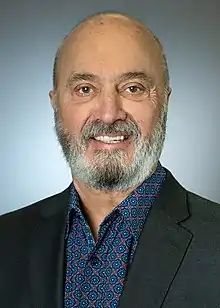

John Antioco

John Antioco is an American businessman, known for being the former CEO of Blockbuster Video who missed an opportunity to purchase Netflix before it became a multi-billion dollar streaming platform. He is now the chairman of the board of directors at Red Mango and the Managing Partner of JAMCO Interests LLC.[6]

John Antioco | |

|---|---|

John Antioco, 2022 | |

| Born | November 1, 1949 |

| Education | New York Institute of Technology (BS)[2] |

| Employer(s) | Managing Member of JAMCO Interests,[3] Chairman of Brix Holdings,[4] Chairman of Red Mango[5] |

| Known for | CEO of Blockbuster[5] Executive roles at 7-Eleven, Circle K, and Taco Bell[5] |

| Title | Chairman |

| Term | 2008–present[5] |

Biography

John Antioco was born and raised in Brooklyn, New York.[1][7] His father was a milkman, whom Antioco would sometimes accompany on his morning delivery route.[7] He is a graduate of the New York Institute of Technology, where he earned a B.S. in Business Administration.[2]

Antioco is best known for declining an offer, from Reed Hastings, to purchase Netflix for $50 million in 2000, while CEO of Blockbuster. He also refused a proposal from Netflix to run Blockbuster's online presence.[8]

John Antioco was a member of the board of governors of the Boys & Girls Clubs of America.[9]

Career

7-Eleven

Antioco began his professional career at 7-Eleven, which he joined as a management trainee in 1970.[10] He was at the company for 20 years, in various roles.[11][12] As Senior Vice President of Marketing in April 1989, he was responsible for bringing on advertising firm J. Walter Thompson to create a slate of television commercials that marketed 7-Eleven to new-collar workers.[11] Antioco was also Senior Vice President of Operations, which meant he was in charge of operations for every 7-Eleven store worldwide.[12][10]

Pearle Vision, Circle-K, and Taco Bell

Antioco left 7-Eleven in 1990 to become COO at Pearle Vision.[10][13]

In 1991, he joined the convenience store chain Circle K, where he assumed the role of president and COO.[7] Circle K had filed for bankruptcy in May of 1990 and Antioco was brought in to streamline the company's operations.[14][15] Under Antioco's leadership, the chain announced plans to close or sell about 1,550 of its least profitable locations and invest in improving the rest of its stores.[14] In March 1992, at which point Antioco had become the company's CEO, Circle K was sold for approximately $425 million to a private investor group led by management in conjunction with Investcorp.[16][17] In 1994, as CEO Antioco took Circle K public, selling 6.5 million shares of stock on the New York Stock Exchange.[15][18] Antioco left Circle K in 1996, shortly after overseeing a $710 million sale of the company to Tosco Corp.[19][18]

Antioco joined Taco Bell as its new CEO in 1996.[13] During his time at Taco Bell, he oversaw changes to the company's menu, advertising, and its franchising model.[7][20]

Blockbuster

Antioco took over as Blockbuster CEO in July 1997.[13] When he joined the company, it was struggling financially, with cash flow down 70 percent during the second quarter of the 1997 financial year.[21][13] This was in part due to Blockbuster's expansions into areas outside the video retail market, such apparel sales and a chain of music stores called Blockbuster Music.[13][22][23] Antioco decoupled Blockbuster Music from its video division, putting it under separate management.[24] The music store division was sold in August 1998 by Blockbuster's parent company Viacom to Wherehouse Entertainment for $115 million.[21][24] Early in Antioco's CEO tenure, Blockbuster also ended its relationships with Virgin Interactive, Discovery Zone, and Spelling Entertainment.[25]

In 1998, Antioco entered Blockbuster into revenue-sharing agreements with Hollywood studios, which allowed its stores to obtain many copies of new releases at a lower price than their competitors.[7] In August 1999, Antioco took Blockbuster public, selling 18 percent of its stock on the New York Stock Exchange and raising $465 million.[21][23] On the day of the initial public offering, he rang the opening bell of the NYSE alongside actress Rene Russo.[26] At the time, Blockbuster's market share in the video rental space had recently grown to 31 percent.[25]

In 2004, Antioco oversaw the launch of a new DVD subscription service called Blockbuster Online.[27][28] The service allowed customers to rent Blockbuster DVDs online and have them delivered by mail.[27][29] By the end of 2006, Blockbuster Online had approximately two million subscribers.[27] In 2007, Antioco pushed to expand the service and rebranded it as Blockbuster Total Access, which in addition to offering online DVD rentals, also allowed customers to return a Blockbuster Online DVD to a brick and mortar Blockbuster store to receive one additional free rental.[29][30]

