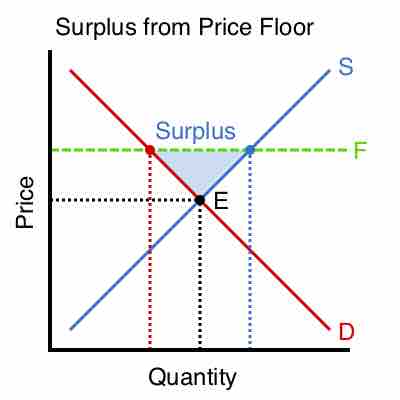

A price floor will only impact the market if it is greater than the free-market equilibrium price. If the floor is greater than the economic price, the immediate result will be a supply surplus. As you can see from , a higher base price will lead to a higher quantity supplied. However, quantity demand will decrease because fewer people will be willing to pay the higher price. This will lead to a surplus of supply.

Surplus from a price floor

If a price floor is set above the free-market equilibrium price (as shown where the supply and demand curves intersect), the result will be a surplus of the good in the market.

A price floor will also lead to a more inefficient market and a decreased total economic surplus. Economic surplus, or total welfare, is the sum of consumer and producer surplus. Consumer surplus is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest that they are willing pay. Producer surplus is the amount that producers benefit by selling at a market price that is higher than the least they would be willing to sell for. An effective price floor will raise the price of a good, which means that the the consumer surplus will decrease. While the effective price floor will also increase the price for producers, any benefit gained from that will be minimized by decreased sales caused by decreased demand from consumers due to the increase in price. This translates into a net decrease total economic surplus, otherwise known as deadweight loss.

Since well designed price floors create surpluses, the big issue is what to do with the excess supply. The first option is to let inventories grow and have the private producers bear the cost of storing it. The other option is for the government that set the price floor to purchase the excess supply and store it on its own. The government could then sell the surplus off at a loss in times of a food shortage.