Long Term Loans

Long term loans are generally over a year in duration and sometimes much longer. Three common examples of long term loans are government debt, mortgages, and bonds or debentures .

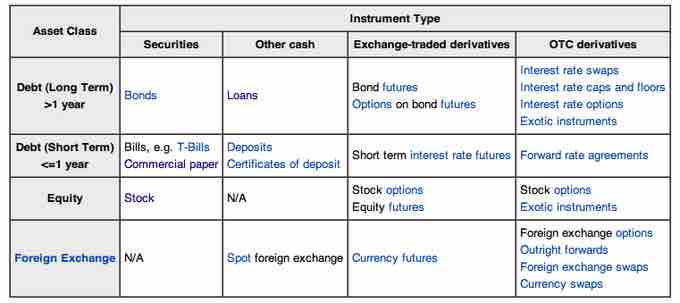

Different Financial Instruments

Long term loans are generally over a year in duration and sometimes much longer.

Government Debt

Government debt (also known as public debt or national debt) is the debt owed by a central government. Government debt is one of numerous methods of financing government operations.

Governments may create money to monetize their debts, thereby removing the need to pay interest. This practice, also known as quantitative easing, reduces government interest costs but does not actually cancel government debt. Governments usually borrow by issuing securities, government bonds, and bills. Less creditworthy countries sometimes borrow directly from a supranational organization (e.g., the World Bank) or international financial institutions.

Government bonds are issued by a national government. Such bonds are often denominated in the country's domestic currency, and they are sometimes regarded as risk-free bonds, as national governments can raise taxes or reduce spending up to a certain point. In many cases, governments print more money in order to redeem the bond at maturity. Most governments in developed countries are prohibited by law from printing money directly, as this function is generally assigned to their central banks. However, central banks may buy government bonds in order to finance government spending, thereby monetizing the debt.

Mortgage Loan

A mortgage is a loan secured by real property. It requires a mortgage note affirming the existence of the loan and the encumbrance of the realty through the granting of a mortgage securing the loan. In U.S. property law, a mortgage occurs when an owner (usually of a fee simple interest in realty) pledges his or her interest (right to the property) as security or collateral for a loan.

A home buyer or builder can obtain a loan to purchase or secure against the property from a financial institution, such as a bank, or either directly or indirectly through intermediaries. Features of mortgage loans such as the size of the loan, maturity of the loan, interest rate, method of paying off the loan, and other characteristics can vary considerably.

Mortgage loans are generally structured as long term loans, the periodic payments for which are similar to an annuity and calculated according to the time value of money formulae. The most basic arrangement requires a fixed monthly payment over a period of ten to thirty years, depending on local conditions. Over this period, the principal component of the loan (the original loan) is slowly paid down through amortization. However, many variants on this arrangement are possible within different countries.

Many types of mortgages are used worldwide, though several characteristics, subject to local regulations and legal requirements, define most mortgages:

- Interest: Interest may be fixed for the life of the loan or variable, and it may change at certain pre-defined periods; the interest rate may rise or fall.

- Term: Mortgage loans generally have a maximum term, or a number of years after which an amortizing loan will be repaid. Some mortgage loans may have no amortization or require full repayment of any remaining balance at a certain date; others may have negative amortization.

- Payment amount and frequency: The amount paid per period and the frequency of payments may change, or the borrower may have the option to increase or decrease the amount paid.

- Prepayment: Some types of mortgages may limit or restrict prepayment of all or a portion of the loan, or they may require payment of a penalty to the lender for prepayment.

Debenture

A debenture is a document that either creates or acknowledges a debt, and the debt is one without collateral. In corporate finance, debenture refers to a medium- to long-term debt instrument used by large companies to borrow money. In some countries, the term is used interchangeably with bond, loan stock, or note. A debenture thus resembles a certificate of loan or a loan bond, evidencing the fact that the company is liable to pay a specified amount with interest. Although the money raised by the debenture becomes part of the company's capital structure, it does not become share capital.

In general, debentures are freely transferable by the debenture holder. Debenture holders have no right to vote in the company's general meetings of shareholders, but they may hold separate meetings or votes (regarding, for instance, changes to the rights attached to the debentures). The interest paid to debenture holders is a charge against profit in the company's financial statements.

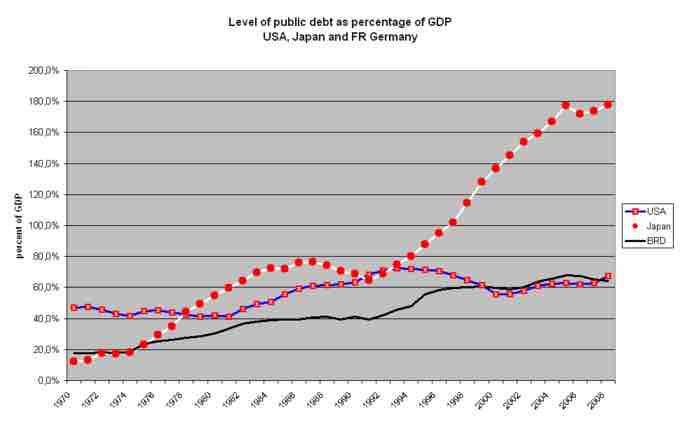

Level of Public Debt as a Percentage of GDP

U.S., Japan, and Germany