Under Antioco, Blockbuster launched these services in part to compete with Netflix, which at the time was a growing competitor in the video retail space.[27][28][30] It has been widely reported that, in 2000, Netflix co-founders Reed Hastings and Marc Randolph offered to sell their company to Blockbuster for $50 million, but Antioco declined.[31][32][23] Hastings and Randolph have also claimed this in books and interviews.[31][23][33] Antioco has disputed this version of events, stating that he never had serious discussions with Hastings or Randolph about acquiring Netflix.[31] In 2007, at the Sundance Film Festival, Antioco and Hastings met to discuss the possibility of Netflix purchasing Blockbuster Online.[34][35] Antioco preferred a full merger, and a deal between the two companies was never struck.[34][35]

Antioco left Blockbuster in 2007 due to disagreements with Blockbuster board members, most notably billionaire investor Carl Icahn, regarding the company's strategy.[36][37]

JAMCO and other roles

In February 2010, Antioco founded JAMCO Interests, a private equity firm that invests in retail and hospitality ventures.[38][39] JAMCO, through its subsidiary Brix Holdings, holds an interest in chain restaurants such as Red Mango, Souper Salad, and Friendly's, which it purchased in 2020 for $2 million following the chain's bankruptcy.[40][41][42][43] JAMCO is also a member of TriArtisan Partners, an investment group that owns TGI Fridays, where Antioco served as interim CEO in 2015.[44][45] He was also CEO of P.F. Chang's for approximately one year, following the company's acquisition by TriArtisan Partners.[46] Antioco is currently chairman of Red Mango, a position he has held since 2008.[40][5]

In August 2011, Antioco was appointed chairman of the board at Rave Cinemas.[12][47] He was chairman when Rave sold 32 of its theaters to Cinemark in November 2012 for approximately $240 million.[48][49]

References

- Rayner, Abigail (April 2, 2005). "Big Shot". The Times. Retrieved January 4, 2022.

- "Fast Facts: Blockbuster Key Players". Fox News. May 11, 2005. Retrieved January 4, 2022.

- "Our Team". JAMCO Interests. January 4, 2022. Retrieved January 4, 2022.

- "Red Mango parent forms company to buy, grow smaller brands". Dallas Morning News. May 13, 2014. Retrieved January 4, 2022.

- Brown, Steven E.F. (August 12, 2008). "Red Mango raises $12 million". San Francisco Business Times. Retrieved January 4, 2022.

- "Our Team". BRIX Holdings. Retrieved 2017-08-04.

- Sweeting, Paul (November 25, 2002). "John Antioco, Innovator in video retailing, Chairman & CEO, Blockbuster Inc". Video Business. p. V5.

- Graser, Marc (2013-11-12). "Epic Fail: How Blockbuster Could Have Owned Netflix". Variety.com. Variety Media, LLC. Retrieved 2019-01-07.

in 2000 [...] Reed [Hastings, Netflix CEO] had the chutzpah to propose to [Blockbuster] that [Netflix] run their brand online and that they run [our] brand in the stores and they just about laughed us out of their office.

- "BGCA - John Antioco". stg.bgca.org. Retrieved 2017-08-04.

- Szalai, George (March 21, 2007). "Antioco checks out at B'buster". The Hollywood Reporter. Retrieved January 4, 2022.

- Rothenburg, Randall (April 28, 1989). "7-Eleven Reaches Out With Realism". New York Times. Retrieved January 4, 2022.

- Lang, Brent (August 18, 2011). "Former Blockbuster Chief John Antioco Named Head of Rave Cinemas". Reuters. Retrieved January 4, 2022.

- Johnson, Greg (June 4, 1997). "Taco Bell Chief Antioco Moving To Blockbuster". Los Angeles Times. Retrieved January 4, 2022.

- Carlson, Gus (December 19, 1991). "A Victim of Too Much Convenience". Miami Herald. p. 6.

- Meyer, Tara (June 23, 1995). "Circle K Updating Image Chain Adding Food Service, Polishing Store Look". The Oklahoman. Retrieved January 4, 2022.

- "Circle K to be acquired for $425 million". UPI. March 16, 1992. Retrieved January 4, 2022.

- Faison Jr., Seth (March 17, 1992). "Investcorp Heads Group Seeking to Buy Circle K". New York Times. Retrieved January 4, 2022.

- Johnson, Greg (October 11, 1996). "PepsiCo Ousts Longtime President of Taco Bell". Los Angeles Times. Retrieved January 4, 2022.

- "Circle K Chief Plans to Leave Following Purchase by Tosco". Wall Street Journal. May 30, 1996. Retrieved January 4, 2022.

- McDowell, Bill (February 10, 1997). "Taco Bell Plans Overhaul To Get Beyond Low Prices". Ad Age. Retrieved January 4, 2022.

- Poggi, Jeanine (September 23, 2010). "Blockbuster's Rise and Fall: The Long, Rewinding Road". The Street. Retrieved January 4, 2022.

- Shapiro, Eben; Deogun, Nikhil (June 4, 1997). "Antioco to Take Top Job At Troubled Blockbuster". Wall Street Journal. Retrieved January 4, 2022.

