Wage theft

Wage theft is the failing to pay wages or provide employee benefits owed to an employee by contract or law. It can be conducted by employers in various ways, among them failing to pay overtime; violating minimum-wage laws; the misclassification of employees as independent contractors; illegal deductions in pay; forcing employees to work "off the clock", not paying annual leave or holiday entitlements, or simply not paying an employee at all.

.jpg.webp)

Wage theft in the United States

According to some studies, wage theft is common in the United States, particularly against low wage workers, including legal citizens to undocumented immigrants.[1][2] The Economic Policy Institute reported in 2014 that survey evidence suggests wage theft costs US workers billions of dollars a year.[3] Some rights violated by wage theft have been guaranteed to workers in the United States in the 1938 Fair Labor Standards Act (FLSA).[4]

In 2019, the U.S. Department of Labor cited about 8,500 employers for taking about $287 million from workers, but they rarely punish repeat offenders, which "perpetuates income inequality, hitting lowest-paid workers hardest."[5] A 2023 study showed that a significant amount of wage theft goes unreported because employees may not fully understand what constitutes wage theft, or they fear reprisals.[6]

Overtime

According to the FLSA, unless exempt, employees are entitled to receive overtime pay of at least "time-and-a-half", or one and one-half times normal pay, for all time worked past forty hours a week. Some exemptions to this rule apply to public service agencies or to employees who meet certain requirements in accordance to their job duties along with a salary of no less than $684 a week. Despite regulations, there are many employees today who are not paid the overtime due them. A 2009 study of workers in the United States found that in 12 occupations more than half of surveyed workers reported being denied overtime pay: child care (90.2 percent denial), stock and office clerks (86 percent), home health care (82.7 percent), beauty/dry cleaning and general repair workers (81.9 percent), car wash workers and parking attendants (77.9 percent), waiters, cafeteria workers and bartenders (77.9 percent), retail salespersons (76.2 percent), janitors and grounds workers (71.2 percent), garment workers (69.9 percent), cooks and dishwashers (67.8 percent), construction workers (66.1 percent) and cashiers (58.8 percent).[7][8]

Minimum wage

In 2009, reform placed the new United States federal minimum wage at $7.25. Some states have legislation that sets a state minimum wage. In the case an employee is subject to both federal and state minimum wage acts, the employee is entitled to the higher standard of compensation. For tipped employees, the employer is only required to compensate the employee $2.13 an hour as long as the fixed wage and the tips add up to be at or above the federal minimum wage. Minimum wage is enforced by the Wage and Hour Division (WHD). WHD is generally contacted by 25,000 people a year in regards to concerns and violations of minimum wage pay.[7][9] A common form of wage theft for tipped employees is to receive no standard pay ($2.13 an hour) along with tips.[8]

A 2017 study found that U.S. employers underpay 2.4 million sub-minimum wage workers over $15 billion yearly, amounting to an average of $64 per week, or nearly a quarter of earnings. Year-round workers are underpaid $3,300 per year and receiving $10,500 in annual wages on average.[10]

Misclassification

Misclassification of employees is a violation that leaves employees very vulnerable to other forms of wage theft. Under the FLSA, independent contractors do not receive the same protection as an employee for certain benefits. The difference between the two classifications depends on the permanency of the employment, opportunity for profit and loss, the worker's level of self-employment along with their degree of control. An independent contractor is not entitled to minimum wage, overtime, insurance, protection, or other employee rights. Attempts are sometimes made to define ordinary employees as independent contractors.[7][8]

Misclassification in the United States is extensive. In New York state, for example, it was found in a 2007 study that 704,785 workers, or 10.3% of the state's private sector workforce, were misclassified each year. For the industries covered in the study, average unemployment insurance taxable wages underreported due to misclassification was on average $4.3 billion for the year and unemployment insurance tax underreported in these industries was $176 million.[11][12]

Illegal deductions

Employees are subject to forms of wage theft through illegal deductions. Trivial or fabricated violations in the workplace are used to validate deductions. Any deduction that brings an employee to a level of compensation lower than minimum wage is also illegal. In many states, employers are required to issue employees documentation of deductions along with earnings. Failure to issue this documentation is generally prevalent in working places subject to wage theft.[7][8]

Full wage theft

The most blatant form of wage theft is for an employee to not be paid for work done. An employee being asked to work overtime, working through breaks, or being asked to report early and/or leave late without pay is being subjected to wage theft. This is sometimes justified as displacing a paid meal break without guaranteeing meal break time. In the most extreme cases, employees report receiving nothing.[7][8] In some cases, the legal status of the workers can enable employers to withhold pay without fear of facing any consequences.[13]

Other forms

Putting the pressure on injured workers to not file for workers' compensation is frequently successful.[1] Employees are often confronted with threats of firing or calls to immigration services if they complain or seek redress. Workers are often denied time off or vacation time that they have acquired or denied pay for sick leave or vacation time.

