In order to account of complex, interconnected factors, all of which may affect financial outcomes, companies turn to statistical methods. The Monte Carlo method solves a problem by directly simulating the underlying process and then calculating the average result of the process. It simulates the various sources of uncertainty (eg. inflation, default risk, market changes, etc.) that affect the value of the instrument, portfolio, or investment in question, and calculates a representative value given these possible values of the underlying inputs. In essence, the Monte Carlo method is designed to find out what happens to the outcome on average when there are changes in the inputs.

Each potential factor is assigned a probability or statistical distribution. For example, the investor may estimate the probability of default on a bond as 20%. That means that 20% of the time, he will not earn back his principal. The investor may also estimate that the inflation rate is normally distributed around a mean of 3% and standard deviation of 0.5%.

The investor estimates the probability or distribution of every factor that could change the result of the investment. Then, he essentially uses the distributions to run many many simulations of all the inputs to see how they affect the output and then finds the average output .

Monte Carlo Simulation

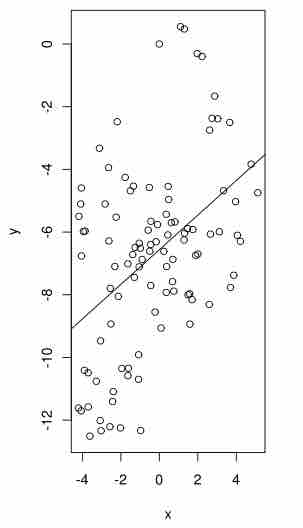

By running many simulations based on the probability or distribution of an input (x), the analyst can see the average output (y). This is done for multiple inputs at once to find out how they affect the output.

For example, for bonds and bond options, under each possible evolution of interest rates the investor observes a different yield curve and a different resultant bond price. To determine the bond value, these bond prices are then averaged. To value the bond option, as for equity options, the corresponding exercise values are averaged and present valued. By determining the average, the investor can figure out what the expected value is.

The advantage of the Monte Carlo method is that it is able to handle multiple moving, and possible related, inputs. As the number of factors increases, it becomes harder to figure out the "base case. " Statistical analysis through Monte Carlo simulations is great at handling problems with multiple, inter-related, and uncertain factors.