Northwest Bank

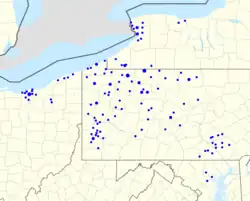

Northwest Bank is a bank headquartered in Warren, PA. It is the leading subsidiary of Northwest Bancshares, Inc., a bank holding company. It operates 170 branches in central and western Pennsylvania, western New York, eastern Ohio, and Indiana.

| Type | Public company |

|---|---|

| Nasdaq: NWBI S&P 600 component | |

| Industry | Banking |

| Founded | 1896 |

| Headquarters | Warren, PA |

Key people | Ronald J. Seiffert, President & CEO William W. Harvey, Jr., CFO |

| Total assets | |

| Total equity | |

Number of employees | 2,421 (2020) |

| Website | www |

| Footnotes / references [1] | |

History

The bank was founded in 1896 in Bradford, Pennsylvania.[1] At that time, the bank was known as Northwest Mutual Savings Association.[2]

In 1974, the bank moved its headquarters to Warren, Pennsylvania.

In more recent times, while still known as Northwest Mutual Savings Association, the bank acquired a number of other financial institutions including: Ridgway Federal Savings and Loan Association in 1983; Mutual Savings and Loan Association in 1984; Bakerstown Savings and Loan Association in 1985; Horizon Savings Association in 1990; Steitz Savings and Loan Association in 1990; American Federal Saving in 1992; First Federal Savings Bank of Kane in 1996; The First National Bank of Centre Hall in 1996; Bridgeville Savings Bank in 1997; and Corry Savings Bank in 1998.[2] In 1985, the bank acquired four southwestern Pennsylvania branches from Equimark subsidiary Pittsburgh-based Equibank.[3]

In 1993, the bank changed its name for the first time when it became Northwest Savings Bank.[2] It also changed its regulatory agency to the FDIC and became a mutual savings bank.[2]

On December 18, 2009, the bank converted from a mutual savings bank to a joint stock company.[1]

In 2015, the bank changed its name to the present Northwest Bank.[2]

In August 2015, the bank's holding company, Northwest Bancshares, Inc., merged with LNB Bancorp, Inc., in a stock and cash deal and acquired Lorain National Bank.[4] The transaction value was approximately $179 million, and resulted in a bank with approximately $9.0 billion in total assets.

In March 2016, Northwest Bank acquired Best Insurance Agency, Inc.[5]

On September 9, 2016, the bank acquired 18 branches in western New York from First Niagara Bank, which was about to be acquired by KeyBank. These branches were once part of the former Marine Midland Bank.[1][6]

In May 2017, Northwest Bank exited the Maryland market by selling all 3 remaining branch locations to locally-based Shore United Bank.[7] In 2017, the bank’s assets were valued at $9.5 billion and the bank was ranked number 134 in the whole country.[2]

In April 2020, the bank acquired MutualFirst Financial, a Muncie, Indiana-based bank, in a stock and cash deal valued at $346 million.[8] The transaction expanded Northwest's footprint into the Indiana market, and gave the bank a total of 221 branches across four states.[9]

Following that acquisition, Northwest Bank enacted a 'branch optimization plan', closing 40 branches spread across its multi-state footprint.[10] In 2020, the bank's assets were valued at $13.8 billion.

In February 2021, the bank officially moved the headquarters for its holding company from Warren, PA to Columbus, Ohio, relocating several key executives including CEO Ron Seiffert.[11]

In April 2021, Northwest announced the sale of its insurance services business to USI Insurance Services,[12] based in Valhalla, New York. [13]

References

- "Northwest Bancshares, Inc. 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- "Northwest Savings Bank: History of Northwest Bank".

- "Equibank concluded the restructuring of its branch system Tuesday" (Press release). UPI. May 21, 1985.

- "Northwest Bancshares, Inc. Completes Merger with LNB Bancorp, Inc" (Press release). PR Newswire. August 14, 2015.

- "Northwest to Acquire Best Insurance Agency, Inc" (Press release). PR Newswire. March 22, 2016.

- "Northwest Bank Completes First Niagara Office Acquisition" (Press release). PR Newswire. September 12, 2016.

- "Northwest Bank Completes Sale of Maryland Offices" (Press release). PR Newswire. May 22, 2017.

- "Northwest Bancshares, Inc. Completes Merger with MutualFirst Financial, Inc" (Press release). PR Newswire. April 24, 2020.

- "Northwest Bancshares to buy MutualFirst Financial for $346m" (Press release). NS Banking. October 30, 2019.

- "Northwest Bank to close more than 40 locations". Times Observer. Sep 15, 2020.

- "Northwest Bank Relocates Holding Company to Columbus, Ohio". 11 February 2021.

- "USI Insurance Services, Valhalla, NY - Linked in".

- "USI Insurance Services to acquire Northwest Bank's insurance business".