Starter home

A starter home or starter house is a house that is usually the first which a person or family can afford to purchase, often using a combination of savings and mortgage financing. In the real estate industry the term commonly denotes small one- or two-bedroom houses, often older homes but sometimes low-cost new developments. The concept originated in the United States during the post-World War II era when entry-level home ownership was a preferred option for young families and regarded as part of the American Dream.

The original concept of a newly built starter home outside of the city has changed due to both the end of low-cost land development and the changing preferences of successive generations in the United States. Since the end of the 20th century, more new homeowners are seeking different kinds of housing such as a condominium or older existing homes.

Changes in the 21st century

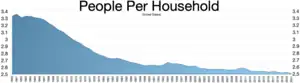

Median people per household hit 2.51 in 2021

In the United States, as real-estate market conditions continue to inflate and rise in major and medium cities where growth is fast, many starter homes are only affordable or available in metropolitan area outer suburbs. The American Dream of a new-build single-family home on a previously unused lot continues to move further out of urbanized areas to capture the lowest cost land. However, as many areas in the nation experience urbanization in multiple clusters, states such as California experience diffused land economics where no low-cost land exists. This has caused many real estate developers to either develop many low-cost townhomes densely or large single-family homes at high sale prices. The latter is frequently chosen resulting in starter-homes continuing to favor people in upper income brackets as the majority of a metro area's suburbs approach build-out and the distance to work ratio approaches a maximum. Factors that influence developers include land prices, perceived value, market demand, city planning law, construction costs, and maintaining profit margins.[1]

For the buyer's end, changing financial requirements and mortgage interest rates as low as half a percentage point may affect large groups of income brackets to not be able to finance market-determined affordable housing in the long-term. Personal income for individuals and families have also not kept up with market inflation and cost of living to overcome this.[2] While starter homes may be considered affordable based on income, the true cost of home ownership has historically not been reflected in actual financing.[3]

More than 37 million people live alone in a one-person household

Percent of households with one person

Number of one person households (thousands)

|

Percent of households by type

Married households

Non-family households

Other family households

|

Entry level housing

- 1,000 - 1,199 ft2

- 1,200 - 1,399 ft2

- 1,400 - 1,799 ft2

- 1,800+ ft2

- Under 1,000 ft2

- 1,000 - 1,199 ft2

- 1,200 - 1,399 ft2

- 1,400 - 1,799 ft2

- 1,800+ ft2

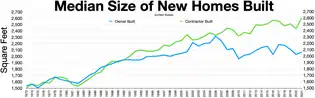

Only 8% of new single family homes built in 2021 were 1,400 sq ft (130 m2) or less and in the 1940s 70% of new housing built was under 1,400 sq ft (130 m2). Local governments regulate out entry level housing with square foot requirements, zoning ordinances, and permits. Condominiums of 500 to 1,000 sq ft (46 to 93 m2) that can be owned instead of leased, which could be a studio, 1 bedroom, or 2 bedroom with a reasonable HOA monthly fee and property taxes would be less expensive than renting in the longer run and a way to start building wealth starting out. [4]

Efforts to increase availability

In locations with a lack of affordable housing, such as New York City, Los Angeles, Philadelphia, San Francisco, London, or Shanghai, it may be impossible for first-time home buyers to find starter houses close to the city center.[5] To assist such home buyers, local authorities such as that in Santa Cruz, California, have re-zoned previously commercial areas for residential housing specifically to allow developers to build starter homes.[6] The Wall Street Journal tracks median home purchase prices of starter homes as part of its real estate index.[7] Cities, whether suburban or the central core, have generally moved to a trend of master planned communities where large tracts of land are set aside for one complete build-out in order to maintain low costs to the developer and provide essential affordable and entry-level housing. Commercial and retail components are almost always included in these starter home communities.

United Kingdom

A starter home is in the United Kingdom a house sold at a 20% discount to first time buyers under 40.[8] Starter homes are a policy of the Conservative Government. Starter homes are being introduced in the Housing and Planning Bill 2015-16. The National Housing Federation have described starter homes as “yet another short-term initiative that fails to address the root of the problem”.[9]

See also

References

- Andrew Caffrey and Charlie Russo (2006-11-06). "Can the starter home be saved?". Boston Globe. Retrieved 2007-10-08.

- Les Christie (2005-11-08). "Fewer new buyers can afford a home". CNN. Retrieved 2007-10-08.

- Eric de Place (2006-07-02). "The True Cost of Home Ownership". Sightline Institute. Retrieved 2013-12-20.

- "Whatever Happened to the Starter Home?". The New York Times. 25 September 2022.

- In China, the Starter Home is a Non Starter, BusinessWeek, Jun. 8, 2006

- Tiny one-bedrooms could be the new 'starter home' in Santa Cruz, Santa Cruz Sentinel, Sep. 27, 2006

- Starter Home Index - November 13, 2006, The Wall Street Journal's Real Estate Journal (latest available data)

- "200,000 starter homes promised by Cameron | the Planner". 3 March 2015.

- "Starter homes initiative – everything you need to know". TheGuardian.com. 2 March 2015.