Square (financial services)

Square is a financial services platform developed by Block, Inc.[1][2] It is aimed at small-and medium-sized businesses, allowing them to accept credit card payments and use phones or tablets as payment registers for a point-of-sale system.

| Parent | Block, Inc. |

|---|---|

| URL | squareup |

| Launched | 2009 |

History

The inspiration for Square occurred to Jack Dorsey in 2009, when his friend Jim McKelvey was unable to complete a $2,000 sale of his glass faucets and fittings because he could not accept credit cards.[3][4]

At the TechCrunch Disrupt conference in May 2011, Square announced the release of two apps, Square Card Case (later rebranded Square Wallet)[5] and Square Register. Square Wallet, before it was removed from the Apple App Store and Google Play Store in 2014, allowed customers to set up a tab and pay for their order by providing their name (or a barcode) using a stored credit, debit, or gift card.

In April 2012, rival payment company Verifone claimed that the Square system was insecure and that a reasonably skilled programmer could write a replacement app that could use the Square device to skim a credit card and return its details, because of the lack of encryption. VeriFone posted a demonstration video and sample skimming app to its web site.[6] Dorsey called VeriFone's claims "neither fair nor accurate", noting that all card data can be compromised by visually examining the card and that even if an attack succeeded, card issuers offered fraud protection.[7] Square later introduced strong encryption on its devices.[8]

In August 2012, Starbucks announced it would use Square to process transactions with customers who pay via debit or credit card.[9] In December 2012, Square introduced virtual gift cards.[10] Physical gift cards were added in 2014.[11]

In May 2013, the firm announced that its mobile payments service was available in Japan after agreeing to a partnership with Sumitomo Mitsui Card Corporation. In May 2013, Square announced it would no longer support firearms-related transactions.[12]

In June 2013, the firm launched Square Market, which allows sellers to create a free online storefront with online payment processing functionality.[13] Square Stand was introduced the same month.[14]

In February 2014, Whole Foods Market announced it would use Square Register at select stores' sandwich counters, pizzerias and coffee, juice, wine and beer bars.[15] In March 2014, the firm announced it would allow sellers to accept bitcoin on their own storefronts through Square Market. The seller takes no risk of bitcoin value fluctuations.[16]

In July 2014 the firm announced a card reader that would accept chip cards and contactless cards.[17] In June 2015, Apple announced Square would release a Reader capable of accepting Apple Pay and other contactless payments.[18]

In 2014, Square launched Square Capital[19] and an online booking tool.[20]

In 2015, Square launched a reader for Android and iOS that accepts contactless and chip card payments.[21] That year, the firm launched Square Payroll for small business owners to process payroll.[22]

In October 2017, Square Register, was announced for small to medium-sized businesses.[23] Square launched in the UK in 2017.[24]

In August 2018, Square released a version of its magstripe reader with a Lightning connector, allowing it to be used on iPhones without a headphone jack.[25] In October 2018, the company introduced its Terminal product.[26] That Square began allowing merchants to develop custom interfaces for the platform, via an application programming interface.[27]

Square Financial Services launched in 2021, based in Salt Lake City, after receiving FDIC and Utah Department of Financial Institutions approval.[28]

On September 7-8, 2023, Square and Cash App experienced a 14-hour long outage that left businesses unable to process customers' payments. Square recommended vendors switch to an offline mode to mitigate the issue, where the payments get processed once the network connectivity is re-established but were met with mixed results. Several days later, Square determined that the disruption was caused due to a misconfiguration in the DNS.[29][30]

Devices

Square Reader for magstripe

.jpg.webp)

The Square Reader was the firm's first product. It accepts credit card payments by connecting to a mobile device's audio jack. The original version consisted of a read head directly wired to a 3.5 mm audio jack, through which unencrypted, analog card information was fed to smartphones for amplification and digitization.[31] Square Reader also supports Apple Lightning on post-2018 products.

Neither card numbers, nor magnetic stripe data, nor security codes are stored on Square devices.[8] Square Reader is Payment Card Industry Data Security Standard (PCI) compliant and Verisign certified.[8]

Square provides its magnetic stripe card readers to sellers without charge.[32] Square charges $99 for Square Stand and $29 for its chip-based Square Reader.[33] The Square app is freely downloadable from the Apple App Store and the Google Play Store.

