In financial accounting, a cash flow statement, also known as statement of cash flows or funds flow statement, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business.

Statement of cash flows

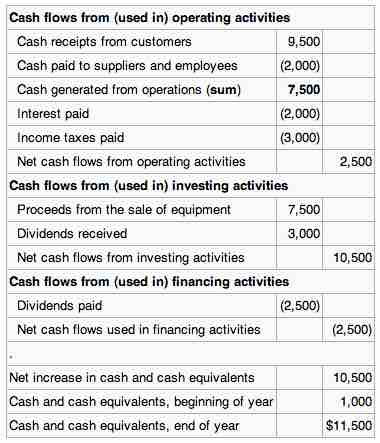

Sample statement of cash flows.

The statement captures both the current operating results and the accompanying changes in the balance sheet. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7), is the International Accounting Standard that deals with cash flow statements.

People and groups interested in cash flow statements include: (1) Accounting personnel who need to know whether the organization will be able to cover payroll and other immediate expenses, (2) potential lenders or creditors who want a clear picture of a company's ability to repay, (3) potential investors who need to judge whether the company is financially sound, (4) potential employees or contractors who need to know whether the company will be able to afford compensation, and (5) shareholders of the business.

The cash flow statement is intended to:

- Provide information on a firm's liquidity and solvency and its ability to change cash flows in future circumstances provide additional information for evaluating changes in assets, liabilities, and equity;

- Improve the comparability of different firms' operating performance by eliminating the effects of different accounting methods; and

- Indicate the amount, timing, and probability of future cash flows.

The cash flow statement has been adopted as a standard financial statement, because it eliminates allocations, which might be derived from different accounting methods, such as various timeframes for depreciating fixed assets.