Monetary policy of India

Monetary policy is the process by which the monetary authority of a country, generally central bank controls the supply of money in the economy.[1] In India, the central monetary authority is the Reserve Bank of India (RBI).

Monetary policy committee

The Reserve Bank of India Act, 1934 (RBI Act) was amended by the Finance Act, 2016, to provide a statutory and institutionalised framework for a Monetary Policy Committee, for maintaining price stability, while keeping in mind the objective of growth. The Monetary Policy Committee is entrusted with the task of fixing the benchmark policy rate (repo rate) required to maintain inflation within the specified target level. As per the provisions of the RBI Act, three of the six Members of the Monetary Policy Committee will be from the RBI and the other three Members will be appointed by the Central Government.

The Government of India, in consultation with RBI, notified the 'Inflation Target' in the Gazette of India Extraordinary dated 5 August 2016 for the period beginning from the date of publication of the notification and ending on 31 March 2021 as 4%. At the same time, lower and upper tolerance levels were notified to be 2% and 6% respectively. Inflation rate in 2020 is 6.2% .[2][3][4][5][6]

Instruments of monetary policy

Key indicators

The key indicators as of 8 February 2023 are[7]

| Indicator | Current rate |

|---|---|

| Inflation | 6.52% (23 Jan) |

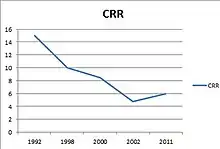

| CRR | 4.50% |

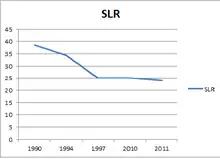

| SLR | 18.0% |

| SDF | 6.25% |

| MSF | 6.75% |

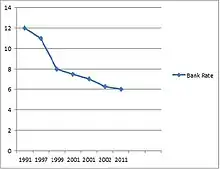

| Bank rate | 6.75% |

| Reverse repo rate | 3.35% |

| Repo rate | 6.5% |

| GDP forecast | 6.8% FY23 |

References

- Monetary Policy, Investopedia

- "Monetary Policy Committee constitution under the Reserve Bank of India Act, 1934 notified".

- "Reserve Bank of India". www.rbi.org.in. Retrieved 9 October 2020.

- Data taken from RBI Archived 29 August 2011 at the Wayback Machine

- Credit Authorization Scheme Came Into Existence During the Tenure of P C Bhattacharya

- "Reserve Bank of India".

- Current Policy Rates, Reserve Ratio, Reserve Bank of India