Money Basics

Staying Out of Debt

Staying out of debt

By the end of this lesson, you should be able to:

- Estimate a reasonable amount of personal debt

- Recognize signs of compulsive indebtedness

- Effectively manage existing debt

- Recognize the benefits of staying out of debt

What is debt?

Debt is money owed to a person or entity that must be paid off by a deadline. Mortgage loans, student loans, car loans, and credit card balances are types of debt.

Cutting expenses and taking other steps to better manage your money can help you get out of or avoid debt.

How much debt is too much debt?

At some point in your life, it's likely that you'll have debt. But how do you know if you have too much debt? On average, your annual debt payments—including car payments, credit cards, and bank loans—should ideally be no more than 20 percent of your annual take-home income. (This 20 percent debt guideline does not include rent or mortgage costs, which can be 30 percent on their own).

Example: Michael's annual take-home income is $30,000. Does he carry a reasonable amount of debt?

To calculate whether he falls under or at the 20 percent limit:

- List monthly debt payments. This includes a $250 car payment, credit card payments of $60 and $50 each, and a $120 student loan payment.

- Add up all debt payments for one month, then multiply by 12 to determine how much is spent annually. Michael's total monthly debt payment is $480, or $5,760 annually.

- Calculate whether debt payments exceed 20 percent of annual take-home pay. To calculate 20 percent of his take-home pay, Michael multiplies 0.20 by $30,000 to get $6,000.

Michael's annual debt payments of $5,760 do not exceed the recommended 20 percent limit for his income of $6,000. However, he probably shouldn't take on any more debt if he can avoid it.

To help you determine your debt, use our Debt Worksheet.

Do you have a compulsive debt problem?

If your debt far exceeds the 20 percent rule, you may be a compulsive debtor. According to Debtors Anonymous, here are some other signs of compulsive indebtedness:

- Unclear financial situation: Not knowing account balances, monthly expenses, loan interest rates, fees, fines, or contractual obligations

- Poor saving habits: Not planning for taxes, retirement, or other predictable items, then feeling surprised when they come due

- Compulsive shopping: Being unable to pass on what appears to be a good deal, making impulsive purchases, leaving price tags on clothes so they can be returned, and not using purchased items

- Difficulty in meeting basic financial or personal obligations: An inability to pay bills, and an inordinate sense of accomplishment when such obligations are met

- Always dealing with a financial crisis: Using one credit card to pay another; bouncing checks

- Living paycheck to paycheck: Taking risks with health and car insurance coverage; writing checks without knowing your checking account's balance

- Overworking or under-earning: Working extra hours to earn money to pay creditors; taking jobs below your skill and education level

- Living in self-imposed deprivation: Denying basic needs in order to pay creditors

- A false feeling of hope: The belief that someone will take care of you if necessary so you won't get into serious financial trouble

If you are struggling with debt, seek help. Look for resources in your community, and review the resources at the end of this lesson.

Credit counseling and debt consolidation

If you need help getting your debt under control, contact a credit counseling agency. Such agencies are designed to assist people who are dealing with difficult financial situations.

Consumer Credit Counseling Service (CCCS), one of the oldest counseling services in the United States, is part of the National Foundation for Credit Counseling (NFCC). Local CCCS organizations are listed online under debt or financial counseling, or call the national number at (800) 388-2227 to speak with a counselor near you.

If you cannot find an office in your area, NFCC suggests asking the following questions to help you choose another qualified credit counseling service:

- Is this agency a nonprofit organization?

- How much will these services cost?

- Are agency services confidential, and what types of services are offered?

- Are the counselors and agency certified?

- Are budget and credit education opportunities offered?

- Will my funds be protected?

If you have a serious problem with incurring debt, consider joining Debtors Anonymous. This fellowship of men and women share their experiences, strengths, and hope with each other as they work to recover from compulsive indebtedness. The only requirement for membership is a desire to stop incurring unsecured debt; no dues or fees are required.

What is bankruptcy?

Bankruptcy is a legal procedure that provides a financial fresh start to people who cannot pay their debts. It is a serious step and should not be considered a quick fix for money woes. Bankruptcy should only be pursued as a last resort when all other attempts to solve financial problems fail.

There are three types of bankruptcy:

- Chapter 13 is for when you are temporarily unable to pay your debts and would prefer to pay them in installments over a period of time. You can usually keep your property, but you must earn wages or have another source of regular income, and you must agree to pay part of that income to creditors. A federal court must approve your repayment plan and your budget. A trustee is appointed and will collect the payments from you, pay your creditors, and make sure you abide by the terms of your repayment plan.

- Chapter 11 is primarily for the reorganization of a business. Under Chapter 11, you may continue to operate a business, but your creditors and the court must approve a plan to repay debts. No trustee is appointed unless a judge decides that one is necessary. If a trustee is appointed, the trustee takes control of your business and property.

- Chapter 7 is for debtors who cannot pay their debts. Under Chapter 7, you may be able to keep certain property, and a trustee may take control of the remaining property of value and sell it to pay creditors.

