Managing cash is about monitoring how it comes in and goes out . To meet this goal, a business must come up with a system that not only documents all of these transactions, but organizes those documents in such a way so that any issues are immediately noticed by management.

A current liability, such as a credit purchase, can be documented with an invoice.

Current liabilities are debt owed and payable no later than the current accounting period.

Voucher System

A voucher system is used primarily for monitoring and documenting payments made by a company to a third party. A voucher is composed of five parts.

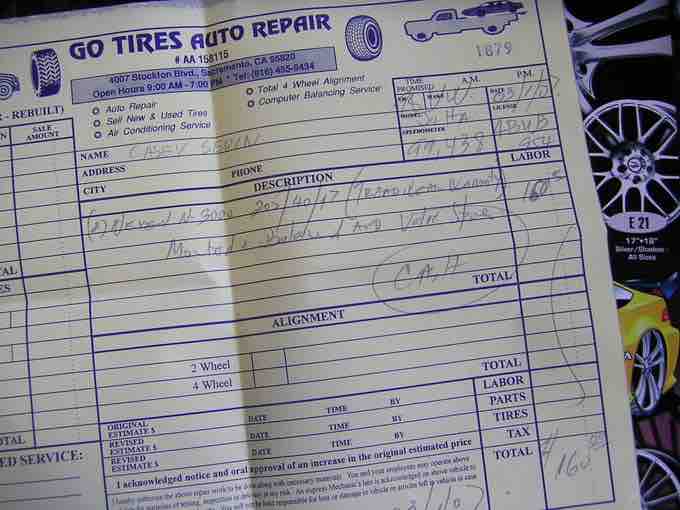

- Individual vouchers: A voucher is a document that proves a payment was authorized and eventually made. Each voucher should be assigned a number to identify it. A voucher should be prepared for every transaction.

- Voucher register: Is a book or spreadsheet that lists every voucher.

- Unpaid voucher file: Where all vouchers that have been authorized, but not yet been paid are kept.

- Paid voucher file: Where all paid vouchers are kept. The paid vouchers should be filed in numerical order.

- Check register: A book or spreadsheet that records when all vouchers were paid and how it was paid. If the voucher was paid using a check, the check register will pair the voucher identification numbers with the check identification numbers.

When an obligation is about to be settled, the person in charge of the vouchers should review the other documents associated with the transaction prior to transferring the related voucher from the unpaid to paid file. The related documents generally include purchase orders, receiving reports, and invoices. These documents demonstrate that the payment was authorized, all goods and services that the business was supposed to get were received, and that the amount paid equaled the amount due.

Bank Reconciliations

Bank reconciliations, or the process of checking to make sure that a business's financial records on cash equals how much is in the business's bank accounts, are especially useful as a control over deposits. This type of control will be discussed in a later section.