Cabela's

Cabela's Inc. is an American retailer that specializes in hunting, fishing, boating, camping, shooting and other outdoor recreation merchandise. The chain is based in Sidney, Nebraska. Cabela's was founded by Richard N. Cabela and Jim Cabela in 1961. Cabela's was acquired by Springfield, Missouri-based Bass Pro Shops in 2017 and has been a subsidiary since then.

| |

| Type |

|

|---|---|

| Industry | Retail |

| Founded | December 14, 1961 in Chappell, Nebraska, U.S. |

| Founders |

|

| Headquarters | Sidney, Nebraska, U.S. |

Number of locations | 82 (May 2016, U.S. and Canada) |

Key people | Thomas Millner (CEO) |

| Products | Hunting, fishing, outdoor merchandise |

Number of employees | 19,100 (2016) |

| Parent | Bass Pro Shops (2017–present) |

| Subsidiaries | White River Marine Group |

| Website | cabelas |

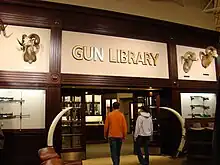

Cabela's mail-order catalogs are shipped to 50 states and 120 countries. More than 120 million catalogs were mailed in its first year as a public company.[1] It also has "Trophy Properties LLC" (a real estate market), the "Gun Library" (for buying and selling new, used, and collectible firearms).

History

The company that would become a sporting goods reseller and chain was started in December 1961. Richard (Dick) N. Cabela purchased $45 worth of fishing flies at a furniture expo in Chicago which he then advertised for sale in a local newspaper advertisement.[2] When his first effort produced only one response, he placed an ad in a national magazine, Sports Afield, which was more successful. Included with each order was a catalog of other products for sale by Cabela.[2]

As the business grew, Cabela and his wife Mary moved their operation to Sidney, Nebraska in 1963. Dick's brother Jim also joined the business. From those beginnings, the company has since grown to a publicly traded corporation with over $3 billion in annual sales.[3]

On February 17, 2014, founder Dick Cabela died at his home in Sidney, Nebraska, at the age of 77.[4][5]

About half of Cabela's sales come from hunting-related merchandise with about a third derived from the sale of firearms, ammunition and accessories in 2012. Additionally, in 2012 30% of revenue came from direct sales (through catalog and online orders), and 59% from physical retail stores. The remaining 11% of revenue came from its financial subsidiary and credit card business.[1]

In 1996, Gander Mountain, prior to declaring bankruptcy, sold its mail order business to Cabela's with a non-compete clause. In 2007, Cabelas brought suit against them to prevent their re-entry into the mail-order business. Gander Mountain won the lawsuit and began selling online as well.[6]

In February 2013, Cabela's sued Gander Mountain for patent infringement over a fold-up cot that Gander was selling.[6] In December 2013, Gander sued Cabela's for cybersquatting.[6]

In March 2014, Cabela's sold their recreational real estate division, Cabela's Trophy Properties, to Sports Afield.[7]

In December 2015, Cabela's sold their Outdoor Adventures & T.A.G.S. divisions to Worldwide Trophy Adventures.[8]

On October 3, 2016, Bass Pro Shops announced an agreement to acquire Cabela's for $5.5 billion.[9]

Retail stores

The largest Cabela's retail facility is in Hamburg, Pennsylvania, with more than 250,000 square feet (23,000 m2) of floor space.

In 2007, Cabela's purchased family-owned S.I.R. Warehouse Sports Store in Winnipeg.[10] In 2010, the Canadian Head Office and Distribution Centre moved across the city, leaving the original location as only a retail store. The company had intended to be a part of the 1,400,000-square-foot (130,000 m2) Lac-Mirabel project near Montreal, which was to include 220,000 square feet (20,000 m2) of retail space, and was planned to open in 2008.[11] But instead, rival chain Bass Pro Shops became one of the mall anchors.[12] In 2011 Cabela's opened a 70,000-square-foot (6,500 m2) store in Edmonton, Alberta and a 50,000-square-foot (4,600 m2) store opened in Saskatoon in 2012 another 70,000-square-foot (6,500 m2) store in Calgary, Alberta opened in 2015.

