Reinvestment risk is one of the main genres of financial risk. The term describes the risk that a particular investment might be canceled or stopped somehow, and that one may have to find a new place to invest their money with the risk being there might not be a similarly attractive investment available. This primarily occurs if bonds (which are portions of loans to entities) are paid back earlier than expected.

The risk resulting from the fact that interest or dividends earned from an investment may not be able to be reinvested in such a way that they earn the same rate of return as the invested funds that generated them. Reinvestment risk is more likely when interest rates are declining. For example, falling interest rates may prevent bond coupon payments from earning the same rate of return as the original bond. Pension funds are also subject to reinvestment risk. Especially with the short-term nature of cash investments, there is always the risk that future proceeds will have to be reinvested at a lower interest rate.

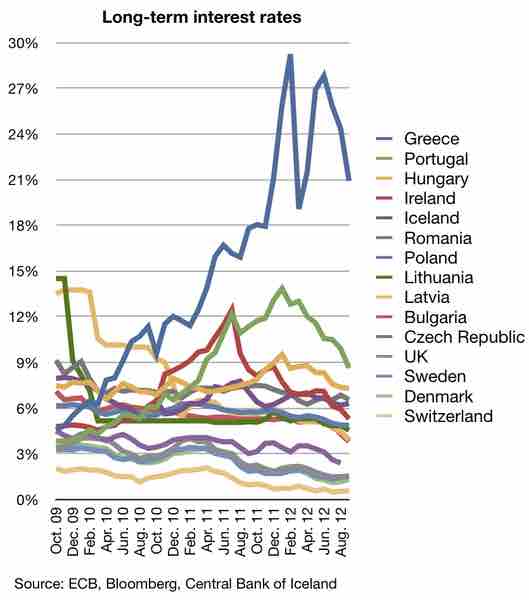

Interest rates

Reinvestment risk is more likely when interest rates are declining.

Reinvestment risk affects the yield-to-maturity of a bond, which is calculated on the premise that all future coupon payments will be reinvested at the interest rate in effect when the bond was first purchased.

Two factors that have a bearing on the degree of reinvestment risk are:

Maturity of the bond - The longer the maturity of the bond, the higher the likelihood that interest rates will be lower than they were at the time of the bond purchase.

Interest rate on the bond - The higher the interest rate, the bigger the coupon payments that have to be reinvested, and, consequently, the reinvestment risk. Zero coupon bonds are the only fixed-income instruments to have no reinvestment risk, since they have no interim coupon payments.