S&P Global Ratings

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is considered the largest of the Big Three credit-rating agencies, which also include Moody's Investors Service and Fitch Ratings.[2] Its head office is located on 55 Water Street in Lower Manhattan, New York City.[3]

| |

| Type | Subsidiary |

|---|---|

| Industry | Financial services |

| Predecessor |

|

| Founded | 1860 1941 (present corporation status) |

| Founder | Henry Varnum Poor |

| Headquarters | , U.S. |

Key people | John Berisford |

| Revenue | |

Number of employees | 10,000+ |

| Parent | S&P Global |

| Website | www |

History

.jpg.webp)

The company traces its history back to 1860, with the publication by Henry Varnum Poor of History of Railroads and Canals in the United States. This book compiled comprehensive information about the financial and operational state of U.S. railroad companies. In 1868, Henry Varnum Poor established H.V. and H.W. Poor Co. with his son, Henry William Poor, and published two annually updated hardback guidebooks, Poor's Manual of the Railroads of the United States and Poor's Directory of Railway Officials.[4][5]

In 1906, Luther Lee Blake founded the Standard Statistics Bureau, with the view to providing financial information on non-railroad companies. Instead of an annually published book, Standard Statistics would use 5-by-7-inch cards, allowing for more frequent updates.[4]

In 1941, Paul Talbot Babson purchased Poor's Publishing and merged it with Standard Statistics to become Standard & Poor's Corp. In 1966, the company was acquired by The McGraw-Hill Companies, extending McGraw-Hill into the field of financial information services.[4]

Credit ratings

As a credit rating agency (CRA), the company issues credit ratings for the debt of public and private companies, and other public borrowers such as governments and governmental entities. It is one of several CRAs that have been designated a nationally recognized statistical rating organization by the U.S. Securities and Exchange Commission.

Overall Long-term credit ratings

The company rates borrowers on a scale from AAA to D. Intermediate ratings are offered at each level between AA and CCC (such as BBB+, BBB, and BBB−). For some borrowers, the company may also offer guidance (termed a "credit watch") as to whether it is likely to be upgraded (positive), downgraded (negative) or uncertain (neutral).

Investment Grade

- AAA: An obligor rated 'AAA' has extremely strong capacity to meet its financial commitments. 'AAA' is the highest issuer credit rating assigned by Standard & Poor's.

- AA: An obligor rated 'AA' has very strong capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree. Includes:

- AA+: equivalent to Moody's Aa1 (high quality, with very low credit risk, but susceptibility to long-term risks appears somewhat greater)

- AA: equivalent to Aa2

- AA−: equivalent to Aa3

- A: An obligor rated 'A' has strong capacity to meet its financial commitments but is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

- A+: equivalent to A1

- A: equivalent to A2

- BBB: An obligor rated 'BBB' has adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Non-Investment Grade (also known as speculative-grade)

- BB: An obligor rated 'BB' is less vulnerable in the near term than other lower-rated obligors. However, it faces major ongoing uncertainties and exposure to adverse business, financial, or economic conditions, which could lead to the obligor's inadequate capacity to meet its financial commitments.

- B: An obligor rated 'B' is more vulnerable than the obligors rated 'BB', but the obligor currently has the capacity to meet its financial commitments. Adverse business, financial, or economic conditions will likely impair the obligor's capacity or willingness to meet its financial commitments.

- CCC: An obligor rated 'CCC' is currently vulnerable, and is dependent upon favorable business, financial, and economic conditions to meet its financial commitments.

- CC: An obligor rated 'CC' is currently highly vulnerable.

- C: highly vulnerable, perhaps in bankruptcy or in arrears but still continuing to pay out on obligations

- R: An obligor rated 'R' is under regulatory supervision owing to its financial condition. During the pendency of the regulatory supervision, the regulators may have the power to favor one class of obligations over others or pay some obligations and not others.