In early 2012, Cabela's unveiled a new retail initiative called Cabela's Outpost Stores.[13] The first outpost store opened in Union Gap in the fall of 2012.

Cabela's stores have been a target of gun thieves over the years. One store alone in South Carolina had guns stolen from it on three occasions within a one-year interval between 2017 and 2018.[14]

Acquisition by Bass Pro Shops

On July 5, 2017, the Federal Trade Commission approved the acquisition of Cabela's by Bass Pro Shops. The acquisition was complete on September 25, 2017.[15] The acquisition resulted in 2,000 jobs lost in Cabela's headquarters of Sidney, Nebraska.[16][17]

Banking and finance

Founded on March 23, 2001 (FDIC Certificate #57079), Cabela's financial subsidiary was named World's Foremost Bank (WFB, a play on Cabela's marketing moniker, World's Foremost Outfitter).[18] The bank's primary activity was as a credit card issuer for the Cabela's Club Visa card, a branded rewards card. With 11% of total sales attributed to the subsidiary, in 2013 it ranked as the 13th largest issuer of credit cards in the US.[1] Around a third of Cabela's customers have this Visa card.[19]

The subsidiary consisted of a single-branch bank with a deposit market share in the state of Nebraska of just under 1.2 percent, with $505 million in deposits as of 2011.[20] At the end of 2012, the bank claimed to have $3,731,567,000 in assets.[21]

Sean Baker was appointed president of World's Foremost Bank and chief executive officer on January 1, 2013. Baker replaced Joseph M. Friebe, whose planned retirement was announced in June 2012.[22]

2011 FDIC settlement

In its annual report, Cabela's announced that it has reached a settlement with the Federal Deposit Insurance Corporation (FDIC) regarding its credit card policies and practices. It was ordered to repay wronged cardholders $10 million plus a $250,000 penalty.[19][23] The subsidiary did not admit to or deny the FDIC's finding, but agreed to do the following:

- Refrain from the Bank's prior practice of contacting a cardholder at the cardholder's place of employment for purposes of collecting a debt after a verbal or written request is made by either the cardholder or the cardholder's employer to cease such contact because the cardholder's employer prohibits such communications.

- Refrain from the Bank's prior practice of assessing a penalty interest rate on balances that existed prior to the event that caused the penalty interest rate to be imposed.

- Refrain from the Bank's prior practice of assessing late fees when periodic payments are due on Sundays or holidays and the payment is posted the following business day.

- Refrain from the Bank's prior practice of assessing a second over-the-credit-limit fee (OL fee) on the first day of a billing cycle when a cardholder exceeded his or her credit limit during the prior billing cycle, was assessed an over limit fee during the prior billing cycle and was over limit at the end of that billing cycle and through the beginning of the next billing cycle.

- Refrain from the Bank's prior practice of imposing an over limit fee if such fee is imposed as a result of applying a cardholder's reduced credit limit to balances that preceded the date of a credit line decrease, or imposing an over limit fee if such fee is imposed solely as a result of a credit line decrease at the end of the billing cycle without adequate notice.

- Refrain from the Bank's prior practice of establishing a minimum periodic payment amount that is insufficient to avoid recurring OL fees.

- Refrain from the Bank's prior practice of implementing an increase in penalty rates without providing adequate notice to cardholders, as required by 12 C.F.R. § 226.9.[19][23]

Additionally, the FDIC required WFB to make certain changes in their management policy to increase oversight of their credit card business and to prevent further unfair practices.

2011 Royal Bank of Canada loan

The Bank entered into a $411.7 million commitment with the Royal Bank of Canada under a series of variable funding notes issued by Cabela's Credit Card Master Note Trust. The loan is for three years and accrues interest at a variable rate of commercial paper plus a spread.[22]

2017 Sale to Synovus & Capital One

As part of the merger with Bass Pro Shops, Cabela's sold the World's Foremost Bank aspect of their business, including over $1 billion in assets, to Synovus who then proceeded to immediately sell Cabela's CLUB credit card program to Capital One.[24][25]

Video games

Cabela's has produced several series of video games for a variety of gaming platforms, including Cabela's Legendary Adventures, Cabela's Big Game Hunter series, Cabela's Dangerous Hunts series, and Cabela's Outdoor Adventures series.

