Financial Leverage Models

There are several measures we can use to define and quantify the effect of financial leverage. The first and most famous, the Modigliani–Miller theorem, forms the basis for modern thinking on capital structure. The basic theorem states that in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information - and in an efficient market - the value of a firm is unaffected by how that firm is financed. The Modigliani–Miller theorem is also often called the Capital Structure Irrelevance Principle.

Although the conditions of the theorem are never met in a real market scenario, the theorem is still taught and studied because it tells something very important - capital structure matters precisely because one or more of these assumptions is violated. It tells us where to look in order to determine, and how those factors might affect, the optimal capital structure.

Modigliani-Miller with Taxes

Modigliani-Miller including Taxes

The value of a levered firm equals the value of an unlevered firm plus the tax rate times the value of debt.

In the above equation, VL is the value of a levered firm, VU is the value of an unlevered firm, TC is the corporate tax rate, and D is the value of the company's debt. By relaxing the assumption of no taxes, Modigliani-Miller tells us that there are advantages for firms to be levered, since a company's interest payments are tax-deductible. In other words, as the level of leverage increases by replacing equity with cheap debt, the WACC drops and an optimal capital structure does indeed exist. Further, value may be added by utilizing leverage.

Degree of Financial Leverage

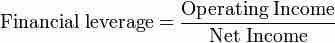

Financial leverage can be measured, or defined, using certain ratios. One of these ratios is that of operating income to net income.

Financial Leverage

Financial leverage is defined as the ratio of operating income to net income.

A more quantitative way of looking at this ratio can be found in the Degree of Financial Leverage (DFL). This measure gives us the percentage change in earnings given a change in operating income.

The higher the Degree of Financial Leverage, the riskier the business. The DFL is calculated in relation to earnings before interest and taxes (EBIT). We discount the amount of preferred dividends payed by the tax deductions brought about by those dividends and subtract the result and the cost of interest on debt from EBIT. We then divide EBIT by the result of this calculation.