Monetary policy is can be classified as expansionary or restrictive (also called contractionary). Restrictive monetary policy expands the money supply more slowly than usual or even shrinks it, while and expansionary policy increases the money supply. It is intended to slow economic growth and/or inflation in order to avoid the resulting distortions and deterioration of asset values

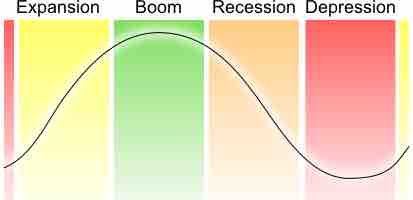

Business cycle

Restrictive monetary policy is used during expansion and boom periods in the business cycle to prevent the overheating of the economy.

Contractionary policy attempts to slow aggregate demand growth. As you may remember, aggregate demand is the sum of private consumption, investment, government spending and imports. Monetary policy focuses on the first two elements. By decreasing the amount of money in the economy, the central bank discourages private consumption. Increasing the money supply also increase the interest rate, which discourages lending and investment. The higher interest rate also promotes saving, which further discourages private consumption. The decrease in consumption and investment leads to a decrease in growth in aggregate demand.

It is important for policymakers to make credible announcements. If private agents (consumers and firms) believe that policymakers are committed to limiting inflation through restrictive monetary policy, the agents will anticipate future prices to be lower than they would be otherwise. The private agents will then adjust their long-term strategies accordingly, such as by putting plans to expand their operations on hold. But if the agents believe that the central bank's actions will soon be reversed, they may not alter their actions and the effect of the contractionary policy will be minimized.

The Basic Mechanics of Expansionary Monetary Policy

A central bank can enact a contractionary monetary policy several ways. The primary means a central bank uses to implement an expansionary monetary policy is through open market operations. The central bank can issue debt in exchange for cash. This results in less cash being in the economy.

Because the banks and institutions that purchased the debt from the central bank have less cash, it is harder for them to make loans to its customers. As a result, the interest rate for loans increase. Businesses then, presumably, have less money to use to expand its operations or even maintain its current levels. This could lead to an increase in unemployment.

The higher interest rates also can slow inflation. Consumption and investment are discouraged, and market actors will choose to save instead of circulating their money in the economy. Effectively, the money supply is smaller, and there is reduced upward pressure on prices since demand for consumption goods and services has dropped.

Other Methods of Enacting Restrictive Monetary Policy

Another way to enact a contractionary monetary policy is to decrease the amount of discount window lending. The discount window allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by internal or external disruptions

A final method of enacting a contractionary monetary policy is by increasing the reserve requirement. All banks are required to have a certain amount of cash on hand to cover withdrawals and other liquidity demands. By increasing the reserve requirement, less money is made available to the economy at large.