Incidence

| Violation | Percent of All Workers Surveyed |

Percent of Workers at Risk of Violation |

|---|---|---|

| Minimum wage violation | 25.9% | 25.9% |

| Overtime violation | 19.1% | 76.3% |

| Off-the-clock violation | 16.9% | 70.1% |

| Meal break violation | 58.3% | 69.5% |

| Worker was subjected to an illegal pay deduction |

4.7% | 40.5% |

| Tips were stolen by employer or supervisor |

1.6% | 12.2% |

| • Violation occurred in week prior to worker being surveyed • Results based on survey of 4,387 low wage workers | ||

A 2009 study based on interviews of over 4,000 low wage workers in Chicago, Los Angeles, and New York City found that wage theft from low wage workers in large cities in the United States was severe and widespread. Incidents varied with the type of job and employee. Sixty-eight percent of the surveyed workers experienced at least one pay-related violation in the week prior to the survey. On average the workers in the three cities lost a total of $2,634 annually due to workplace violations, out of an average income of $17,616, which translates into wage theft of fifteen percent of income. Extrapolating from these figures, low wage workers in Chicago, Los Angeles, and New York City lost more than $2.9 billion due to employment and labor law violations.[7]

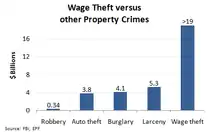

In 2017, the Economic Policy Institute estimated that wage theft amounts to up to $50 billion annually, more than all robberies, car thefts, and burglaries combined, and that around 17 percent of low wage workers are victims of this crime.[14]

Workers at risk

Studies have found inflated rates of wage theft violations in markets employing women and foreign-born populations, and there are indications that wage exploitation and wage theft are among key motivations of employers for hiring migrant workers.[15] Within the foreign-born population, women were at a much greater risk for wage violations than their male counterparts. Undocumented workers or unauthorized immigrants stood at the highest risk levels. Education, longer tenured employment, and English proficiency proved to be influential factors in employee populations. All three variables reduced the probability of wage theft for the aforementioned demographics. Workplaces where the compensation was paid in one weekly flat rate or in cash saw a higher instance rate of wage theft. Smaller businesses with less than 100 employees also saw a higher instance rate of violations than larger business. In one study, the manufacturing industry, repair services, and private home employment were at the highest risk for violations at the workplace. Home health care, education, and construction saw the lowest levels of wage theft. Restaurants, grocery stores, retail, and warehousing fell around the median.[7][16]

Contemporary examples

In November 2011, Warehouse Workers helped Wal-Mart warehouse employees file their fourth class-action lawsuit against the warehouse companies. Without Wal-Mart being a direct defendant, the argument was made that Wal-Mart has created this culture amongst the companies it works with. The first lawsuit filed was in 2009. The workers argued that poor record keeping and broken promises have led to workers receiving less than minimum wage. Walmart also denied workers paid vacations that they were promised upon contracting.[17] In a report released on November 26, 2011, a Palm Beach County organization, People Engaged in Active Community Efforts (PEACE), sent postcards to Macy's and Bealls executives as a form of protest. The Florida Retail Federation had recently proposed a bill to block a wage theft ordinance in their county, which was intended to create a system that would speed the investigation and processing of wage theft reports.[18]

A 2012 study by the Iowa Policy Project calculated that dishonest employers defraud Iowa workers out of about $600 million annually in wages. State Senator Tony Bisignano, Democrat from Des Moines and Senator William Dotzler, a Democrat from Waterloo, Iowa, proposed a bill to strengthen wage law enforcement on January 28, 2015, "since Iowa's wage theft laws are so weak they are impossible to enforce". The Iowa Association of Business and Industry opposed the bill, saying that resources for enforcement should be the focus instead.[19]

In 2021, Tyler Technologies paid $3 million to settle claims that it had required some employees to work overtime and had not paid them for that time.[20]

Documentation

In the United States, the Fair Labor Standards Act (FLSA) requires employers to keep detailed records regarding the identity of workers and hours worked for all workers who are protected under federal minimum wage laws.[21][22] Most states require that employers also provide each worker with documentation every pay period detailing that worker's hours, wages and deductions.[23] As of September 2011 Arkansas, Florida, Louisiana, Mississippi, Nebraska, South Dakota, Tennessee and Virginia did not require this documentation.[24] A 2008 survey of wage theft from workers in Illinois, New York, and California found that 57% of low wage workers did not receive this required documentation and that workers who were paid in cash or on a weekly rate were more likely to experience wage theft.[7] Anecdotal evidence suggests that tip theft, which is a legally complex issue distinct from wage theft and not necessarily under the control of the same laws governing the payment of wages,[25] may also be common in instances where employer record keeping does not comply with the law.[26]

