Deadweight loss is the decrease in economic efficiency that occurs when a good or service is not priced and produced at its pareto optimal level. When output is at its pareto optimal point, the price, production, and consumption of a good cannot be altered for one person's benefit without making at least one other worse off. In a perfectly competitive market, products are priced at the pareto optimal point.

When deadweight loss occurs, it comes at the expense of either the consumer economic surplus or the producer's economic surplus. Consumer surplus is the gain that consumers receive when they are able to purchase a product for less than the price they are willing to pay; producer surplus is the benefit producers receive when the sell a product for more than they are willing to sell for. While price controls, subsidies and other forms of market intervention might increase consumer or producer surplus, economic theory states that any gain would be outweighed by the losses sustained by the other side. This net harm is what causes deadweight loss.

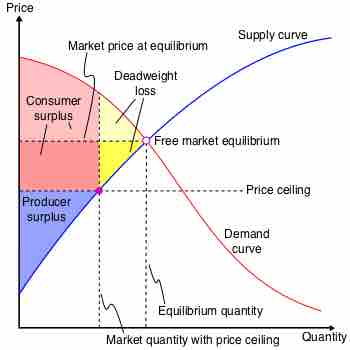

Deadweight loss can be visually represented on supply and demand graphs . Known as Harberger's triangle, the deadweight loss equals the area within the following three points:

Deadweight loss

This chart illustrates the deadweight loss created when a price floor is instituted on the market for a good. The amount of deadweight loss is shown by the triangle highlighted in yellow. This area is known as Harberger's triangle.

- where the supply and demand curve intersect, otherwise known as the free market equilibrium;

- the point on the supply curve where the y-coordinate equals the non-pareto optimal price;

- the point on the demand curve where the y-coordinate equals the non-pareto optimal price.

Example - Price Ceilings and Deadweight Loss

The chart above shows what happens when a market has a binding price ceiling below the free market price. Without the price ceiling, the producer surplus on the chart would be everything to the left of the supply curve and below the horizontal line where y equals the free market equilibrium price. The consumer surplus would equal everything to the left of the demand curve and above the free market equilibrium price line.

With the price ceiling, instead of the producer's surplus going all the way to the pareto optimal price line, it only goes as high as the price ceiling.The consumer surplus extends down to the price ceiling, but it is limited on the right by Harberger's triangle. In this case, the reason for that limitation is due to quantity produced. The consumer would purchaser more of the product at the ceiling price, but the producers are unwilling to supply enough to meet that demand because it is not profitable. As a result all of the goods that might have been produced and consumed if the good was priced optimally are not, representing a net loss for society.