- Zetlin, Minda (September 20, 2019). "Blockbuster Could Have Bought Netflix for $50 Million, but the CEO Thought It Was a Joke". Inc Magazine. Retrieved January 4, 2022.

- White, George (August 12, 1998). "Wherehouse to Buy Blockbuster Music". Los Angeles Times. Retrieved January 4, 2022.

- Goodman, Cindy Krischer (August 12, 1999). "Blockbuster's Sequel Different From the Original". Miami Herald. p. 1C.

- Pappademas, Alex (November 7, 2013). "Blockbuster Video: 1985-2013". Grantland. Retrieved January 4, 2022.

- Huddlestone Jr., Tom (September 22, 2020). "Netflix didn't kill Blockbuster — how Netflix almost lost the movie rental wars". CNBC. Retrieved January 4, 2022.

- Olito, Frank (August 20, 2020). "The Rise and Fall of Blockbuster". Business Insider. Retrieved January 4, 2022.

- Haque, Nafiul (October 23, 2021). "The Rise and Fall of Blockbuster: Why Blockbuster Really Failed?". Tech Inspection. Retrieved January 4, 2022.

- Keating, Gina (June 13, 2007). "Blockbuster CEO promises "pedal to metal" online". Reuters. Retrieved January 4, 2022.

- Cagnassola, Mary Ellen; Giella, Lauren (March 11, 2021). "Fact Check: Did Blockbuster Turn Down Chance to Buy Netflix for $50 Million". Newsweek. Retrieved February 4, 2022.

- Graser, Marc Ellen (November 12, 2013). "Epic Fail: How Blockbuster Could Have Owned Netflix". Variety. Retrieved March 23, 2022.

- Levin, Sam (September 14, 2019). "Netflix co-founder: 'Blockbuster laughed at us … Now there's one left'". The Guardian. Retrieved March 23, 2022.

- Sandoval, Greg (May 25, 2011). "Former Blockbuster CEO tells his side of Netflix story". Reuters. Retrieved January 4, 2022.

- Wilonsky, Robert (May 25, 2011). "Bloomberg Series Reveals How Netflix Needed Blockbuster". Retrieved January 4, 2022.

- Peers, Martin; Zimmerman, Ann (May 12, 2005). "Dissident Investor Icahn Wins Board Seats at Blockbuster". Wall Street Journal. Retrieved January 4, 2022.

- Wilkerson, David (April 28, 2005). "Icahn keeps firing at Blockbuster". Retrieved January 4, 2022.

- "Jamco Interests LLC". JAMCO Interests. January 4, 2022. Retrieved January 4, 2022.

- "Sherif Mityas takes on additional role as president of BRIX Holdings". NBC News. January 12, 2022. Retrieved January 4, 2022.

- Jennings, Lisa (May 15, 2014). "Red Mango parent reveals plans for two newest brands". Retrieved January 4, 2022.

- Jennings, Lisa (July 28, 2021). "Friendly's/Brix Holdings names former P.F. Chang's exec to role of chief experience officer". Retrieved January 4, 2022.

- Jennings, Lisa (December 15, 2021). "Friendly's/Brix Holdings names Carissa DeSantis chief technology officer". Retrieved January 4, 2022.

- Maze, Jonathan (November 2, 2020). "Friendly's Declares Bankruptcy and Will Be Sold to the Owner of Red Mango". Retrieved January 4, 2022.

- Ruggless, Ron (July 13, 2015). "Nick Shepherd resigning as TGI Fridays' CEO". Retrieved January 4, 2022.

- Lalley, Heather (January 13, 2022). "Red Mango Parent Names Sherif Mityas President". Retrieved January 13, 2022.

- Nanda, Ashish; Nohria, Nitin; Cross, Margaret (March 30, 2021). "P.F. Chang's". Harvard Business School Case 721-380.

- "Ex-Blockbuster Boss John Antioco Tapped As Chairman Of Board At Rave Cinemas". Deadline. August 8, 2011. Retrieved January 4, 2022.

- Verrier, Richard (November 17, 2012). "Cinemark signs deal to buy Rave Cinemas". Los Angeles Times. Retrieved January 4, 2022.

- Stewart, Andrew (November 19, 2012). "Cinemark buys Rave Cinemas". Retrieved January 4, 2022.

External links

- How I Did It: Blockbuster’s Former CEO on Sparring with an Activist Shareholder

- Bloomberg profile no longer valid**

- A Look Back At Why Blockbuster Really Failed And Why It Didn’t Have To

- Former Blockbuster CEO tells his side of Netflix story

- Former rival's advice to Netflix: 'Don't let Icahn get to you'

- Ex-Blockbuster Boss John Antioco Tapped As Chairman Of Board At Rave Cinemas

- JOHN F. ANTIOCO profile at The Wall Street Transcript

- Executive Profile - CIC Advantage Holdings LLC - John F. Antioco - Customer Intelligence