- SD: has selectively defaulted on some obligations

- D: has defaulted on obligations and S&P believes that it will generally default on most or all obligations

- NR: not rated

Short-term issue credit ratings

The company rates specific issues on a scale from A-1 to D. Within the A-1 category it can be designated with a plus sign (+). This indicates that the issuer's commitment to meet its obligation is very strong. Country risk and currency of repayment of the obligor to meet the issue obligation are factored into the credit analysis and reflected in the issue rating.

- A-1: obligor's capacity to meet its financial commitment on the obligation is strong

- A-2: is susceptible to adverse economic conditions however the obligor's capacity to meet its financial commitment on the obligation is satisfactory

- A-3: adverse economic conditions are likely to weaken the obligor's capacity to meet its financial commitment on the obligation

- B: has significant speculative characteristics. The obligor currently has the capacity to meet its financial obligation but faces major ongoing uncertainties that could impact its financial commitment on the obligation

- C: currently vulnerable to nonpayment and is dependent upon favorable business, financial and economic conditions for the obligor to meet its financial commitment on the obligation

- D: is in payment default. Obligation not made on due date and grace period may not have expired. The rating is also used upon the filing of a bankruptcy petition.

Governance scores

S&P has had a variety of approaches to reflecting its opinion of the relative strength of a company's corporate governance practices. Corporate governance serves as investor protection against potential governance-related losses of value, or failure to create value.

CGS scores

S&P developed criteria and methodology for assessing corporate governance. It started issuing Corporate Governance Scores (CGS) in 2000. CGS assessed companies' corporate governance practices. They were assigned at the request of the company being assessed, were non-public (although companies were free to disclose them to and sometimes did) and were limited to public U.S. corporations. In 2005, S&P stopped issuing CGS.[6]

GAMMA scores

S&P's Governance, Accountability, Management Metrics and Analysis (GAMMA) scores were designed for equity investors in emerging markets and focused on non-financial-risk assessment, and in particular, assessment of corporate-governance risk. S&P discontinued providing stand-alone governance scores in 2011, "while continuing to incorporate governance analysis in global and local scale credit ratings".[7]

Management and Governance criteria

In November 2012, S&P published its criteria for evaluating insurers and non-financial enterprises' management and governance credit factors.[8] These scores are not standalone, but rather a component used by S&P in assessing an enterprise's overall creditworthiness. S&P updated its management and governance scoring methodology as part of a larger effort to include enterprise risk management analysis in its rating of debt issued by non-financial companies. "Scoring of management and governance is made on a scale of weak, fair, satisfactory or strong, depending on the mix of positive and negative management scores and the existence and severity of governance deficiencies."[9]

Downgrades of Countries

Downgrade of U.S. long-term credit rating

On August 5, 2011, following enactment of the Budget Control Act of 2011, S&P lowered the US's sovereign long-term credit rating from AAA to AA+.[10] The press release sent with the decision said, in part:

- " The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government's medium-term debt dynamics.

- " More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned when we assigned a negative outlook to the rating on April 18, 2011.

- " Since then, we have changed our view of the difficulties in bridging the gulf between the political parties over fiscal policy, which makes us pessimistic about the capacity of Congress and the Administration to be able to leverage their agreement this week into a broader fiscal consolidation plan that stabilizes the government's debt dynamics any time soon."[10]

The United States Department of the Treasury, which had first called S&P's attention to its $2 trillion error in calculating the ten-year deficit reduction under the Budget Control Act, commented, "The magnitude of this mistake – and the haste with which S&P changed its principal rationale for action when presented with this error – raise fundamental questions about the credibility and integrity of S&P’s ratings action."[11] The following day, S&P acknowledged in writing the US$2 trillion error in its calculations, saying the error "had no impact on the rating decision" and adding:[12]

In taking a longer term horizon of 10 years, the U.S. net general government debt level with the current assumptions would be $20.1 trillion (85% of 2021 GDP). With the original assumptions, the debt level was projected to be $22.1 trillion (93% of 2021 GDP).[12]

