Economists Modigliani and Miller put forth a theory that only the firm's ability to earn money and riskiness of its activity can have an impact on the value of the company; the value of a firm is unaffected by how that firm is financed. It does not matter if the firm's capital is raised by issuing stock or selling debt, nor does it matter what the firm's dividend policy is. Dividend irrelevance follows from this capital structure irrelevance.

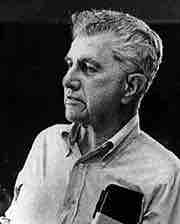

Merton Miller

Merton Miller, one of the co-authors of the capital irrelevance theory which implied dividend irrelevance.

Modigliani-Miller grounded their theory on a set of assumptions:

- No time lag and transaction costs exist.

- Securities can be split into any parts (i.e., they are divisible).

- No taxes and flotation costs.

- Financial leverage does not affect the cost of capital.

- Both managers and investors have access to the same information.

- Firm's cost of equity is not affected in any way by distribution of income between dividend and retained earnings.

- Dividend policy has no impact on firm's capital budget

Under these frictionless perfect capital market assumptions, dividend irrelevance follows from the Modigliani-Miller theorem. Essentially, firms that pay more dividends offer less stock price appreciation that would benefit stock owners who could choose to profit from selling the stock. However, the total return from both dividends and capital gains to stockholders should be the same. If dividends are too small, a stockholder can simply choose to sell some portion of his stock. Therefore, if there are no tax advantages or disadvantages involved with these two options, stockholders would ultimately be indifferent between returns from dividends or returns from capital gains.

Since the publication of the papers by Modigliani and Miller, numerous studies have shown that it does not make any difference to the wealth of shareholders whether a company has a high dividend yield or if a company uses its earnings to reinvest in the company and achieves higher growth. However, the importance of a firm's dividend decision is still contested, with a number of theories arguing for dividend relevance.