TONAR

Tokyo Overnight Average Rate (TONA rate or TONAR) or Japanese Yen Uncollateralized Overnight Call Rate (Japanese: 無担保コールO/N物レート) is an unsecured interbank overnight interest rate and reference rate for Japanese yen.[1][2][3] Mutan rate and TONA rate are the same things.

History

Japanese yen uncollateralized overnight call market started in July 1985.[4]

Since December 28, 2016, the Bank of Japan has recommended the TONA rate as the preferred Japanese yen risk-free reference rate.[5][6]

TONA rate is recommended as a replacement for Japanese yen LIBOR, which was phased out at the end of 2021, and Euroyen TIBOR, which will be terminated at the end of 2024.[3][7][8][9]

Target rates

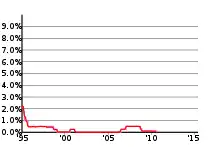

TONA rate

| Dates | Target rates |

|---|---|

| 1998.09 - 1999.02 | 0.25% |

| 1999.02 - 2000.08 | Initially 0.15%, then 0%. |

| 2000.08 - 2001.02 | 0.25% |

| 2001.02 - 2001.03 | 0.15% |

| 2001.03 - 2006.03 | None (0%) |

| 2006.03 - 2006.07 | 0.00% |

| 2006.07 - 2007.02 | 0.25% |

| 2007.02 - 2008.10 | 0.50% |

| 2008.11 - 2008.12 | 0.30% |

| 2008.12 - 2010.10 | 0.10% |

| 2010.10 - 2013.04 | 0.00% - 0.10% |

| 2013.04 - | None (0%) |

TONA Compounded Benchmarks

- TONA Averages

- TONA Averages are derived from the daily compounded TONA rate. The terms are 30day, 90days, and 180 days.[11]

- TONA Index

- Assets when 100 was invested in TONA on June 14, 2017.[11]

References

- Interest Rate Benchmark Reform (Preparedness for the Discontinuation of LIBOR) : 日本銀行 Bank of Japan

- "LIBOR: Where Things Now Stand | Insight | Baker McKenzie". www.bakermckenzie.com. Archived from the original on 2017-12-03.

- "EXPLAINER-What is SOFR? The new U.S. Libor alternative". Reuters. 3 April 2018.

- BOJ's Main Time-series Statistics

- Report on the Identification of a Japanese Yen Risk-Free Rate - Study Group on Risk-Free Reference Rates - Bank of Japan

- "Libor Reform – What You Need to Know". 26 September 2017.

- "Libor Enters 'Final Chapter' as Global Regulators Set End Dates". Bloomberg.com. 5 March 2021. Retrieved 10 March 2021.

- LIBOR Transition | Japanese Bankers Association

- JBA TIBOR Reform | JBA TIBOR

- 日本銀行による追加緩和の行方 ― 金融政策の現状と課題 ― 立法と調査 2019.12 No.418 参議院常任委員会調査室・特別調査室

- TONA Averages & TONA Index | QUICK

External links

- Daily TONA rate - Bank of Japan

- Monthly TONA rate - Bank of Japan

- TONA Averages & TONA Index - QUICK Corp

This article is issued from Wikipedia. The text is licensed under Creative Commons - Attribution - Sharealike. Additional terms may apply for the media files.