Definition of Stock Warrants

A stock warrant is similar to a stock option in that it entitles the holder to buy the underlying stock of the issuing company at a fixed exercise price until the expiration date. Stock warrants, like options, are discretionary and it is not mandatory for the warrant holder to acquire the underlying stock. Warrants are frequently attached to bonds or preferred stock as an added bonus for the buyer. They benefit the warrant issuer by allowing the company to pay lower interest rates or dividends. They can be used to enhance the yield of the bond and make them more attractive to potential buyers. Warrants can also be used in private equity deals .

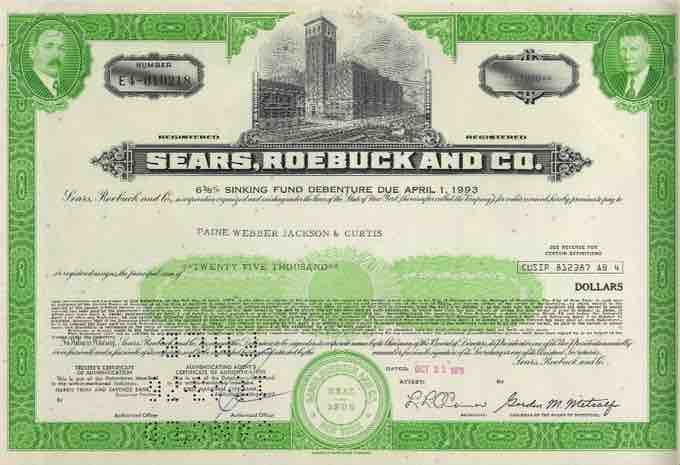

Sears Roebuck & Co. Bond Certificate

Public companies can offer company bonds for sale with stock warrants attached.

Stock Warrant Features

Since warrants are typically attached to other securities, in certain cases it is possible to detach them and sell them independently of the bond or stock. In the case of warrants issued with preferred stocks, stockholders may need to detach and sell the warrant before they can receive dividend payments. Therefore, it is sometimes beneficial to detach and sell a warrant as soon as possible. Stock warrants have several features that can make them more or less attractive investments:

- Premium (the extra amount paid for the shares when exercising the warrant as compared to the market price paid when acquiring the stock through the open market)

- Leverage (risk exposure to the underlying shares acquired through the warrant as compared to the risk exposure of shares purchased in the open market)

- Expiration Date (the date the warrant expires; the longer the time frame involved until expiration the greater the opportunities for stock price appreciation, which increases the price of the stock warrant until its value diminishes to zero on the expiration date)

- Restrictions on Exercise (American-style warrants must be exercised before the expiration date and European-style warrants can only be exercised on the expiration date.

Stock Warrants and Stockholder's Equity

There are many types of stock warrants -- equity, callable, putable, covered, basket, index, wedding, detachable, and naked warrants. No matter the type of warrant, all are reported in the stockholder's equity section of the balance sheet as a line item under contributed capital. They are valued at their exercise price multiplied by the specified number of common shares the warrant provides.