Choosing a Policy

Guided by criteria measuring cash flow, liquidity, profitability, and return on capital, the management of a firm will use a combination of policies and techniques for the management of working capital. These policies aim to manage the current assets - generally, cash and cash equivalents, inventories and debtors - and the short term financing, such that cash flows and returns are acceptable. As with any decision involving the management of capital, the firm's goal should be to minimize the overall cost of capital and maximize value to the shareholders . In order to effectively manage cash flow, a firm should identify the cash balance which allows for the business to meet day to day expenses, but reduces cash holding costs - i.e., the opportunity cost of holding cash as opposed to investing it.

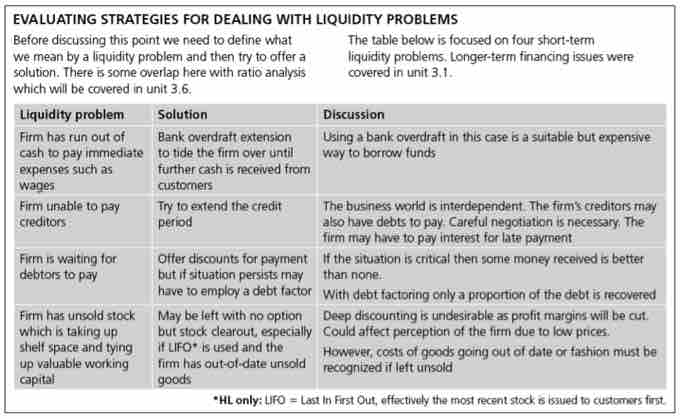

Policies Regarding Liquidity

This chart lays out sample working capital issues and some possible solutions.

A company should also identify the level of inventory which allows for uninterrupted production, but reduces the investment in raw materials – and minimizes reordering costs – and therefore increases cash flow. Another area of concern for a firm will be managing debtors. Management should identify the appropriate credit policy so that any impact on cash flows and the cash conversion cycle will be offset by increased revenue and return on capital. Moreover, management should implement appropriate credit scoring policies and techniques so that the risk of default on any new business is acceptable given these criteria.

A final area management should be concerned with when deciding on a working capital policy is short-term financing. A firm should identify the appropriate source of financing, given the cash conversion cycle. Inventory is ideally financed by credit granted by the supplier. However, it may be necessary to utilize a bank loan.

Refinancing Risk

One of the objectives within working capital management and general financing decisions is to match the maturity of liabilities with the life expectancy of assets. This allows liabilities to be self-liquidating. If the maturity of liabilities is less than the life expectancy of assets, a firm faces refinancing risk since it will have to raise new capital to pay off liabilities. If the maturity of liabilities is longer than the life expectancy of assets, then there should be sufficient working capital available to pay off debts. The mismatching of liabilities with assets can occur if financing is not available.

For example, suppose long-term financing is not available. Short-term sources of financing may have to be used. Mismatching can also be intentional. For example, suppose a company expects long-term interest rates to fall. The firm may want to finance assets with short-term maturities since it can refinance in a few years at much lower rate.