Generally Accepted Accounting Principles

Generally Accepted Accounting Principles (GAAP) refer to the standard framework of guidelines for financial accounting used in any given jurisdiction; generally known as accounting standards. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing accounting transactions, and in the preparation of financial statements.

GAAP is a codification of how CPA firms and corporations prepare and present their business income and expense, assets and liabilities in their financial statements. GAAP is not a single accounting rule, but rather an aggregate of many rules on how to account for various transactions. .

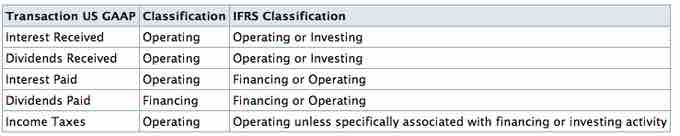

GAAP vs. IFRS Cash Flow Classification

This image demonstrates the differences in accounting standards between GAAP and IFRS regarding classifying cash flows.

Introduction to U.S. GAAP

Like many other common law countries, the United States government does not directly set accounting standards by statute. However, the U.S. Securities and Exchange Commission (SEC) requires that US GAAP be followed in financial reporting by publicly traded companies. Currently, the Financial Accounting Standards Board (FASB) establishes generally accepted accounting principles for public and private companies, as well as for non-profit organizations.

History

Historically, accounting standards have been set by the American Institute of Certified Public Accountants (AICPA) subject to Securities and Exchange Commission regulations. The AICPA first created the Committee on Accounting Procedure in 1939, and replaced it with the Accounting Principles Board in 1951.

In 1973, the Accounting Principles Board was replaced by the FASB under the supervision of the Financial Accounting Foundation with the Financial Accounting Standards Advisory Council serving to advise and provide input on the accounting standards.

Circa 2008, the FASB issued the FASB Accounting Standards Codification, which reorganized the thousands of US GAAP pronouncements into roughly 90 accounting topics. In 2008, the SEC issued a preliminary "roadmap" that may lead the U.S. to abandon GAAP in the future and to join more than 100 countries around the world already using the London-based IFRS.

As of 2010, the convergence project was underway with the FASB meeting routinely with the IASB. The SEC expressed its resolve to fully adopt IFRS in the U.S. by 2014. As the highest authority over IFRS, the IASB is becoming more important in the U.S.

Basic Objectives

Financial reporting should provide information that is:

- Useful to present to potential investors and creditors and other users in making rational investment, credit, and other financial decisions.

- Helpful to present to potential investors and creditors and other users in assessing the amounts, timing, and uncertainty of prospective cash receipts.

- About economic resources, the claims to those resources, and the changes in them.helpful for making financial decisions.

- Helpful in making long-term decisions.

- Helpful in improving the performance of the business.

- Useful in maintaining records.

Four Basic Assumptions

- Accounting Entity: assumes that the business is separate from its owners or other businesses. Revenue and expense should be kept separate from personal expenses.

- Going Concern: assumes that the business will be in operation indefinitely. This validates the methods of asset capitalization, depreciation, and amortization. In cases when liquidation is certain, this assumption is not applicable. The business will continue to exist in the unforeseeable future.

- Monetary Unit Principle: assumes a stable currency is going to be the unit of record. The FASB accepts the nominal value of the US Dollar as the monetary unit of record unadjusted for inflation. This is also know at the stable dollar principle.

- Time-period Principle: implies that the economic activities of an enterprise can be divided into artificial time periods.

Four Basic Principles

- Historical Cost Principle: requires companies to account and report based on acquisition costs rather than fair market value for most assets and liabilities.

- Revenue Recognition Principle: requires companies to record when revenue is (1) realized or realizable and (2) earned, not when cash is received. Also, under this principle a company should establish an allowance for bad debt account. This way of accounting is called accrual based accounting.

- Matching Principle: Expenses have to be matched with revenues as long as it is reasonable to do so. Expenses are recognized not when the work is performed, or when a product is produced, but when the work or the product actually makes its contribution to revenue. Only if no connection with revenue can be established, cost may be charged as expenses to the current period (e.g. office salaries and other administrative expenses).

- Full Disclosure Principle: Amount and kinds of information disclosed should be decided based on trade-off analysis as a larger amount of information costs more to prepare and use. Information disclosed should be enough to make a judgment while keeping costs reasonable. Information is presented in the main body of financial statements, in the notes or as supplementary information.

Please note: Historical cost and the matching principle are slowly disappearing, having been replaced by FASB No. 157 which requires companies to classify assets based on fair value.

Five Basic Constraints

- Objectivity principle: the company financial statements provided by the accountants should be based on objective evidence.

- Materiality principle: the significance of an item should be considered when it is reported.

- Consistency principle: the company uses the same accounting principles and methods from year to year.

- Conservatism principle: when choosing between two solutions, the one that will be least likely to overstate assets and income should be picked.

- Cost-Benefit Relationship: the company considers the costs necessary to prepare the information and what benefit users will get from it.