The Debate Around Fiscal Policy

Governments use fiscal policy to influence the level of aggregate demand in the economy, in an effort to achieve economic objectives of:

- Price stability

- Full employment

- Economic growth

Keynesian economics suggests that increasing government spending and decreasing tax rates are the best ways to stimulate aggregate demand, and decreasing spending and increasing taxes after the economic boom begins.

Keynesians argue that this method may be used in times of recession or low economic activity as an essential tool for building the framework for strong economic growth and working towards full employment.

In theory, the resulting deficits would be paid for by an expanded economy during the boom that would follow; this was the reasoning behind the New Deal.

Governments can use a budget surplus to do two things:

- To slow the pace of strong economic growth

- To stabilize prices when inflation is too high

Keynesian theory posits that removing spending from the economy will reduce levels of aggregate demand and contract the economy, thus stabilizing prices.

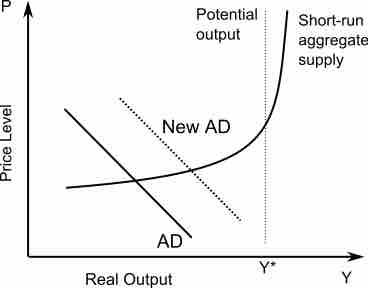

AS + AD graph

The "aggregate supply" and "aggregate demand" curves for the AS-AD model.

Economists debate the effectiveness of fiscal stimulus.

The argument mostly centers on crowding out, a phenomenon where government borrowing leads to higher interest rates that offset the stimulative impact of spending.

When the government runs a budget deficit, funds will need to come from public borrowing (the issue of government bonds), overseas borrowing, or monetizing the debt. When governments fund a deficit with the issuing of government bonds, interest rates can increase across the market, because government borrowing creates higher demand for credit in the financial markets. This causes a lower aggregate demand for goods and services, contrary to the objective of a fiscal stimulus.

Neoclassical economists generally emphasize crowding out, while Keynesians argue that fiscal policy can still be effective especially in a liquidity trap where, they argue, crowding out is minimal, while Austrians argue against almost any government distortion in the market.

Some classical and neoclassical economists argue that crowding out completely negates any fiscal stimulus; this is known as the Treasury View, which Keynesian economics rejects.

The Treasury View refers to the theoretical positions of classical economists in the British Treasury, who opposed Keynes' call in the 1930s for fiscal stimulus. The same general argument has been repeated by some neoclassical economists up to the present.

Austrians say that Fiscal Stimulus, such as investing in roads and bridges, does not create economic growth or recovery, pointing to the case that unemployment rates don't decrease because of fiscal stimulus spending, and that it only puts more debt burden on the economy. Many times, they point to the American Recovery and Reinvestment Act of 2009 as an example.

In the classical view, the expansionary fiscal policy also decreases net exports, which has a mitigating effect on national output and income.

When government borrowing increases interest rates, it attracts foreign capital from foreign investors. This is because, all other things being equal, the bonds issued from a country executing expansionary fiscal policy now offer a higher rate of return.

In other words, companies wanting to finance projects must compete with their government for capital so they offer higher rates of return.

To purchase bonds originating from a certain country, foreign investors must obtain that country's currency. Therefore, when foreign capital flows into the country undergoing fiscal expansion, demand for that country's currency increases.

The increased demand causes that country's currency to appreciate. Once the currency appreciates, goods originating from that country cost more to foreigners than they did before, and foreign goods cost less than they did before. Consequently, exports decrease, and imports increase.

Other possible problems with fiscal stimulus include the time lag between the implementation of the policy and detectable effects in the economy, and inflationary effects driven by increased demand.

In theory, fiscal stimulus does not cause inflation when it uses resources that would have otherwise been idle. For instance, if a fiscal stimulus employs a worker who otherwise would have been unemployed, there is no inflationary effect; however, if the stimulus employs a worker who otherwise would have had a job, the stimulus is increasing labor demand, while labor supply remains fixed, leading to wage inflation and, therefore, price inflation.