

- Hyde, Dan (29 July 2015). "London workers £300,000 better off living an hour outside capital". Telegraph.co.uk. Retrieved 13 June 2016.

- "Guide to the Renters (Reform) Bill". GOV.UK. Retrieved 19 September 2023.

- "Statutory homelessness in England: April to June 2015 - GOV.UK". www.gov.uk. Retrieved 7 July 2017.

- "Rough sleeping in England: autumn 2014 - GOV.UK". www.gov.uk. Retrieved 7 July 2017.

- "The homeless people - a priority need? - Arkas Law". ArkasLaw.co.uk. 1 July 2015. Retrieved 7 July 2017.

- "The estimated number of homeless people in Britain is broadly comparable to the population of Iceland". Full Fact. Retrieved 1 October 2019.

- "No Space at Home:Overcrowding in London" (PDF). 4 in 10 London Children Live in Poverty. Retrieved 11 January 2016.

- "English Housing Survey 2009/10". DCLG. July 2011.

- "English Housing Survey Headline Report 2013-14" (PDF). Department of Communities and Local Government. February 2015. p. 32.

- Kozma, Glynis (24 June 2013). "Generation boomerang: how to cope with grown-up children at home". Telegraph.co.uk. Retrieved 17 January 2016.

- "The Impact of Overcrowding on Health &Education" (PDF). Office of the Deputy Prime Minister. May 2004. Retrieved 11 January 2016.

- "The History of Council Housing". fet.uwe.ac.uk. Retrieved 15 January 2016.

- "English Housing Survey Headline Report 20130-14" (PDF). February 2015. p. 15, Figure 1.4 Household aged 25–34 by tenure.

- "Housing Secretary: beautiful homes should become 'norm'". GOV.UK. Retrieved 11 October 2021.

Text was copied from this source, which is available under an Open Government Licence v3.0. © Crown copyright.

Text was copied from this source, which is available under an Open Government Licence v3.0. © Crown copyright. - "English Housing Survey ENERGY EFFICIENCY OF ENGLISH HOUSING 2013" (PDF). 2013. p. 50.

The majority of the least energy efficient homes were the oldest homes, built before 1919 (61%). These oldest homes were more likely to be of solid wallconstruction, which can more expensive to insulate where required.

- "Energy Efficiency and Historic Buildings -Insulating Solidwalls". English Heritage. 1 March 2012.

In some cases the technical risks of adding insulation to solid walls will be too great.

- "Energy Efficiency English Housing 2013" (PDF). p. 49.

In 2013, there were around 1.5 million homes (6%) with the worst energy efficiency. Private rented homes were over represented in this group:

- "Energy Efficiency of English Housing 2013" (PDF).

..converted flats formed higher proportions of the least energy efficient homes...whereas purpose built flats were under represented

- "UK government's Green Deal to cut fuel bills". BBC.co.uk. 23 November 2011. Retrieved 12 February 2012.

- "Empty homes in England".

- "Dwelling Stock Estimates: 2015, England" (PDF). ONS. 28 April 2016.

Long-term vacant dwellings numbered 203,596 on 5 October 2015, a fall of 2,225 (1.1%) from 205,821 on 6 October 2014.

- "Why are so many British homes empty?". BBC.co.uk. Retrieved 6 January 2016.

- Homer, Alex (24 November 2017). "Empty homes spike in London commuter belt". BBC News.

- "Empty Homes in England" (PDF). EmptyHomes.com. Retrieved 6 January 2016.

- Busby, Mattha (25 September 2018). "England has more than 200,000 empty homes. How to revive them?". The Guardian.

- "HOUSING IN LONDON 2015" (PDF). p. 35.

- Booth, Robert (4 December 2014). "Property investors in Islington who leave homes empty could face jai". The Guardian. Guardian.

- Cumming, Ed (25 January 2015). "'It's like a ghost town': lights go out as foreign owners desert London homes". The Guardian.