In 2013 the Justice Department charged Standard & Poor's with fraud in a $5 billion lawsuit: U.S. v. McGraw-Hill Cos et al., U.S. District Court, Central District of California, No. 13-00779. Since it did not charge Fitch and Moody's and because the Department did not give access to evidence, there has been speculation whether the lawsuit may have been in retaliation to S&P's decision to downgrade. On April 15, 2013, the Department of Justice was ordered to grant S&P access to evidence.[13]

Downgrade of France's long-term credit rating

On November 11, 2011, S&P erroneously announced the cut of France's triple-A rating (AAA). French leaders said that the error was inexcusable and called for even more regulation of private credit rating agencies.[14][15][16][17] On January 13, 2012, S&P truly cut France's AAA rating, lowering it to AA+. This was the first time since 1975 that Europe's second-biggest economy, France, had been downgraded to AA+. The same day, S&P downgraded the rating of eight other European countries: Austria, Spain, Italy, Portugal, Malta, Slovenia, Slovakia and Cyprus.[18]

Publications

The company publishes The Outlook, a weekly investment advisory newsletter for individuals and professional investors, published continuously since 1922.[19] Credit Week is produced by Standard & Poor's Credit Market Services Group. It offers a comprehensive view of the global credit markets, providing credit rating news and analysis. Standard & Poor's offers numerous other editorials, investment commentaries and news updates for financial markets, companies, industries, stocks, bonds, funds, economic outlook and investor education. All publications are available to subscribers.[20]

S&P Dow Jones Indices publishes several blogs that do not require a subscription to access. These include Indexology, VIX Views and Housing Views.[21]

Criticism and scandal

Role in the 2007–08 financial crisis

Credit rating agencies such as S&P have been cited for contributing to the financial crisis of 2007–08.[22] Credit ratings of AAA (the highest rating available) were given to large portions of even the riskiest pools of loans in the collateralized debt obligation (CDO) market. When the real estate bubble burst in 2007, many loans went bad due to falling housing prices and the inability of bad creditors to refinance. Investors who had trusted the AAA rating to mean that CDO were low-risk had purchased large amounts that later experienced staggering drops in value or could not be sold at any price. For example, institutional investors lost $125 million on $340.7 million worth of CDOs issued by Credit Suisse Group, despite being rated AAA by S&P.[23][22]

Companies pay S&P, Moody's and Fitch to rate their debt issues. As a result, some critics have contended that the credit ratings agencies are beholden to these issuers in a conflict of interests and that their ratings are not as objective as they ought to be, due to this "pay to play" model.[24]

In 2015, Standard and Poor's paid $1.5 billion to the U.S. Justice Department, various state governments, and the California Public Employees' Retirement System to settle lawsuits asserting its inaccurate ratings defrauded investors.[25]

Criticism of sovereign debt ratings

In April 2009, the company called for "new faces" in the Irish government, which was seen as interfering in the democratic process. In a subsequent statement they said they were "misunderstood".[26]

S&P acknowledged making a US$2 trillion error in its justification for downgrading the credit rating of the United States in 2011,[27] but stated that it "had no impact on the rating decision".[28] Jonathan Portes, director of NIESR, Britain's longest established independent economic research institute, has observed that "S&P's record . . . is remarkable. The agency downgraded Japan's credit rating in 2002, since when it has had the lowest long-term interest rates in recorded economic history."[29] Paul Krugman wrote, "it’s hard to think of anyone less qualified to pass judgment on America than the rating agencies," and, "S&P’s demands suggest that it’s talking nonsense about the US fiscal situation".[30]

In late 2013, S&P downgraded France's credit rating. Paul Krugman commented that the decision was based on politics rather than sound financial analysis.[31]

Australian Federal Court decision

In November 2012, Judge Jayne Jagot of the Federal Court of Australia found that: "A reasonably competent ratings agency could not have rated the Rembrandt 2006-3 CPDO AAA in these circumstances";[32] and "S&P’s rating of AAA of the Rembrandt 2006-2 and 2006-3 CPDO notes was misleading and deceptive and involved the publication of information or statements false in material particulars and otherwise involved negligent misrepresentations to the class of potential investors in Australia, which included Local Government Financial Services Pty Ltd and the councils, because by the AAA rating there was conveyed a representation that in S&P’s opinion the capacity of the notes to meet all financial obligations was “extremely strong” and a representation that S&P had reached this opinion based on reasonable grounds and as the result of an exercise of reasonable care when neither was true and S&P also knew not to be true at the time made."[32]

