Bonds derive their value primarily from two promises made by the borrower to the lender or bondholder. The borrower promises to pay (1) the face value or principal amount of the bond on a specific maturity date in the future, and (2) periodic interest at a specified rate on face value at stated dates, usually semiannually, until the maturity date .

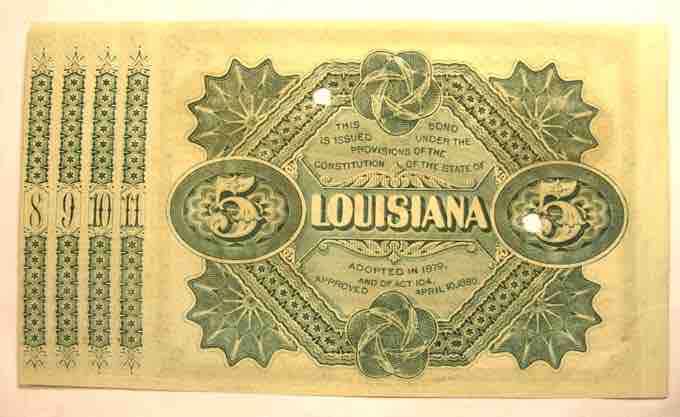

Old Lousianna State Bond

Louisiana "baby bond", 1874 series, payable 1886

Example of bonds issued at face value on an interest date:-

Valley Company's accounting year ends on December 31. On 2010 December 31, Valley issued 10-year, 12% yield bonds with a USD 100,000 face value, for USD 100,000. The bonds are dated 2010 December 31, call for semiannual interest payments on June 30 and December 31, and mature on 2020 December 31. Valley made the required interest and principal payments when due. The entries for the 10 years are as follows:

On 2010 December 31, the date of issuance, the entry is:

2010 Dec. 31 Cash (+A) 100,000

Bonds payable (+L) 100,000

To record bonds issued at face value.

On each June 30 and December 31 for 10 years, beginning 2010 June 30 (ending 2020 June 30), the entry would be: Each year June 30 And Dec.31

Bond Interest Expense ($100,000 x 0.12 x½) (-SE) 6,000

Cash (-A) 6,000

To record periodic interest payment. On 2020 December 31, the maturity date, the entry would be:

2020 Dec. 31

Bond interest expense (-SE) 6,000

Bonds payable (-L) 100,000

Cash (-A) 106,000

To record final interest and bond redemption payment.

Note that Valley does not need adjusting entries because the interest payment date falls on the last day of the accounting period. The income statement for each of the 10 years (2010-2018) would show Bond Interest Expense of USD 12,000 (USD 6,000 X 2); the balance sheet at the end of each of the years (2010-2018) would report bonds payable of USD 100,000 in long-term liabilities. At the end of 2019, Valley would reclassify the bonds as a current liability because they will be paid within the next year.

The real world is more complicated. For example, assume the Valley bonds were dated 2010 October 31, issued on that same date, and pay interest each April 30 and October 31. Valley must make an adjusting entry on December 31 to accrue interest for November and December. That entry would be:

2010 Dec. 31

Bond interest expense ($100,000 x 0.12 x 2/12) (-SE) 2,000

Bond interest payable (+L) 2,000

To accrue two month's interest expense.

The 2011 April 30, entry would be: 2011 Apr. 30

Bond interest expense ($100,000 x 0.12 x(4/12)) (-SE) 4,000

Bond interest payable (-L) 2,000

Cash (-A) 6,000

To record semiannual interest payment.

The 2011 October 31, entry would be:

2011 Oct. 31

Bond interest expense (-SE) 6,000

Cash (-A) 6,000

To record semiannual interest payment.

Each year Valley would make similar entries for the semiannual payments and the year-end accrued interest. The firm would report the USD 2,000 Bond Interest Payable as a current liability on the December 31 balance sheet for each year.