Section 3

Key Characteristics of Bonds

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

6 concepts

Par Value

Par value is the amount of money a holder will get back once a bond matures; a bond can be sold at par, at premium, or discount.

Coupon Interest Rate

The coupon rate is the amount of interest that the bondholder will receive per payment, expressed as a percentage of the par value.

Maturity Date

Maturity date refers to the final payment date of a loan or other financial instrument.

Call Provisions

A callable bond allows the issuer to redeem the bond before the maturity date; this is likely to happen when interest rates go down.

Sinking Funds

A sinking fund is a method by which an organization sets aside money to retire debts.

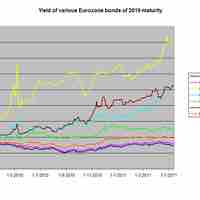

Other Features

Other important features of bonds include the yield, market price and putability of a bond.