Square charges a fee of 2.6% plus $0.10 on every electronically scanned credit card transaction[34] or 3.50% plus $0.15 per manually-entered transaction. No monthly or set-up fees are charged. The firm claims that its costs are, on average, lower than the costs charged by conventional credit card processors.[35] Swiped payments are deposited directly into a seller's bank account within 1-2 business days. In some instances, Square withholds payments pending issues related to chargebacks.[36]

Square no longer returns fees for refunds or cancelled transitions (as of 4-2023)

Square Reader for contactless and chip

Square Reader's bluetooth-connected reader allows Android and iOS devices to accept contactless and chip card payments.[21]

Square Terminal

Square Terminal features a display, prints receipts, and accepts chip, swipe, and contactless payments.[26] Unlike the basic card reader, it does not require a phone or tablet. It is more affordable than Square Register. It was designed to replace the older credit card terminals encountered in many stores. Square argued that these terminals often come with onerous contracts, and are not a positive experience for consumers. Terminal works with WiFi and is powered by an all-day battery, so it can be carried around the store and handed to customers.[37]

Square Stand

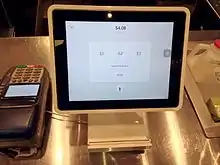

Square Stand turns the Apple iPad into a more complete point-of-sale system.[14]

Services

The firm generates revenue from selling services to businesses, including subscription-based products such as Customer Engagement, Square Payroll, and Square Register.

Square Payroll charges sellers a monthly fee of $20 plus $5 for each employee paid.[39]

Square offers virtual and physical gift cards. A QR code is scanned to use the funds.[10][11]

Square Market enables businesses to accept online payments.[40]

Square Capital offers financing to merchants using Square.[19]

An online booking tool allows small businesses to accept appointments on their website,[20] but does not accept restaurant reservations.[41]

Square Payroll allows small business owners to process payroll. The product is available in all 50 states + DC. It automatically handles withholding, payments, and tax filings.[22]

Merchants can develop custom interfaces for the platform, via an application programming interface.[27]

Square Financial Services offers other financial services.[28]

Square offers a Tap to Pay service on Android and iOS devices, allowing merchants to accept contactless payments without needing to purchase an external reader.[42][43]

Firearms

Square does not support firearms-related transactions. The company denied that this move was related to the debate over gun control.[12]

Controversies

In June 2019, The Wall Street Journal reported that Square inadvertently sent transaction receipts to the wrong email address, leading to adverse consequences such as outing one woman's impending divorce.[44]

A Canadian food truck which sold Cuban coffee faced a loss of C$14,000 because transactions were processed through a Canadian subsidiary of Chase Manhattan Bank, contracted by Square to handle its Canadian accounts. As the parent company is governed by US laws, the bank would have been subject with charges of trafficking in prohibited Cuban goods if it had processed the fund transactions.[45]

Square marks certain merchants as high risk, a designation that can come suddenly and without warning. Merchants classified as risky can have 20-30% of their funds withheld to handle chargebacks and disputes. Square received criticism from affected merchants due to the opaque nature of the process, its suddenness, and difficulties in appealing the designation.[46][47]

See also

References

- "How Square Works | Square UK". Square. Retrieved 2022-09-20.

- "How Does Square Work? The Beginner's Guide To Square For Small Business". Merchant Maverick. 2019-07-16. Retrieved 2022-09-20.

- "Square Brings Credit Card Swiping to the Mobile Masses, Starting Today". Fast Company. May 11, 2010. Retrieved September 19, 2011.

- Popper, Nathaniel (2017-10-25). "Square, the Twitter Boss's Other Company, Could Pass It in Value". The New York Times. ISSN 0362-4331. Retrieved 2023-02-10.

- Harrison Weber (June 13, 2013). "Square Wallet for iPhone gets redesigned with a visually-driven UI and streamlined payments". The Next Web. Retrieved March 11, 2014.

- Hsu, Tiffany (March 9, 2011). "Square's mobile credit card reader easily hacked, says VeriFone". Los Angeles Times. Retrieved March 11, 2011.

- Olivarez-Giles, Nathan (March 10, 2011). "Square answers VeriFone's accusations on security of mobile credit card reader". Los Angeles Times. Retrieved March 11, 2011.

- "Square - Security". Squareup.com. Retrieved September 19, 2011.

- Miller, Claire Cain (2012-08-08). "Starbucks and Square to Team Up". The New York Times. ISSN 0362-4331. Retrieved 2020-05-21.

- Thomas, Owen (December 10, 2012). "Square Now Offers Gift Cards, Thrusting It Deeper Into The Money Business". Business Insider. Retrieved May 8, 2018.

- McCracken, Harry (November 18, 2014). "Now Square Lets Its Merchants Sell Gift Cards". Fast Company. Retrieved May 8, 2018.

