Timothy Sykes

Timothy Sykes is a penny stock trader[1][2] who earned $1.65 million from a $12,415 Bar mitzvah gift through day trading while in college.[3][4]

Timothy Sykes | |

|---|---|

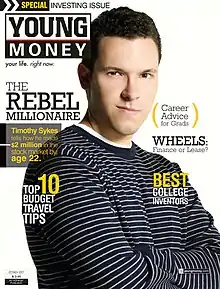

Sykes on the cover of Young Money magazine for November 2007 | |

| Born | April 15, 1981 Orange, Connecticut, U.S. |

| Alma mater | Tulane University |

| Website | timothysykes |

Career

Sykes graduated from Tulane University in 2003 with a bachelor's degree in philosophy and a minor in business. He is Jewish. [5] While at Tulane, Sykes routinely cut class to day trade.[6] In 2003 he founded Cilantro Fund Management, a small short bias hedge fund,[7][8] using $1 million mostly from his friends and family.[9] After initially seeing profits the fund shut down 3 years later after heavy losses.[10]

In 2006, Sykes was included on Trader Monthly's "30 Under 30" list of up-and-coming traders in the market,[11] a selection which editor Randall Lane later called "our worst pick" among the chosen honorees.[9] Sykes claimed that the Cilantro Fund was "the number one long-short microstock hedge fund in the country, according to Barclays";[9] Lane later discovered that the rating came from "the Barclay Group," a small research company based in Fairfield, Iowa, and not the well-known Barclays British bank.[12][13]

In 2008 Sykes attempted to recreate his initial investing success by again starting with $12,415.[14][15]

Sykes self-published An American Hedge Fund: How I Made $2 Million as a Stock Operator & Created a Hedge Fund in 2007.[16] The book documented Sykes' experiences as a day-trader and the difficulties he encountered in attempting to start a hedge fund.[17]

In 2012, Sykes created "Miss Penny Stock," a financial beauty pageant among the female representatives for his brand and company.[18]

Appeared on Below Deck season 2 episode 10. And season 5 episode 13. On Bravo network

Teaching and other projects

After the shut down of Cilantro Fund Partners in 2007, Sykes wrote the book "An American Hedge Fund" and launched TimothySykes.com.>[19]

In 2009, Sykes launched Investimonials.com, a website devoted to collecting user reviews of financial services, videos, and books, as well as financial brokers.[20]

Sykes co-founded Profit.ly in 2011, a social service with about 20,000 users that provides stock trade information online.[21] Sykes said the service serves two purposes: "creating public track records for gurus, newsletter writers and students everyone to learn from both the wins and losses of other traders to benefit the entire industry."[22] One of Sykes’ students, Tim Grittani, was able to turn $1,500 into $1 million in three years by trading stocks.[23] Another student, Jack Kellogg, made more than $10 million by stock trading under Sykes’ tutelage.[24]

Sykes founded the Timothy Sykes Foundation, which has raised $600,000 and has partnered with Make-a-Wish Foundation and the Boys and Girls Club.[25]

In February 2017, Sykes donated $1 million to Pencils of Promise to help build 20 new primary schools across Ghana, Guatemala and Laos, to be completed between 2017 and 2018.[26]

The Timothy Sykes Foundation was eventually renamed the Karmagawa Foundation and by 2019, Karmagawa had built 57 schools and donated more than $4 million to 45 charities for environmental causes.[27][28]

In 2020, Sykes and Karmagawa made a joint pledge to donate $1 million for relief efforts in Yemen during the Yemeni civil war and the cholera and COVID-19 epidemics.[29] Karmagawa built its 100th school in Myanmar in 2022.[30]

Controversy

Sykes has publicly criticized various businesses and celebrities, including Shaquille O'Neal[31] and Justin Bieber,[32][33] for promoting "pump and dump" schemes,[32][34][35] in which an investor purchases stock, hypes others into buying that stock to inflate its price, then sells the shares at a higher price and subsequently shorts the stock to profit from the resulting decline.

In May 2017, Sykes and Bow Wow had an Instagram feud in which at least one user accused Sykes of using "coded racist language".[36]

References

- Yousuf, Hibah (December 16, 2013). "Trader turns $1,500 to $1 million in 3 years". CNN Money. Archived from the original on 2018-12-04. Retrieved 2019-08-27.

- de la Merced, Michael (December 8, 2006). "Culturally, Hedge Funds Go Public". New York Times. Archived from the original on June 23, 2018. Retrieved February 23, 2017.

- "Timothy Sykes Will Not Be Stopped, Gosh Darn It". New York Magazine. November 1, 2007. Archived from the original on June 23, 2018. Retrieved February 20, 2020.

- Neal, Jeff (March 13, 2009). "Interview Central: Timothy Sykes, Part 1". Forbes.com. Archived from the original on October 19, 2017. Retrieved September 16, 2017.

- "Timothy Sykes' LinkedIn Profile". LinkedIn. Archived from the original on 2010-02-27. Retrieved 2013-01-29.

- Toren, Adam (October 25, 2011). "Young Entrepreneurs: "Quit being such babies!" Tim Sykes Tells it Like it Is". YoungEntrepreneur.com. Archived from the original on November 1, 2012. Retrieved 2019-08-27.

