Bond Retirement

A maturity date is the date when the bond issuer must pay off the bond. Maturity is generally an indication of when you as an investor will get your money back. Typically, bonds stop earning interest after they mature. As long as all due payments have been made, the issuer has no further obligations to the bondholders after the maturity date.

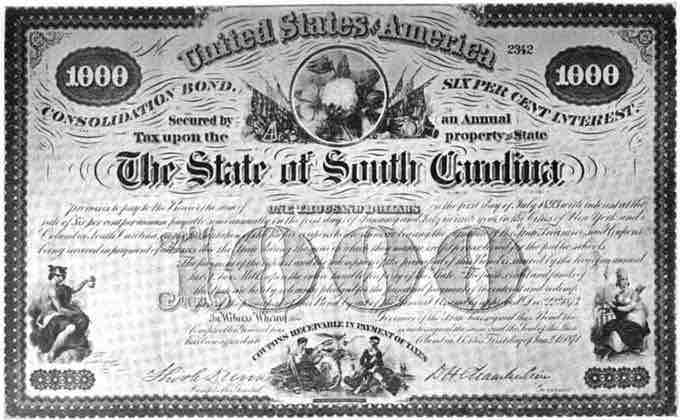

A bond certificate

A bond certificate issued via the South Carolina Consolidation Act of 1873. How the sale of a bond is recorded on a company's books depends on how the debt is initially classified by the acquiring investor. Debt securities can be classified as "held-to-maturity," a "trading security," or "available-for-sale. "

The carrying value of bonds at maturity will always equal their par value. In other words, par value (nominal, principal, par or face amount), the amount on which the issuer pays interest, and which, most commonly, has to be repaid at the end of the term. For a bond sold at discount, its carrying value will increase and equal their par value at maturity. For a bond sold at premium, its carrying value will decrease and equal the par value at maturity.

Some structured bonds can have a redemption amount that is different from the face amount and can be linked to performance of particular assets such as a stock or commodity index, foreign exchange rate or a fund. This can result in an investor receiving less or more than his original investment at maturity.

Bonds can be classified to coupon bonds and zero coupon bonds. For coupon bonds, the bond issuer is supposed to pay both the par value of the bond and the last coupon payment at maturity. In case of a zero coupon bond, only the amount of par value is paid when the bond is redeemed at maturity.

Bonds Payable & The Balance Sheet

Unless the bond matures in a year or less it is shown on the balance sheet in the long-term liabilities section. If current assets will be used to retire the bonds, a Bonds Payable account should be listed in the current liability section. If the bonds are to be retired and new ones issued, they should remain as a long-term liability. All bond discounts and premiums also appear on the balance sheet.

A separate account should be maintained for each bond issue. On the balance sheet, the Bonds Payable account can be shown as different issues or consolidated into a single balance. If a single balance is shown, then a schedule or note should disclose the details of the bond issues.

A description of bonds issued including the effective interest rate, maturity date, terms, and sinking fund requirements are included in the notes to financial statements.

Redeeming at Maturity

The journal entry to record the retirement of a bond:

Debit Bonds payable

Credit Cash

Keep in mind the carrying value - cash paid to retire bonds = gain or loss on bond retirement