Understanding the Business Needs

Working capital is a financial metric which represents the operating liquidity available to a business. Working capital is considered a part of operating capital along with fixed assets, such as plant and equipment. Sufficient working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term and long-term debt and take care of upcoming operational expenses. However, too much working capital can carry with it a higher cost of capital. A company can be endowed with assets and profitability but short of liquidity if its assets cannot readily be converted into cash. The management of working capital involves managing inventories, accounts receivable and payable, and cash.

Calculation of Working Capital

When calculating working capital, we think in terms of net working capital, which is calculated as current assets minus current liabilities. This is the figure commonly used in valuation techniques such as discounted cash flows. If current assets are less than current liabilities, an entity has a working capital deficiency, also called a working capital deficit. Current assets and current liabilities include three accounts which are of special importance. These accounts represent the areas of the business where managers have the most direct impact:

- Accounts receivable (current asset)

- Inventory (current asset)

- Accounts payable (current liability)

A company ideally wants accounts receivable to be collected as quickly as possible in order to have as much use of the funds as possible. Conversely, a firm strives to put off the settlement of accounts payable as long as possible for the same reason. The current portion of debt is also critical, because it represents a short-term claim to current assets and is often secured by long term assets. Common types of short-term debt are bank loans and lines of credit. Inventory is a special case in which even non-financial managers have a stage. Too much inventory on hand will reduce the risk of a company failing to satisfy customer needs, but it can also reduce profitability. An example of reduced profitability would be in the computer industry, where inventories regularly lose value because of the fast-moving nature of the industry.

Inventory Software

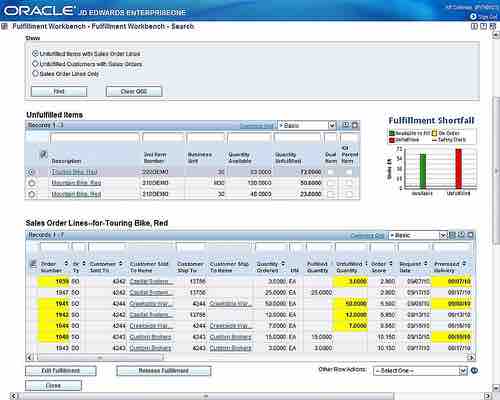

This is an example of modern inventory software that enables managers to precisely track orders and inventory levels.

Profitability and Liquidity Tradeoff

In any company, large or small, there is an inherent tradeoff between liquidity and profitability. Large companies possess resources to help them manage this tradeoff, such as an accounting department, negotiating power with their suppliers, or access to the capital markets. For the entrepreneur, however, who is often resource-starved and doesn't have enough operating history to secure additional credit, managing this tradeoff can feel like walking a tightrope. Consider the case of a new customer for a small company. This new customer has the potential to offer huge growth in the company's sales, but this growth in sales will be accompanied by a subsequent growth in variable costs. The company may not have the resources, i.e., working capital, to meet these variable costs that come with increased sales.