Interest Rate Overview

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender in the market. The interest rates are influenced by macroeconomic factors. In economics, a Taylor rule is a monetary-policy rule that stipulates how much the Central Bank should change the nominal interest rate in response to changes in inflation, output, or other economic conditions. In particular, the rule stipulates that for each 1% increase in inflation, the Central Bank should raise the nominal interest rate by more than one percentage point.

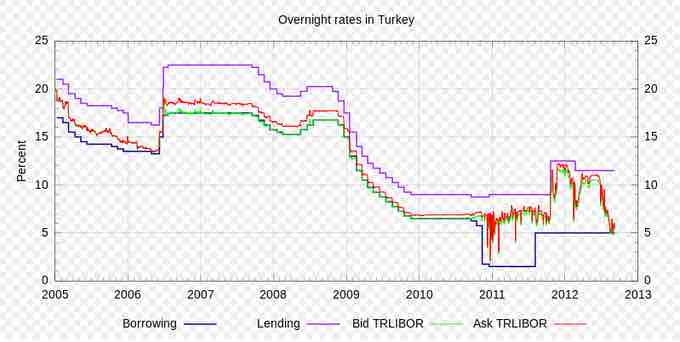

Interest Rates in Turkey

Overnight rates in Turkey are estimated to fall in 2013, indicating a loosened monetary policy.

Taylor Rule

According to Taylor's original version of the rule, the nominal interest rate should respond to divergences of actual inflation rates from target inflation rates and of actual Gross Domestic Product (GDP) from potential GDP:

it = πt + r*t + απ(πt - π*t) + αy(yt - y*t)

In this equation, it is the target short-term nominal interest rate (e.g., the federal fund rates in the United States), πt is the rate of inflation as measured by the GDP deflator, π*t is the desired rate of inflation, r*t is the assumed equilibrium real interest rate, yt is the logarithm of real GDP, and y*t is the logarithm of potential output, as determined by a linear trend.

In other words, (πt - π*t)is inflation expectations that influence interest rates. Most economies generally exhibit inflation, meaning a given amount of money buys fewer goods in the future than it will now. The borrower needs to compensate the lender for this. If the inflationary expectation goes up, then so does the market interest rate and vice versa.

Output Gap

The GDP gap or the output gap is (yt - y*t). If this calculation yields a positive number, it is called an "inflationary gap" and indicates the growth of aggregate demand is outpacing the growth of aggregate supply (or high level of employment), possibly creating inflation, signaling an increase in interest rates made by the Central Bank; if the calculation yields a negative number it is called a "recessionary gap," which is accompanied by a low employment rate, possibly signifying deflation and a reduction in interest rates.

In this equation, both απ and αy should be positive (as a rough rule of thumb, Taylor's 1993 paper proposed setting απ =αy = 0.5). That is, the rule "recommends" a relatively high interest rate (a "tight" monetary policy) when inflation is above its target or when output is above its full-employment level, in order to reduce inflationary pressure. It recommends a relatively low interest rate ("easy" monetary policy) in the opposite situation to stimulate output.

Taylor explained the rule in simple terms using three variables: inflation rate, GDP growth, and the equilibrium real interest rate.