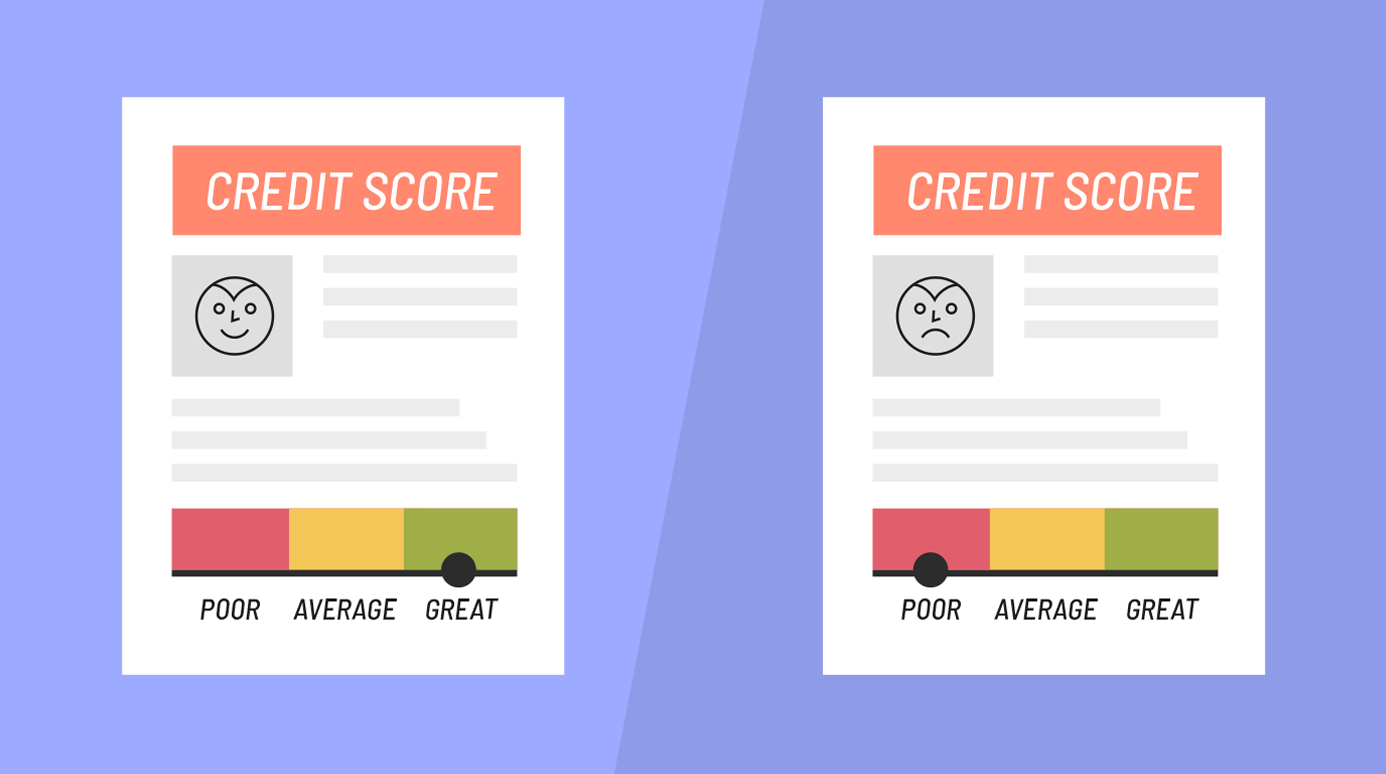

Bankruptcy does not fix a bad credit history, and it remains on your credit record for up to 10 years. It also may be a roadblock toward obtaining a mortgage or credit card. Also, not all debt can be cleared up through bankruptcy. For example, you must still pay taxes, alimony, child support, student loans, and court fines.

Check with a financial counselor to find out if it's necessary for you to file for bankruptcy. Instead, you may be able to reach an agreement with your creditors.

Tips for staying out of debt

Consider taking one or more of the following steps to help pay off debt or stay out of debt:

Credit cards

- Stop paying high interest rates. Apply for a card with a lower rate, but make sure you understand the credit card agreement before signing it.

- Consolidate credit card debt. Transfer your largest high-rate balances to a card with a low rate and work to pay it down.

- Stop using credit cards if possible. Cancel and cut up the cards you don't need. Write to card issuers, and close the accounts. (Check terms of use first because some issuers charge a higher interest rate on the remaining balance due to people who close accounts. If this is the case, pay it off and then cancel it.)

- If you have savings, consider using some of it to pay off debt. It may sound drastic, but it makes sense if the money in your savings account is only earning interest of 3.5 percent, while the price of carrying debt is 15 percent or higher.

Student loans

- Consider consolidating if you have sizable student loans. Under the federal Direct Consolidation Loans program, you can combine multiple federal education loans into a new loan. Benefits include no charges for consolidation, a choice of payment plans, and dealing with one lender and one monthly payment. To find out if you're eligible for this program, review Federal Student Aid's Loan Consolidation page.

Benefits of staying out of debt

Debt is not a bad thing. It is how people manage debt that gets them into trouble. There are several benefits of not getting too deep into debt.

- Debt can drain your cash. Once you free yourself of debt, chances are you will have more money to spend on things you want or enjoy without having to worry about interest payments.

- Mishandling debt can lead to a bad credit history. This can have a negative impact if you are applying for a job or attempting to obtain a home loan. Managing your debt wisely can put you in a good financial position when it comes to making major purchases.

- Being in debt can be stressful. It can strain relationships at home and could possibly affect your work. In essence, becoming debt free or paying down your debt could make life easier.

Online

- www.consolidatedcredit.org: Consolidated Credit, a nonprofit financial management organization

- Debtors Anonymous: Aids in recovery from problems with debt

Offline

- Get Out of Debt: Smart Solutions to Your Money Problems - by Steve Rhode and Mike Kidwell

- Getting Real Solutions for Getting Out of Debt (Real Solutions Series) - by Mike Yorkey