MintChip

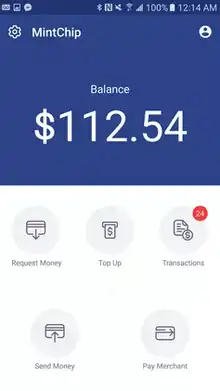

MintChip is a digital currency that provides the underlying system to facilitate the exchange of value between consumers and merchants in real-time. It was designed to reduce the cost and risk of financial transactions. This technology was created by the Royal Canadian Mint, backed by the Government of Canada and denominated in a variety of fiat currencies.[1] The Royal Canadian Mint announced the MintChip project in 2012 and simultaneously launched the MintChip Challenge contest to encourage development of interesting uses for the MintChip.[2] In January 2016, Loyalty Pays Holdings corporation—a wholly owned subsidiary of nanoPay, a fully integrated loyalty and payments platform provider, announced the acquisition of all assets related to MintChip.[1]

Created to be the first regulator-friendly digital cash platform, MintChip was designed to support compliance of regulatory standards including anti-money laundering (AML) and know your customer (KYC) rules. MintChip is a digital replacement for cash linked to a country’s fiat currency. MintChip uses secure asset stores to move funds between parties without an intermediary and can process transactions both online and offline.[3]

Challenge

The Mint ran a challenge during the summer of 2012 to develop apps and ideas for how MintChip could be used. The prizes included $50,000 in gold bullion.[4] Winners included a wallet app for Windows Phone 7, an app to donate micropayments to charity with every transaction you perform, and a mobile checkout/point of sale app.

The challenge also had a public voting component for the ideas section. The top 25 ideas would then be narrowed down to top 10 by a panel of judges.

Concept

British cryptographic expert David Everett[5] is the technical architect of the MintChip program for the Royal Canadian Mint.[6] A related smartcard initiative, the Mondex cash card was launched experimentally in the UK in 1994 but failed to attract commercial interest,[7] but MasterCard's implementation of Mondex smartcards in the USA is still offered.[8] As of September 2013, Marc Brûlé, CFO of the Royal Canadian Mint, had still endorsed the concept and announced the prospect of MintChip 2.0.[9] but in April 2014 the Mint announced a halt to the program and the intention to sell off their MintChip development assets to the private sector.[10]

Privatization

On January 12, 2016, it was announced that MintChip had been sold to Toronto-based nanoPay.[11]

See also

References

- "nanoPay Acquires MintChip™ from the Royal Canadian Mint". January 12, 2016. Archived from the original on January 15, 2016.

- "The Royal Canadian Mint challenged software developers to create apps for MintChip, the evolution of currency".

- "What is MintChip".

- "MintChip Challenge". Archived from the original on January 20, 2013. Retrieved Dec 13, 2012.

- Everett, David; Barber, Jon; Prakash, Nikhil (2005). Smart cards and tokens: technology and applications. Chichester, UK: John Wiley. p. 320. ISBN 978-0470024638.

- Mills, Carys (30 Apr 2013). "Digital cash replacement from Royal Canadian Mint in the works". Toronto Star. Retrieved 31 Oct 2013.

- Steger, Paul. "Visa Cash and Mondex cards". Preserving the History of Visa Cash & Mondex Cards. Retrieved 31 Oct 2013.

- "MastercardUSA Mondex smartcard". Mastercard USA. Retrieved 31 Oct 2013.

- Greenwood, John (19 Sep 2013). "Q&A: MintChip boss Marc Brûlé on getting into the digital currency business". Financial Post. Retrieved 2 November 2013.

- George-Cosh, David. "Canada Puts Halt to MintChip Plans; Could Sell Digital Currency Program". Wall Street Journal - Canada. Retrieved 10 April 2014.

- "Royal Canadian Mint sells Mintchip digital payments platform to Toronto's nanoPay". CBC. Retrieved 13 Jan 2016.