- Sperry, Todd (May 13, 2013). "Mobile-payment service Square blocks gun sales". CNN. Retrieved December 5, 2013.

- "Square Market launches, provides easy online storefronts for small businesses". Engadget. Retrieved 2020-05-21.

- Terdiman, Daniel. “At Square, an obsession with the 'magic' of hardware design”, CNET, June 13, 2013.

- "Whole Foods signs on to use Square". Washington Post. ISSN 0190-8286. Retrieved 2020-05-21.

- Protalinski, Emil March 31, 2014. TheNextWeb "Square now lets sellers accept Bitcoin on their own storefronts"

- Marcus Wohlsen (July 30, 2014). "Square Bets Big on Next-Gen Credit Card Tech". Wired.

- Natt Garun (June 8, 2015). "Square will launch its Apple Pay-compatible wireless reader this fall". Next Web.

- "Square's cash advance: Don't call it a loan". CNN. May 28, 2014. Retrieved May 28, 2014.

- Perez, Sarah (August 11, 2014). "Square Targets Small Business With Launch Of Online Booking Tool "Square Appointments"". TechCrunch. Retrieved May 8, 2018.

- "Square Will Launch An Apple Pay-Ready NFC And Card Chip Reader This Fall". TechCrunch. Retrieved 2018-10-19.

- "Square feels your pain, debuts payroll service". San Francisco Business Times. June 30, 2015.

- Yurieff, Kaya (30 October 2017). "Square unveils cash register of the future". CNNMoney. Retrieved 31 October 2017.

- David Grossman (2 January 2018). "Bank branch closures: How one town has coped". BBC News. Retrieved 2 January 2018.

- Fingas, Jon (29 August 2018). "Square finally has a Lightning card reader for newer iPhones". Engadget. Retrieved 29 August 2018.

- "Square takes on the clunky old-school payment terminal". Fast Company. 2018-10-18. Retrieved 2018-10-19.

- Kastrenakes, Jacob (2 August 2018). "Square checkout systems can now have custom interfaces". The Verge. Vox Media. Retrieved 5 August 2018.

- Fuscaldo, Donna (March 18, 2020). "Square Gets The Nod To Operate A Bank". Forbes. Retrieved June 21, 2020.

- Jay, Marley (8 September 2023). "Square outage costs small-business owners thousands in lost revenue". NBC News.

- Williams, Chris (11 September 2023). "Square blames last week's outage on DNS screw-up". The Register.

- "Inside the Square Reader". Protean Payment. Archived from the original on August 22, 2012.

- "Free Credit Card Reader". Square. Block, Inc. Retrieved July 25, 2012.

- Lunden, Ingrid (12 November 2014). "Square Eschews Free, Starts $29 Pre-Orders For Chip-Based Card Readers". Techcrunch. Retrieved November 12, 2014.

- "Square's Fees".

- "Square - Pricing". Square. Block, Inc. Retrieved September 19, 2011.

- Fast deposits intoyour bank account. (June 25, 2013). "Square Merchant Agreement". Square. Block, Inc. Retrieved December 5, 2013.

- "Square unveils the Square Terminal, designed to replace old keypad credit card machines". TechCrunch. 2018-10-18. Retrieved 2022-08-18.

- Liao, Shannon (30 October 2017). "Square made its own payment register". The Verge. Vox Media. Retrieved 31 October 2017.

- Spector, Nicole (2 July 2015). "Square Launches Payroll, Expanding Suite of Services for Small Businesses". Street Fight. Retrieved July 2, 2015.

- Malik, Om. "Square Market is attracting sellers that have never taken a Reader payment". GigaOm.

- Baldwin, Roberto (August 11, 2014). "Square introduces Appointments online scheduling system for small businesses". The Next Web. Retrieved May 8, 2018.

- "Tap to Pay on Android Contactless Payments". Square. Retrieved 2023-04-24.

- "Tap to Pay on iPhone Contactless Payments". Square. Retrieved 2023-04-24.

- Rudegeair, Peter. "Square Sends Millions of Digital Receipts, Sometimes to the Wrong Person". The Wall Street Journal.

- Rubin, Josh (2 October 2019). "T.O. food truck caught up in Trump's battle with Cuba". Toronto Star. Retrieved 3 October 2019.

- Keyes, Daniel. "Square is under fire for withholding funds from merchants". Business Insider.

- Ray, Siladitya. "Square Is Withholding Up To 30% Of Payments Made To Some Merchants". Forbes.