Penalties and sanctions

When the Wage and Hour Division (WHD) receives reports of violations, it works to ensure that employers change their work practices and pay back missed wages to the employees. Willful violators can face fines up to $10,000 upon their first conviction with imprisonment resulting from future convictions. In regards to child labor laws, an employer can face a fine of up to $11,000 per minor. In 2012 the Wage and Hour Division collected $280 million in back wages for 308,000 workers.[27] As of 2014, there are 1,100 federal investigators for 135 million workers in more than 7 million businesses.[28] The ratio of labor enforcement agents to U.S. workers has decreased over tenfold since the inception of the FLSA, from one for every 11,000 workers in 1941[29] to one for every 123,000 workers in 2014.[28]

In February 2010, Miami-Dade County, Florida became the first jurisdiction in America to ban wage theft with an ordinance passed unanimously by the county commission. Prior to the ordinance, wage theft was called "the crime wave that almost no one talks about".[30]

Wage theft in other countries

Australia

A 2020 report by Unions NSW founded that more than 3000 foreign-language job ads offered illegally lower wages,[31] A 2022 report by the same Union founded that over 7,000 job advertisements in foreign languages offered lower wages.[32][33]

In Australia, another form of wage theft is the failure of employers to pay the mandatory minimum contribution to employee's superannuation fund. Between 2009 and 2013 the Australian Tax Office recovered A$1.3 billion in unpaid superannuation which is estimated to be only a small portion of total unpaid superannuation.[34]

In 2019, Australian celebrity chef George Calombaris admitted to underpaying $7.83 million in wages to 515 employees, which was only discovered after a Fair Work Ombudsman audit revealed the scale of the error following one complaint from an underpaid staff member.[35]

Canada

In 2012 in Windsor, Ontario nearly 200 people gathered at a grassroots meeting to discuss daily workplace challenges that workers face, including wage theft, which a labor union president described as "a sad state of affairs when you have a corporation that can dictate items".[36]

United Arab Emirates

In the UAE, many employers have taken money out of their workers' wages. In some cases, workers have not been paid or workers are duped.[37][38][39]

United Kingdom

A 2017 report by Middlesex University and Trust for London revealed that at least 2 million workers in Britain are losing an estimated £3 billion in unpaid holiday pay and wages per year. It suggested that withholding holiday pay, not paying wages and workers losing a couple of hours money per week are some of the deliberate strategies used by employers to improve their profits.[40]

References

- Steven Greenhouse (September 1, 2009). "Low-Wage Workers Are Often Cheated, Study Says". The New York Times. Retrieved May 29, 2012.

- Steven Greenhouse (August 31, 2014). "More Workers Are Claiming 'Wage Theft'". The New York Times. Retrieved August 31, 2014.

- Brady Meixell and Ross Eisenbrey (September 11, 2014). An Epidemic of Wage Theft Is Costing Workers Hundreds of Millions of Dollars a Year. Economic Policy Institute. Retrieved June 8, 2015.

- Kimberley A. Bobo (2011). Wage Theft in America. Why Millions of Working Americans Are Not Getting Paid —And What We Can Do About It. The New Press. ISBN 978-1595587176. Retrieved March 4, 2012.

- Campbell, Alexia Fernández (4 May 2021). "Ripping off workers without consequences". Center for Public Integrity. Retrieved 11 February 2023.

- "Verfico 2023 Survey: Wage Theft in America". Verfico. 31 May 2023. Retrieved 10 June 2023.

Fear of reprisals and lack of knowledge prevents most from reporting wage theft

- Bernhardt, A.; et al. (2009). "Broken Laws, Unprotected Workers - Violation of Employment and Labor Laws in America's Cities" (PDF). Center for Urban Economic Development, University of Illinois; UCLA Institute for Research on Labor and Employment;National Employment Law Project. p. 72.

- "Wage Theft: Six common methods - National Consumers League". Nclnet.org. July 2011. Retrieved March 23, 2023.

- "Factsheet on Minimum Wage Legislation Around The World" (PDF). Centre for Public Policy Studies (CPPS). 2011.

- Cooper, David; Kroeger, Teresa (May 10, 2017). "Employers steal billions from workers' paychecks each year: Survey data show millions of workers are paid less than the minimum wage, at significant cost to taxpayers and state economies". Economic Policy Institute. Retrieved 11 February 2023.