Absentee owners and the 'buy to leave' market are hurting businesses

- Cumming, Ed (25 January 2015). "'It's like a ghost town': lights go out as foreign owners desert London homes". The Guardian.

When [restaurateur] Racine opened in 2002 the average price of a Knightsbridge home was £745,000; now it is £3.4m.

- "'Almost no evidence' of London homes owned by foreign buyers being left empty".

Further reading

- Back, Glenn, and Chris Hamnett. "State housing policy formation and the changing role of housing associations in Britain." Policy & Politics 13.4 (1985): 393-412.

- Boddy, Martin. The building societies (Macmillan, 1980).

- Branson, Noreen, and Margot Heinemann. Britain in the Nineteen Thirties (1971) pp 180–201.

- Branson, Noreen. Britain in the Nineteen Twenties (1976) pp 103–17.

- Burnett, John. A social history of housing: 1815-1985 (2nd ed. 1986)

- Clark, Gregory. "Shelter from the storm: housing and the industrial revolution, 1550–1909." Journal of Economic History 62#2 (2002): 489-511.

- Cowan, David. "‘This is Mine! This is Private! This is where I belong!’: Access to Home Ownership." in Cowan, ed., Housing Law and Policy (1999). 326-361.

- Damer, Sean. "'Engineers of the human machine': The social practice of council housing management in Glasgow, 1895-1939." Urban Studies 37.11 (2000): 2007-2026.

- Dunleavy, Patrick. The politics of mass housing in Britain, 1945-1975: a study of corporate power and professional influence in the welfare state (Oxford UP< 1981).

- Gauldie, Enid. Cruel habitations: a history of working-class housing 1780-1918 (Allen & Unwin, 1974).

- Ginsburg, Norman. "The privatization of council housing." Critical Social Policy 25.1 (2005): 115-135.

- Glynn, Sean, and John Oxborrow. Interwar Britain: A social and economic history (1976) pp 212–44.

- Hollow, Matthew. "The age of affluence revisited: Council estates and consumer society in Britain, 1950–1970." Journal of Consumer Culture 16.1 (2016): 279-296.

- King, Anthony D. Buildings and Society: Essays on the Social Development of the Built Environment (1980)

- Madigan, Ruth, and Moira Munro. "Gender, house and" home": Social meanings and domestic architecture in Britain." Journal of Architectural and Planning Research (1991): 116-132. in JSTOR

- Melling, Joseph, ed. Housing, Social Policy and the State (1980)

- Merrett, Stephen. State Housing in Britain (1979)

- Merrett, Stephen, and Fred Gray. Owner-occupation in Britain (Routledge, 1982).

- Pugh, Martin. We Danced all Night: A social history of Britain between the Wars (2008), pp 57-75.

- Rodger, Richard. Housing in urban Britain 1780-1914 (Cambridge UP, 1995).

- Scott, Peter. "Marketing mass home ownership and the creation of the modern working-class consumer in inter-war Britain." Business History 50.1 (2008): 4-25.

- Short, John R. Housing in Britain: the post-war experience (Taylor & Francis, 1982).

- Smyth, Stewart. "The privatization of council housing: Stock transfer and the struggle for accountable housing." Critical Social Policy 33.1 (2013): 37-56.

- Stephenson, John, British society 1914–45 (1984) pp 221–42.

- Swenarton, Mark. Homes Fit for Heroes: The Politics and Architecture of Early State Housing in Britain (1981).

- Thane, Pat. Cassel's Companion to 20th Century Britain (2001) pp 195–96.

Historiography

- Hinchcliffe, Tanis. "Pandora's Box: Forty Years of Housing History." The London Journal 41.1 (2016): 1-16. Discusses articles on housing and the scholarly journal The London Journal

- Pepper, Simon, and Peter Richmond. "Homes unfit for heroes: The slum problem in London and Neville Chamberlain's Unhealthy Areas Committee, 1919–21." Town Planning Review 80.2 (2009): 143–171.