Inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money–a loss of real value in the internal medium of exchange and unit of account in the economy.

Inflation's effects on an economy are various and can be simultaneously positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money; uncertainty over future inflation which may discourage investment and savings; and if inflation is rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future. Therefore, high inflation encourages companies to keep a high level of inventories.

Inflation

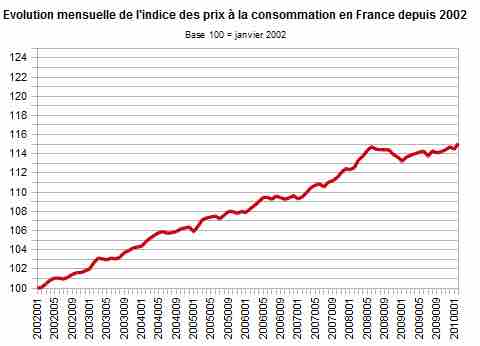

Inflation in France in 2002

The Nobel laureate Robert Mundell noted that moderate inflation would induce savers to substitute lending for some money holding as a means to finance future spending. That substitution would cause market clearing real interest rates to fall. Nobel laureate James Tobin noted that moderate inflation would cause businesses to substitute investment in physical capital (plant, equipment, and inventories) for money balances in their asset portfolios. That substitution would mean choosing the making of investments with lower rates of real return. (The rates of return are lower, because the investments with higher rates of return were already being made before. ) To put it in a word, companies purchase more inventories in case of high inflation. The two related effects are known as the Mundell-Tobin effect. Unless the economy is already over-investing according to models of economic growth theory, that extra investment resulting from the effect would be seen as positive.