Leverage, in general, can defined as any technique that is used to multiply gains and losses. By this definition the use of leverage creates risk, and thus will always necessitate a tradeoff between risk and return. As in any situation of this sort, added risk can produce benefits for a firm, but it can also lead to detrimental consequences.

When considering the benefits of operating leverage, it is appropriate to consider the contribution margin, or the excess of sales over variable costs. When variable costs are lower, the contribution of sales to profits will be greater. In other words, a company with higher operating leverage has the potential to generate much larger profits than a company with lower operating leverage. For example, the variable costs for a software company, such as packaging and the cost of various media devices (like CDs), are very low compared to its fixed costs, such as research and development. Therefore, once a certain break-even point is reached, the contribution that sales make to profits is much higher than it would be if a greater portion of the costs were variable.

Problems can arise if a company has very high fixed costs, and if a company has difficulty selling enough units to break even on a particular investment. This is referred to as "business risk," since it arises from the inherent risk of doing business. In other words, the uncertainty of generating a necessary amount of sales is a dilemma all businesses face. Just as the use of operating leverage can lead to greater profits, if a company is able to reach a given, break-even point, so too can the use of leverage drastically multiply losses if that point is not reached.

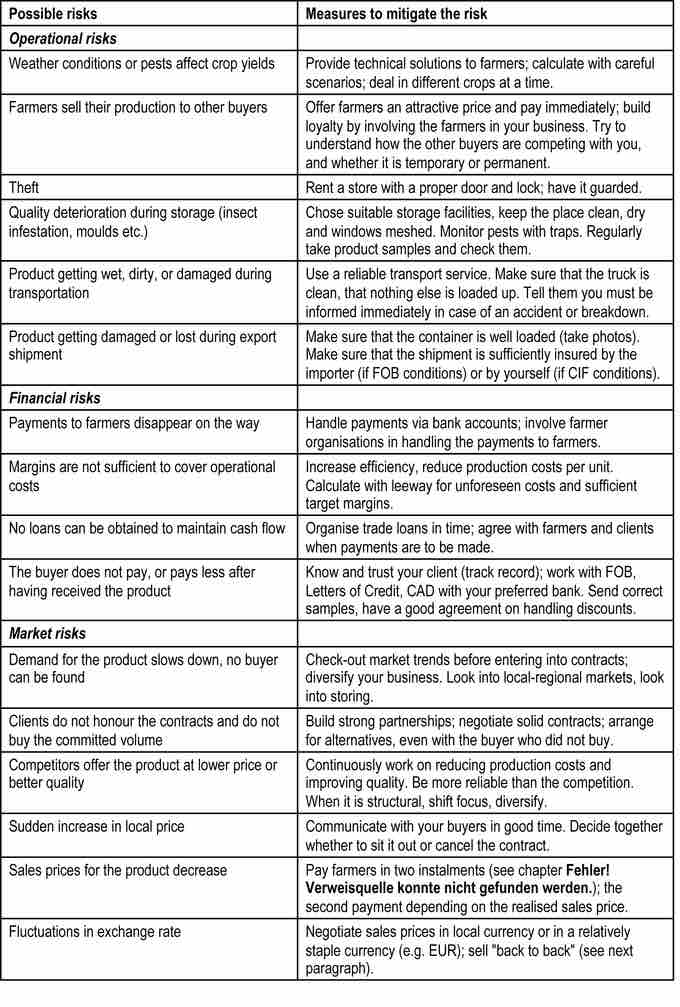

Possible Business Risks

This chart represents a list of the possible risks involved in running an organic business. Risks such as these affect sales, which in turn affect the amount of operating leverage a company should utilize.