In conclusion, Jagot found Standard & Poor's to be jointly liable along with ABN Amro and Local Government Financial Services Pty Ltd.[32]

Antitrust review

In November 2009, ten months after launching an investigation, the European Commission (EC) formally charged S&P with abusing its position as the sole provider of international securities identification codes for United States of America securities by requiring European financial firms and data vendors to pay licensing fees for their use. "This behavior amounts to unfair pricing," the EC said in its statement of objections which lays the groundwork for an adverse finding against S&P. "The (numbers) are indispensable for a number of operations that financial institutions carry out – for instance, reporting to authorities or clearing and settlement – and cannot be substituted.”[33]

S&P has run the CUSIP Service Bureau, the only International Securities Identification Number (ISIN) issuer in the US, on behalf of the American Bankers Association. In its formal statement of objections, the EC alleged "that S&P is abusing this monopoly position by enforcing the payment of licence fees for the use of US ISINs by (a) banks and other financial services providers in the EEA and (b) information service providers in the EEA." It claims that comparable agencies elsewhere in the world either do not charge fees at all, or do so on the basis of distribution cost, rather than usage.[34]

See also

- Global Industry Classification Standard

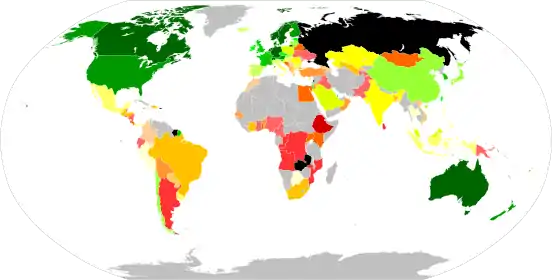

- List of countries by credit rating

References

- "S&P | About S&P | Americas – Key Statistics". Standard & Poor's. Archived from the original on August 16, 2011. Retrieved August 7, 2011.

- Blumenthal, Richard (May 5, 2009). "Three Credit Rating Agencies Hold Too Much of the Power". Juneau Empire – Alaska's Capital City Online Newspaper. Archived from the original on November 1, 2011. Retrieved August 7, 2011.

- "Corporate 55 Water Street New York New York". Standard & Poor's. July 3, 2013. Archived from the original on June 28, 2013.

- "A History of Standard & Poor's". Archived from the original on February 15, 2013. Retrieved February 11, 2013.

- "Corporations: Standard & Unpoor". Time magazine. October 13, 1961. Archived from the original on December 20, 2011. Retrieved October 19, 2011.

- Taub, Stephen (September 9, 2005). "S&P Stops Issuing Governance Scores". CFO. Archived from the original on August 27, 2017. Retrieved May 28, 2017.

- "S&P affirms and withdraws Banco Santander (Brasil) GAMMA score". lta.reuters.com. Reuters. September 1, 2011. Archived from the original on April 28, 2018. Retrieved May 28, 2017.

- "S&P report on criteria for management and governance scores". Reuters. November 13, 2012. Retrieved May 28, 2017.

- Berkenblit, Howard E.; Trumble, Paul D. (January 2, 2013). "Standard & Poor's brings "enhanced transparency" to management and governance credit factors methodology". www.lexology.com. Sullivan & Worcester LLP. Archived from the original on January 6, 2017. Retrieved May 28, 2017.

- Swann, Nikola G; et al. (August 5, 2011). "United States of America Long-Term Rating Lowered To 'AA+' Due To Political Risks, Rising Debt Burden; Outlook Negative" (Press release). McGraw-Hill Companies: Standard & Poor's. Archived from the original on August 9, 2011. Retrieved August 5, 2011.

- Bellows, John (August 6, 2011). "Just the Facts: S&P's $2 Trillion Mistake". United States Department of the Treasury. Archived from the original on August 10, 2011. Retrieved August 7, 2011.