- Linda H. Donahue; James Ryan Lamare; Fred B. Kotler (1 February 2007). "The Cost of Worker Misclassification in New York State". Research Studies and Reports, Cornell University ILR School.

- Lancman, Rory (19 May 2014). "Wage Theft Is Grim Business". Huffington Post. Retrieved May 25, 2014.

- "Construction Booming In Texas, But Many Workers Pay Dearly". National Public Radio (NPR). 2013.

- "Employers Steal Up to $50 Billion From Workers Every Year. It's Time to Reclaim It". In These Times. Retrieved 15 May 2023.

- Harkins, Benjamin (2020-09-28). "Base Motives: The case for an increased focus on wage theft against migrant workers". Anti-Trafficking Review (15): 42–62. doi:10.14197/atr.201220153. ISSN 2287-0113.

- Milkman, R.; Narro, V. & González, A. (2010). "Wage Theft and Workplace Violations in Los Angeles - The Failure of Employment and Labour Law for Low-Wage Workers" (PDF). Institute for Research on Labor and Employment University of California, Los Angeles.

- Kari Lydersen (2011-11-27). "Wage Theft at Wal-Mart Warehouses? Fourth Lawsuit in Two Years Filed on Behalf of Underpaid Workers". AlterNet. Retrieved March 4, 2012.

- "Topic Galleries - South Florida wage theft macys". Sun-sentinel. 26 November 2011. Archived from the original on November 29, 2011. Retrieved March 4, 2012.

- William Petroski (27 January 2015). "Senate Democrats offer plan to stop Iowa wage theft". DesMoinesRegister. Gannett. Retrieved 29 January 2015.

- Maria Dinzeo (23 November 2021). "Tyler Technologies pays $3 million to settle claims it stiffed employees". Courthouse News Service. Wikidata Q119864620.

- "Fact Sheet #21: Recordkeeping Requirements under the Fair Labor Standards Act (FLSA)". US Department of Labor. July 2008.

- "Labor.PART 516—RECORDS TO BE KEPT BY EMPLOYERS". Code of Federal Regulations. U.S. Government Printing Office.

- "Pay Statements: 50 State Laws". HR Specialist. Business Management Daily, division of Capitol Information Group, Inc. August 11, 2011.(subscription required)

- "What States Require Printed Pay Statements?". blog.primepay.com. PrimePay, LLC.

- "Courts Make it More Difficult for Employees to Pursue Tip Theft by Employers". texasemploymentlawblog.com. texasemploymentlaw. May 2013.

- Katharine Shilcutt (December 5, 2011). "Ruggles Waitstaff Stages Walk-Out, Alleging Non-Payment of Tips: UPDATE" (blog). Houston Press. Retrieved May 29, 2012.

- "FY 2014 Department of Labor Budget in Brief" (PDF). US Department of Labor. p. 47.

- Carpenter, Zoë (1 July 2014). "Low-Wage Workers' Newest Ally Is a Washington Bureaucrat". The Nation. Retrieved July 2, 2014.

- Josh Eidelson, Josh Eidelson (5 August 2014). "LinkedIn Stiffed Its Own Employees, Agrees to Pay Millions". Businessweek. Archived from the original on August 7, 2014.

- "Stop Wage Theft — In the News". South Florida Interfaith Worker Justice. Retrieved March 30, 2014.

- "Foreign-language ads offering $8 an hour for jobs". 13 December 2020.

- "Sarah moved to Australia to support her family. Instead, she was working six days for $10 an hour". ABC News. 4 December 2022.

- "60% of foreign language job ads underpaid". 5 December 2022.

- "Unpaid Super a Billion Dollar Problem, Says ACTU". Targeted News Service. 7 July 2014. Retrieved July 7, 2014.

- Ansell, Benjamin (18 July 2019). "Network 10 back celebrity chef following wage scandal". www.msn.com. Retrieved 25 November 2019.

- Pearce, Kristie (29 Oct 2012). "Declining standard of living". Newspapers.com. The Windsor Star. p. A2. Retrieved 10 June 2023.

- "Dubai's striking workers in their own words".

- "'Tricked' workers approach consulate".

- "FEATURE-'Wage theft' in UAE robs African deportees of future". Reuters. 21 October 2021.

- "Unpaid Britain". Trust for London. Retrieved 6 June 2018.

External links

- "Houston, We Have a Wage Theft Problem", Full report by Houston Interfaith Worker Justice Center

- "Broken Laws, Unprotected Workers", Report by the National Employment Law Project

- An Epidemic of Wage Theft Is Costing Workers Hundreds of Millions of Dollars a Year. Economic Policy Institute, September 11, 2014.