Business Goodwill

In accounting, goodwill is the value of an asset that is considered intangible but has a quantifiable "prudent value" in a business. For example, goodwill could be the reputation the firm enjoys with its clients. While goodwill is technically an intangible asset, it is usually listed as a separate item on a company's balance sheet .

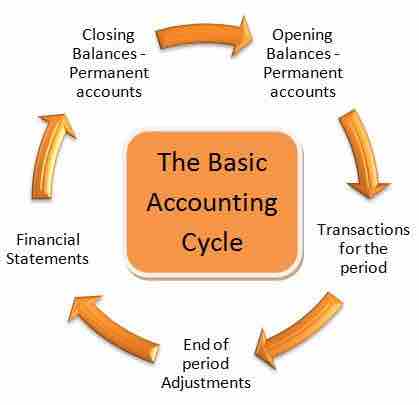

The Accounting Cycle

Correctly reporting intangible assets is important to the accounting cycle.

Accounting for Goodwill

Instead of deducting the value of goodwill annually over a period of maximal 40 years ( amortization ), companies are now required to determine the fair value of the reporting units, using the present value of future cash flow , and compare it to their carrying value (book value of assets + goodwill - liabilities. ).

If the fair value is less than carrying value (impaired), the goodwill value will need to be reduced so that the fair value is equal to carrying value. The impairment loss is reported as a separate line item on the income statement, and new adjusted value of goodwill is reported in the balance sheet.

Impairment of Goodwill

If there is an indication that the book value of goodwill is greater than the recoverable value of net assets, an assessment of the recoverable value is made, and if the suspicion is correct, then an impairment expense is recorded. Goodwill's value on the balance sheet is reported at net of accumulated impairment loss, a contra asset account; the current impairment loss is reported on the income statement.

An impairment cost must be included under expenses when the carrying value of a non-current asset on the balance sheet exceeds the asset's market value subtracted by any transaction costs (recoverable amount). The impairment cost is calculated as follows: carrying value - recoverable amount.

The carrying amount is defined as the value of the asset as it is displayed on the balance sheet. The recoverable amount is the higher of either the asset's future value for the company or the amount it can be sold for, minus any transaction cost.

According IAS 36, reversal of goodwill impairment losses are not allowed.