- "Standard & Poor's Clarifies Assumption Used on Discretionary Spending Growth" (Press release). McGraw-Hill Companies: Standard & Poor's. August 6, 2011. Archived from the original on July 2, 2015. Retrieved August 6, 2011.

- Stempel, Jonathan (April 15, 2014). "S&P fails to split up $5 billion U.S. fraud lawsuit". WSJ. Archived from the original on April 29, 2014. Retrieved April 29, 2014.

- Horobin, William (November 11, 2011). "France Slams S&P for Downgrade Gaffe". The Wall Street Journal. Archived from the original on January 4, 2017.

- S&P downgrades France by ‘mistake’ | euronews, economy. Euronews.net. Retrieved on 2013-12-23.

- Nazareth, Rita (November 10, 2011). "U.S. Stocks Advance as S&P Says It Did Not Downgrade France". The San Francisco Chronicle.

- Dilorenzo, Sarah (November 14, 2011). "France frets about prized AAA debt rating". The San Francisco Chronicle. Archived from the original on November 15, 2011.

- Gauthier-Villars, David; Forelle, Charles (January 14, 2012). "Europe Hit by Downgrades". The Wall Street Journal. p. A1.

- "Standard & Poor's Premium Publications". www.netadvantage.standardandpoors.com. Retrieved May 28, 2017.

- "Standard & Poor's Editorial Features". www.netadvantage.standardandpoors.com. Retrieved May 28, 2017.

- "Thought Leadership – Overview – S&P Dow Jones Indices". us.spindices.com. Archived from the original on May 27, 2017. Retrieved May 29, 2017.

- Klein, Joe (August 6, 2011). "Standard & Poor's Downgrades Itself". Time. Archived from the original on September 18, 2011. Retrieved August 6, 2011.

- Tomlinson, Richard; Evans, David (May 31, 2007). "CDO Boom Masks Huge Subprime Losses, Abetted by S&P, Moody's Fitch". Bloomberg. Archived from the original on July 20, 2011. Retrieved August 6, 2011.

- Efing, Matthias; Hau, Harald (June 18, 2013). "Corrupted credit ratings: Standard & Poor's lawsuit and the evidence". VoxEU.org. Archived from the original on July 3, 2017. Retrieved May 28, 2017.

- Viswanatha, Aruna (February 3, 2015). "S&P reaches $1.5 billion deal with U.S., states over crisis-era..." reuters.com. Archived from the original on April 17, 2017. Retrieved April 28, 2018.

- GAA Video (April 1, 2009). "Cowen Attacks Call for 'New Faces' in Cabinet". Irish Independent. Retrieved August 7, 2011.

- Paletta, Damian (August 5, 2011). "U.S. Debt Rating in Limbo as Treasury Finds Math Mistake by S&P in Downgrade Warning". The Wall Street Journal. Archived from the original on August 13, 2011. Retrieved August 5, 2011.

- Goldfarb, Zachary A. (August 5, 2011). "S&P Downgrades U.S. Credit Rating for First Time". The Washington Post. Archived from the original on August 6, 2011. Retrieved August 5, 2011.

- Jonathan Portes (August 24, 2011). "The coalition's confidence trick". New Statesmen. Archived from the original on January 31, 2012. Retrieved February 17, 2012.

- Paul Krugman (August 5, 2011). "S&P and the USA". The New York Times. Archived from the original on July 9, 2012. Retrieved August 8, 2011.

- Krugman, Paul (November 11, 2013). "The Plot Against France". The New York Times. New York. Archived from the original on November 16, 2006. Retrieved November 11, 2013.

- Bathurst Regional Council v Local Government Financial Services Pty Ltd (No 5) [2012] FCA 1200 (5 November 2012), Federal Court (Australia).

- Securities Technology Monitor, ed. (2009). "EC Charges S&P With Monopoly Abuse". Archived from the original on July 16, 2011.

- Finextra, ed. (2009). "European Commission Accuses S&P of Monopoly Abuse over Isin Fees". Archived from the original on March 12, 2011.