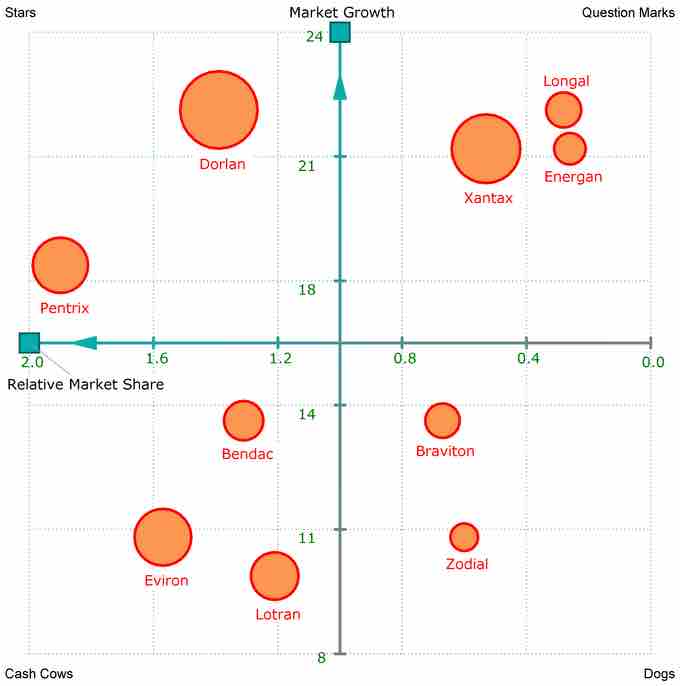

BCG Matrix

The BCG Matrix was created in 1970 by Bruce Henderson and the Boston Consulting Group. The purpose of the BCG Matrix is to determine investment priorities for a company with a portfolio of products/BUs. A scatter graph is used to show how a product/BU ranks according to market share and growth rates.

BCG Matrix

This is the BCG Matrix.

Four Outcomes

According to the BCG Matrix, there are four different possible states for a product/BU:

- Cash Cow

- Dog

- Question Mark

- Star

A cash cow is a product/BU that has high market share and is in a slow growing industry. It is bringing in way more money than is being invested in it and the main idea is to ride it out as long as possible. A company shouldn't invest any more money in a cash cow because the industry cycle is at its end, but it is still a viable product/BU while the profits last.

A dog has a low market share in a mature industry. There is no room for growth so no more funds should be invested in the product or product/BU. If it is a BU, then the consensus is to sell it off.

A question mark is a product/BU growing rapidly in a growing industry. It is consuming vast amounts of financing at this point and creating a low rate of return. A question mark does have the potential to become a star, however, so it should be monitored to determine its growth potential.

A star has a high market share in a high growing industry. This is a product line or BU a company should focus its efforts on in the hopes that it will become a cash cow before the end of its life cycle. According to the principles behind the BCG Matrix, as an industry grows, all business units become cows or dogs. Usually a BU will go from being a question mark, to a star, then a cow, and finally a dog.

Other Uses for the BCG Matrix

Other possible uses for the BCG Matrix are determining relative market share and the market growth rate of a product line. The BCG Matrix can help determine where a product is in its product life cycle and if there is a possibility of growth for the market or product.