Tax Avoidance

Tax avoidance is the legal utilization of the tax regime to one's own advantage, to reduce the amount of tax that is payable by means that are within the law. The term tax mitigation's original use was by tax advisors as an alternative to the pejorative term tax avoidance. The term has also been used in the tax regulations of some jurisdictions to distinguish tax avoidance foreseen by the legislators from tax avoidance which exploits loopholes in the law. The United States Supreme Court has stated that "The legal right of an individual to decrease the amount of what would otherwise be his taxes or altogether avoid them, by means which the law permits, cannot be doubted. "

Tax Evasion

Tax evasion is the general term for efforts by individuals, corporations, trusts and other entities to evade taxes by illegal means. Both tax avoidance and evasion can be viewed as forms of tax noncompliance, as they describe a range of activities that are unfavorable to a state's tax system. Tax evasion is an activity commonly associated with the underground economy, and one measure of the extent of tax evasion is the amount of unreported income, namely the difference between the amount of income that should legally be reported to the tax authorities and the actual amount reported, which is also sometimes referred to as the "tax gap. "

Taxes are imposed in the United States at each of these levels. These include taxes on income, payroll, property, sales, imports, estates, and gifts, as well as various fees. In 2010, taxes collected by federal, state and municipal governments amounted to 24.8% of GDP . Under the federal law of the United States of America, tax evasion or tax fraud is the purposeful illegal attempt of a taxpayer to evade payment of a tax imposed by the federal government. Conviction of tax evasion may result in fines and imprisonment.

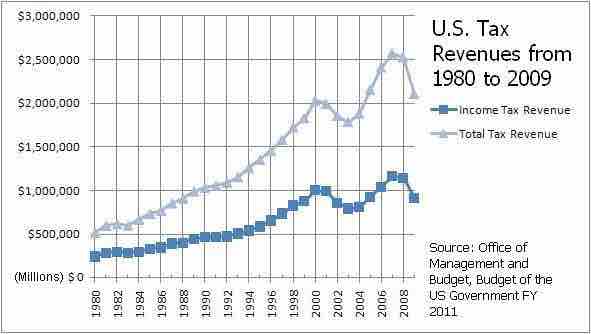

U.S. Income Taxes out of Total Taxes

This graph shows the revenue the U.S. government has made purely from income tax, in relation to all taxes.

The Internal Revenue Service has identified small business and sole proprietorship employees as the largest contributors to the tax gap between what Americans owe in federal taxes and what the federal government receives. Rather than W-2 wage earners and corporations, small business and sole proprietorship employees contribute to the tax gap, because there are few ways for the government to know about skimming or non-reporting of income without mounting more significant investigations. When tips, side-jobs, cash receipts, and barter income is not reported it is illegal cheating, because no tax is paid by individuals. Similarly, those who are self-employed or run small businesses may not declare income and evade the payment of taxes.

Examples of Tax Evasion

An IRS report indicates that, in 2009, 1,470 individuals earning more than $1,000,000 annually faced a net tax liability of zero or less. Also, in 1998 alone, a total of 94 corporations faced a net liability of less than half the full 35% corporate tax rate and the corporations Lyondell Chemical, Texaco, Chevron, CSX, Tosco, PepsiCo, Owens & Minor, Pfizer, JP Morgan Saks, Goodyear, Ryder, Enron, Colgate-Palmolive, Worldcom, Eaton, Weyerhaeuser, General Motors, El Paso Energy, Westpoint Stevens, MedPartners, Phillips Petroleum, McKesson, and Northrup Grumman all had net negative tax liabilities. Additionally, this phenomenon was widely documented regarding General Electric in early 2011. A Government Accountability Office study found that, from 1998 to 2005, 55% of United States companies paid no federal income taxes during at least one year in a seven-year period it studied. A review in 2011 by Citizens for Tax Justice and the Institute on Taxation and Economic Policy of companies in the Fortune 500 profitable every year from 2008 through 2010 stated these companies paid an average tax rate of 18.5%, and that 30 of these companies actually had a negative income tax due.

In the United States, the IRS estimate of the 2001 tax gap was 450 billion. A more recent study estimates the 2008 tax gap in the range of $450–$500 billion, and unreported income to be approximately $2 trillion. Thus, 18-19 percent of total reportable income is not properly reported to the IRS.