- "US magazine toasts star traders aged 30 or younger" (PDF). Reuters. July 27, 2006. Archived (PDF) from the original on May 8, 2013. Retrieved January 29, 2013.

- Joe, Michael (May 8, 2012). "Two students win Sykes Award recognizing nontraditional abilities and interests". Tulane.edu. Archived from the original on February 25, 2013.

- Lane, Randall (2010). The Zeroes. Penguin Group. p. 56. ISBN 978-1-59184-329-0.

- "Failed hedge fund manager tries again on Internet". Reuters. 2007-11-01. Retrieved 2022-01-29.

- Barber, Andrew (August 2006). "30 under 30" (PDF). Trader Monthly. Archived (PDF) from the original on 2013-05-08. Retrieved 2013-01-31.

- Thomassen, Lucilla. "5 Things You Should Know about Tim Sykes". TopTenPK.com. Archived from the original on 2013-01-20. Retrieved 2013-01-31.

- Lane, Randall (2010). The Zeroes. pages 151-153: Penguin Group. ISBN 978-1-59184-329-0.

{{cite book}}: CS1 maint: location (link) - Hansard, Sara (November 12, 2007). "Wunderkid is Back". Investment News. Archived from the original on August 27, 2019. Retrieved August 27, 2019.

- "'Wall Street Warriors' TV Star Timothy Sykes Sets Up New & Transparent Challenge". PR Web. November 1, 2007. Archived from the original on July 6, 2013. Retrieved January 31, 2013.

- Sykes, Timothy (2007). An American Hedge Fund: How I Made $2 Million as a Stock Operator & Created a Hedge Fund. BullShip Press. p. 235. ISBN 978-0979549700. Archived from the original on 2021-02-07. Retrieved 2017-09-16.

- Chatzky, Jean. "An American Hedge Fund". Oprah.com. Archived from the original on 2010-05-15. Retrieved 2019-08-27.

- La Roche, Julia (Aug 23, 2012). "Penny Stock King Tim Sykes Is Hosting A Beauty Pageant Where Girls Will Parade Around In Bikinis And Cocktail Outfits". Business Insider. Archived from the original on 2017-02-19. Retrieved 2019-08-27.

- "Best Penny Stocks Guide: The Ultimate Plan on Trading in 2019". Archived from the original on 2019-01-14. Retrieved 2019-01-14.

- Kincaid, Jason (November 25, 2009). "Investimonials Wants To Be Your Guide To Quality Financial Products". Tech Crunch. Archived from the original on September 29, 2018. Retrieved June 25, 2017.

- "Best Advice I Ever Got: Timothy Sykes". Inc. June 1, 2011. Archived from the original on May 16, 2013. Retrieved January 28, 2013.

- Anderson, Tom (September 15, 2011). "Profit.ly Mines The Masses For Stock-Trading Gold". Forbes. Archived from the original on November 22, 2016. Retrieved September 16, 2017.

- Yousuf, Hibah (2013-12-16). "Penny stock trader: From $1,500 to $1 million in three years". CNNMoney. Retrieved 2022-09-15.

- Maidan, Laila. "A 24-year-old stock trader made over $8 million in 2 years. Here's how he identifies a winning trade regardless of stock-market conditions". Business Insider. Retrieved 2022-09-15.

- Rampton, John The Man Who Wants Everyone to Be a Millionaire Archived 2015-09-25 at the Wayback Machine Inc. September 24, 2015

- "Make Money and Make an Impact with Tim Sykes". Lewis Howes. 23 January 2017. Archived from the original on 2017-02-13. Retrieved 2017-02-12.

- "Represent Launch Charity Collection Alongside Karmagawa to Spread Awareness". Complex. Retrieved 2022-09-15.

- Fox, MeiMei. "Penny Stocks Trader Tim Sykes On Finding His Life Purpose With Karmagawa". Forbes. Retrieved 2022-09-15.

- "Why millionaire stock trader Timothy Sykes donates $ 500,000 to the children of Yemen". Radar 2014. Retrieved 2022-09-15.

- Team, The Karmagawa (2022-01-27). "Karmagawa Announces Big Milestone: 100th School Opened To Help Children Escape Poverty". Karmagawa. Retrieved 2022-09-15.

- Veneziani, Vince (March 3, 2010). "Tim Sykes: I Dare Shaq To Take Me To Court!". Business Insider. Archived from the original on 14 January 2013. Retrieved 7 January 2013.

- Cunningham, Brandon (20 May 2011). "The Curious Case of Justin Bieber and Options Media Group (aka PhoneGuard)". Motley Fool. Archived from the original on 2018-08-19. Retrieved 2013-01-28.

- Peterson, Kim. "Justin Bieber's penny-stock trouble". MSN Money. Archived from the original on 27 May 2011.

- Veneziani, Vince (May 5, 2010). "SpongeTech CEO Arrested For Fraud A Week After Suing Short-Seller". Business Insider. Archived from the original on 2019-08-27. Retrieved 2019-08-27.

- Elstein, Aaron (2011-04-11). "Bill for Spongetech fraud: $52 million". Crain's New York Business. Archived from the original on 2019-08-27. Retrieved 2019-08-27.

- Willis, Kiersten (2017-05-17). "Black Twitter Comes to Bow Wow's Rescue After White Entrepreneur Disses Rapper". Atlanta Black Star. Retrieved 2018-01-06.