Sponsorships

Cabela's Legendary Adventures sponsors Richard Childress Racing driver Daniel Hemric in the Monster Energy NASCAR Cup Series in partnership with Bass Pro Shops. Cabela's also has a deck lid space on Martin Truex Jr.'s Bass Pro Shops car.

See also

References

- Santoli, Michael. "Outdoor Enthusiasts Flock to Cabela's, Investors Follow". Yahoo Finance. Retrieved September 1, 2013.

- Staff (May 2014). "Random Shots: In Memory: Richard "Dick" Cabela". American Rifleman. 162 (5): 28.

- "Richard Cabela, who co-founded outdoor gear retailer, dies at 77". Chicago Tribune.

- "Richard Cabela, co-founder of outdoors outfitter, dies at 77". The Denver Post. Associated Press. February 17, 2014. Retrieved September 7, 2023.

- Harris, Elizabeth A. (February 22, 2014). "Richard Cabela, Who Sold the Great Outdoors, Is Dead at 77". The New York Times. ISSN 0362-4331. Retrieved September 7, 2023.

- Orrick, Dave (December 14, 2013). "Gander Mountain sues Cabela's over web addresses". TwinCities.com, Pioneer Press. Retrieved December 16, 2013.

- "Sports Afield Buys Recreational Real Estate Firm | License! Global". www.licensemag.com. Retrieved August 1, 2017.

- "WTA Redirect : Cabela's". Retrieved October 14, 2016.

- "Cabela's stores to be sold to Bass Pro Shops for $5.5 billion". Archived from the original on December 21, 2016. Retrieved December 18, 2016.

- Canadian Broadcasting Corporation (August 16, 2007). "U.S. firm buys longtime Winnipeg outfitter". CBC News. Retrieved August 16, 2007.

- Cabela's Montreal store Press Release Cabelas.com

- "Lac Mirabel press release" (PDF). Archived from the original (PDF) on September 4, 2012. Retrieved October 14, 2016.

- "Cabela's® Unveils New Outpost Store Retail Initiative". cabelas.com. February 16, 2011. Retrieved August 15, 2010.

- "Gun thieves hit Fort Mill Cabela's again". WSOC. March 19, 2018. Retrieved December 2, 2022.

- Hallie Detrick (September 26, 2017). "Bass Pro Just Completed a $4 Billion Deal to Buy Cabela's". Fortune. Retrieved December 20, 2018.

- Couger, Charles & Pfeiffer, Alex (December 3, 2019). "The death of Sidney, Nebraska: How a hedge fund destroyed 'a good American town'". Fox News. Retrieved June 27, 2020.

{{cite web}}: CS1 maint: multiple names: authors list (link) - Yowell, Paige. "Sidney faces challenge to replace 2,000 jobs, fill vacant homes after Bass Pro takeover of Cabela's". Omaha World-Herald. Retrieved June 27, 2020.

- Staff. "Commercial Banks; Company Overview of World's Foremost Bank". Bloomberg Business. Archived from the original on September 1, 2013. Retrieved December 16, 2013.

- Barr, Colin. "World's foremost credit card ripoff: update". CNN Money. Retrieved September 1, 2013.

- Henderson, Tom (March 9, 2011). "Who's world's foremost bank? Not World's Foremost Bank – Cabela's Visa rewards program goes awry". Crain's Detroit Business. Retrieved September 1, 2013.

- Staff. "About Us". wfbcds.com. Archived from the original on December 16, 2013. Retrieved December 16, 2013.

- "Company Overview of World's Foremost Bank". BusinessWeek. Archived from the original on September 1, 2013. Retrieved September 1, 2013.

- Staff. "CONSENT ORDER AND ORDER TO PAY FDIC-10-775b FDIC-10-777k In the Matter of WORLD'S FOREMOST BANK SIDNEY, NEBRASKA" (PDF). fdic.gov. Retrieved December 16, 2013.

- Arif, Rabia. "Synovus, Capital One to buy banking operations of Cabela's". S&P Global. Retrieved June 27, 2020.

- Detrick, Hallie. "Bass Pro Just Completed a $4 Billion Deal to Buy Cabela's". Fortune. Retrieved June 27, 2020.