Since the election of Ronald Reagan as president in 1980, the United States had championed globalization of trade and finance. It opened its doors wider to foreign products and investment than any other major economy. "" America's entrepreneurial culture was the world's model. The synergy of U.S. political freedoms and free markets appeared vindicated by the Soviet Union's collapse in 1991. At home, a bipartisan consensus emerged in favor of further economic deregulation, which, in turn, spurred a freewheeling expansion of new types of investments that helped fuel a vast increase in international finance and commerce. But America's growth came to rely increasingly on debt. Consumers, businesses, home buyers, and the U.S. government itself borrowed heavily in the belief that the value of their investments—including, fatefully for many, their homes—would continue to grow. The ready availability of credit on easy terms drove home prices, in particular, ever higher.

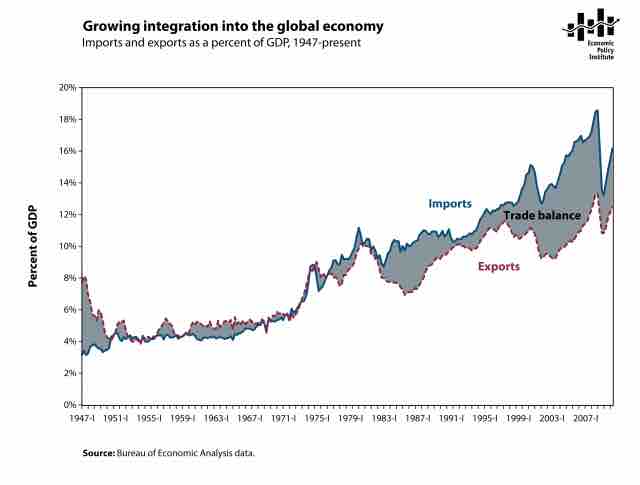

US Integration into the global economy

Imports and exports as a % of GDP, 1947-present

The financial crash of 2008 brought a sudden, traumatic halt to a quarter-century of U.S.-led global economic growth. When the housing boom finally collapsed in 2007, it exposed a fragile layer of high-risk home loans made over a decade to families that could not afford them, particularly if the economy weakened. Some borrowers had purchased homes they could not afford, trusting that in a rising market they could always sell their properties at a profit. As housing prices fell, homeowners who no longer could keep up with their mortgage payments were unable to pay their debt by selling their homes. These home loans thus were the unstable foundation for a massive but largely invisible speculation on mortgage securities and financial contracts sold around the world. Triggered by the housing collapse, this edifice toppled in 2008. Foreclosures grew, and panic followed. Giant Wall Street financial firms fell, reorganized, or were combined with larger competitors. Stock markets plunged, and the world's economies headed into the worst crisis since the Great Depression of the 1930s.

However, large corporations and wealthy businesspeople were minimally affected by the recession, and were the first to recover. Shortly after the economic recovery began, many Fortune 500 corporations reported record profits and many billionaires saw their net worths hit new highs. The 2011 edition of the annual U.S. dollar billionaires ranking compiled by Forbes Magazine broke new records, both in terms of the number of billionaires (1,210) and their total wealth (US $4.5 trillion. )

On the other hand, wages and incomes of typical Americans are lower today than in over a decade. This "lost decade" of no wage and income growth began well before the Great Recession battered wages and incomes. In the historically weak expansion following the 2001 recession, hourly wages and compensation failed to grow for either high school or college-educated workers and, consequently, the median income of working-age families had not regained pre-2001 levels by the time the Great Recession hit in December 2007.

Incomes failed to grow over the 2000–2007 business cycle despite substantial productivity growth during that period. Although economic indicators are stronger today than they were two or three years ago, protracted high unemployment in the wake of the Great Recession has left millions of Americans with lower incomes and in economic distress.

Consensus forecasts predict that unemployment will remain high for many more years, suggesting that typical Americans are in for another lost decade of living standards growth as measured by key benchmarks such as median wages and incomes. For example, as a result of persistent high unemployment, some expect the incomes of families in the middle fifth of the income distribution in 2018 will still be below their 2007 and 2000 levels.