Debt to Equity

The debt-to-equity ratio (D/E) is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets. Closely related to leveraging, the ratio is also known as risk, gearing or leverage. The two components are often taken from the firm's balance sheet or statement of financial position. However, the ratio may also be calculated using market values for both if the company's debt and equity are publicly traded, or using a combination of book value for debt and market value for equity financially. ""

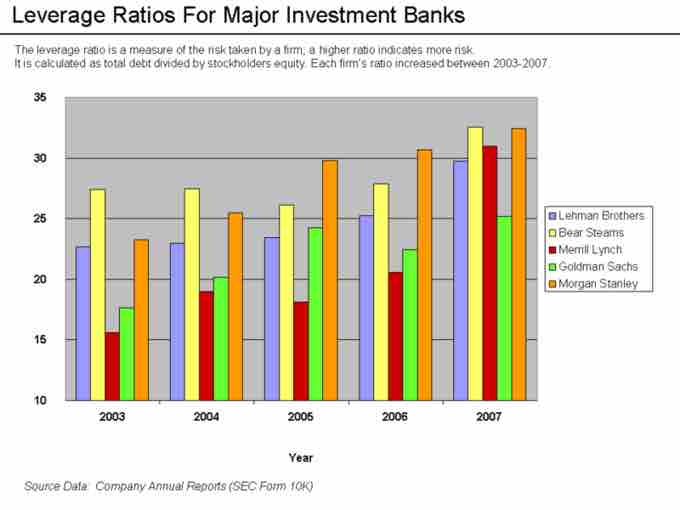

Leverage Ratios of Investment Banks

Each of the five largest investment banks took on greater risk leading up to the subprime crisis. This is summarized by their leverage ratio, which is the ratio of total debt to total equity. A higher ratio indicates more risk.

Preferred stocks can be considered part of debt or equity. Attributing preferred shares to one or the other is partially a subjective decision, but will also take into account the specific features of the preferred shares. When used to calculate a company's financial leverage, the debt usually includes only the long term debt (LTD). Quoted ratios can even exclude the current portion of the LTD.

Financial analysts and stock market quotes will generally not include other types of liabilities, such as accounts payable, although some will make adjustments to include or exclude certain items from the formal financial statements. Adjustments are sometimes also made, for example, to exclude intangible assets, and this will affect the formal equity; debt to equity (dequity) will therefore also be affected.

The formula of debt/equity ratio: D/E = Debt (liabilities) / equity. Sometimes only interest-bearing long-term debt is used instead of total liabilities in the calculation.

A similar ratio is the ratio of debt-to-capital (D/C), where capital is the sum of debt and equity:D/C = total liabilities / total capital = debt / (debt + equity)

The relationship between D/E and D/C is: D/C = D/(D+E) = D/E / (1 + D/E)

The debt-to-total assets (D/A) is defined asD/A = total liabilities / total assets = debt / (debt + equity + non-financial liabilities)

On a balance sheet, the formal definition is that debt (liabilities) plus equity equals assets, or any equivalent reformulation. Both the formulas below are therefore identical: A = D + EE = A – D or D = A – E

Debt to equity can also be reformulated in terms of assets or debt: D/E = D /(A – D) = (A – E) / E