Deadweight Loss

In economics, deadweight loss is a loss of economic efficiency that occurs when equilibrium for a good or service is not Pareto optimal. When a good or service is not Pareto optimal, the economic efficiency is not at equilibrium. As a result, when resources are allocated, it is impossible to make any one individual better off without making at least one person worse off. When deadweight loss occurs, there is a loss in economic surplus within the market. Deadweight loss implies that the market is unable to naturally clear.

Causes of Deadweight Loss

Deadweight loss is the result of a market that is unable to naturally clear, and is an indication, therefore, of market inefficiency. The supply and demand of a good or service are not at equilibrium. Causes of deadweight loss include:

- imperfect markets

- externalities

- taxes or subsides

- price ceilings

- price floors

Determining Deadweight Loss

In order to determine the deadweight loss in a market, the equation P=MC is used. The deadweight loss equals the change in price multiplied by the change in quantity demanded. This equation is used to determine the cause of inefficiency within a market.

For example, in a market for nails where the cost of each nail is $0.10, the demand will decrease from a high demand for less expensive nails to zero demand for nails at $1.10. In a perfectly competitive market, producers would charge $0.10 per nail and every consumer whose marginal benefit exceeds the $0.10 would have a nail. However, if one producer has a monopoly on nails they will charge whatever price will bring the largest profit. If they charge $0.60 per nail, every party who has less than $0.60 of marginal benefit will be excluded. When equilibrium is not achieved, parties who would have willingly entered the market are excluded due to the non-market price.

An example of deadweight loss due to taxation involves the price set on wine and beer. If a glass of wine is $3 and a glass of beer is $3, some consumers might prefer to drink wine. If the government decides to place a tax on wine at $3 per glass, consumers might choose to drink the beer instead of the wine. At times, policy makers will place a binding constraint on items when they believe that the benefit from the transfer of surplus outweighs the adverse impact of deadweight loss .

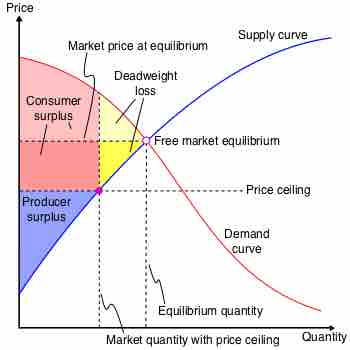

Deadweight loss

This graph shows the deadweight loss that is the result of a binding price ceiling. Policy makers will place a binding price ceiling when they believe that the benefit from the transfer of surplus outweighs the adverse impact of the deadweight loss.