Overview Of Convertible Securities

Convertible securities can be bonds or preferred stocks that pay regular interest and can be converted into shares of common stock (sometimes conditioned on the stock price appreciating to a predetermined level).

A convertible bond (CB) is a type of bond that can be converted into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price. It is a hybrid security with debt and equity-like features. Although a CB typically has a coupon rate lower than that of similar, non-convertible debt, the instrument carries additional value through the option to convert the bond to stock, and thereby participate in further growth in the company's equity value. The investor receives the potential upside of conversion into equity while protecting the downside with cash flow from coupon payments and the return of principal upon maturity. Convertible bonds are usually issued offering a higher yield than obtainable on the shares into which the bonds convert. Convertible bond markets in the United States and Japan are of primary global importance because they are the largest in terms of market capitalization.

Convertible bonds have all the features of typical bonds, plus the following additional features:

- Conversion price: The nominal price per share at which conversion takes place.

- Conversion ratio: The number of shares each convertible bond converts into.

- Parity (Conversion) value: Equity price × Conversion ratio.

- Conversion premium: Represent the divergence of the market value of the CB compared to that of the parity value.

- Call features: The ability of the issuer (on some bonds) to call a bond early for redemption.

- Put features: The ability of the holder of the bond (the lender) to force the issuer (the borrower) to repay the loan at a date earlier than the maturity.

Convertible preferred stocks are securities that contain a provision by which the holder may convert the preferred into the common stock of the company (or, sometimes, into the common stock of an affiliated company) under certain conditions - among which may be the specification of a future date when conversion may begin, a certain number of common shares per preferred share or a certain price per share for the common stock.

Convertible Arbitrage

Convertible arbitrage is a market-neutral investment strategy often employed by hedge funds. It involves the simultaneous purchase of convertible securities and the short sale of the same issuer's common stock. The premise of this strategy is that the convertible is sometimes priced inefficiently relative to the underlying stock, for reasons that range from illiquidity to market psychology. In particular, the equity option embedded in the convertible bond may be a source of cheap volatility, which convertible arbitrageurs can then exploit. Under normal market conditions, the arbitrageur expects the combined position to be insensitive to small fluctuations in the price of the underlying stock.

Arbitrage

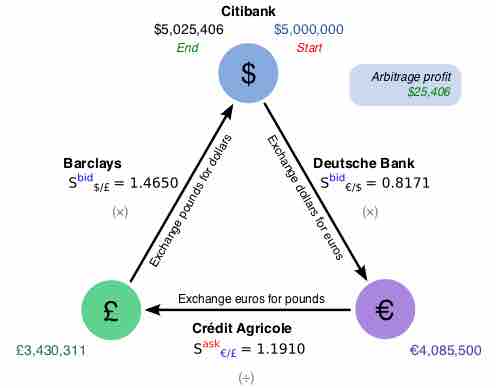

Arbitrage is the simultaneous purchase and sale of an asset in order to profit from a difference in the price. This diagram illustrates an arbitrage opportunity in foreign currency exchange.

Advantages and Disadvantages Of Convertibles

From the issuer's perspective, the key benefit of raising money by selling convertible bonds is a reduced cash interest payment. The advantage for companies of issuing CBs is that, if the bonds are converted to stocks, the company's debt vanishes. Additional advantages for issuers include:

- Lower fixed-rate borrowing costs.

- Locking into low fixed-rate long-term borrowing.

- Deferral of voting dilution.

- Increasing the total level of debt gearing.

- Tax advantages: a high tax-paying shareholder can benefit from the company securitizing gross future income on a convertible income that it can offset against taxable profits.

Convertible bonds are safer for the investor than preferred or common shares; they provide asset protection, because the value of the convertible bond will only fall to the value of the bond floor. At the same time, CBs can provide the possibility of high equity-like returns. Also, CBs are usually less volatile than regular shares.

A primary disadvantage of convertible bonds is their liquidity risk. In theory, when a stock declines, the associated convertible bond will decline less, because it is protected by its value as a fixed-income instrument. However, CBs can decline in value more than stocks due to their liquidity risk. Moreover, in exchange for the benefit of reduced interest payments, the value of shareholder's equity is reduced due to the stock dilution expected when bondholders convert their bonds into new shares. Convertible securities also bring with them the risk of diluting control of the company and forced conversion, which occurs when the price of the stock is higher than the amount it would be if the bond were redeemed. This feature caps the capital appreciation potential of a convertible bond.