Mizuho Financial Group

Mizuho Financial Group, Inc. (株式会社みずほフィナンシャルグループ, Kabushiki-gaisha Mizuho Finansharu Gurūpu), abbreviated as MHFG, or simply called Mizuho, is a banking holding company headquartered in the Ōtemachi district of Chiyoda, Tokyo, Japan. The name "mizuho (瑞穂)" literally means "abundant rice" in Japanese and "harvest" in the figurative sense. Upon its founding, it was the largest bank in the world by assets.[2] It is considered a systemically important bank by the Financial Stability Board.

| |

Mizuho Financial Group Headquarters the Otemachi Tower in Tokyo since 2014 | |

Native name | 株式会社みずほフィナンシャルグループ |

|---|---|

Romanized name | Kabushiki gaisha Mizuho Finansharu Gurūpu |

| Type | Public (Kabushiki gaisha) |

| Industry | Banking, financial services |

| Predecessors | |

| Founded | September 2000 |

| Headquarters | Otemachi Tower, , Japan |

Key people | Masahiro Kihara (President & CEO) |

| Products | Credit cards, consumer banking, corporate banking, investment banking, global wealth management, financial analysis, private equity |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 52,420 (March 2022) |

| Subsidiaries | |

| Website | mizuhogroup |

| Footnotes / references [1] | |

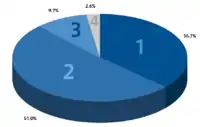

1. Mizuho Bank

2. Mizuho Corporate Bank

3. Mizuho Trust

4. Mizuho Securities

It holds assets in excess of $1.8 trillion US dollars through its control of Mizuho Bank and other operating subsidiaries.[3] The company's combined holdings form the third largest financial services group in Japan. Its banking businesses rank third in Japan after Mitsubishi UFJ Financial Group and SMBC Group. It is the 15th largest banking institution in the world by total assets as of December 2018.[4] It is the 90th largest company in the world according to Forbes rankings as of May 2017.[5] It is listed on the Tokyo Stock Exchange—where it is a constituent of the Nikkei 225 and TOPIX Core30 indices—and in the New York Stock Exchange in the form of American depositary receipts.

Mizuho offers a range of financial services, including banking, securities, trust and asset management services, employing more than 59,000 people[6] throughout 880 offices.[7]

History

Mizuho was established originally as Mizuho Holdings, Inc. by the merger of Dai-Ichi Kangyo Bank, Fuji Bank, and the Industrial Bank of Japan in 2000. The earliest history of the companies that formed the Mizuho group was Yasuda-ya, which was founded as a private company in 1864.[8] Then in 1872 the Dai-Ichi Bank, Ltd. was established as the first bank in Japan to be established under the nation's newly minted National Bank Act of 1872. In 1897 the Nippon Kangyo Bank, Ltd. and the Industrial Bank of Japan, Limited were next established as governmental institutions.[9] In 1912 Yasuda-ya was incorporated and renamed Yasuda Bank, in a process where Yasuda absorbed the assets and business of seventeen different Japanese banking institutions.[10]

In 1948 Yasuda Bank was itself renamed the Fuji Bank, Limited. Over the coming years, Fuji Bank would serve as the major financier for post-war Japanese economic growth, working with other major banks as partners when it was at risk of over-extending its funds.[11] In 1950 the Nippon Kangyo Bank and IBJ were re-privatized after serving as semi-public banks for decades, following a recommendation from the Supreme Commander of the Allied Powers General Douglas MacArthur and the United States during the post-World War II economic reforms.[12] In 1971 the Dai-ichi Bank and the Nippon Kangyo Bank merged to form the Dai-Ichi Kangyo Bank, Limited.[9] Mizuho itself was created from the remnants of these mergers, and in 1999 DKB, Fuji and IBJ announced an agreement to consolidate the three banks' operations.[13] This resulted in the establishment of the holding company named Mizuho Holdings, Inc in the year 2000. Then in 2002 DKB, Fuji and IBJ were officially and legally combined into two banks,[14] Mizuho Bank, Ltd. and Mizuho Corporate Bank, Ltd.[15] Initially Mizuho traded under the ticker symbol MHHD on the London Stock Exchange.[16]

The merger resulted in the world's first trillion-dollar bank, with its $1.2 trillion in assets, surpassing the next largest bank by about $480 billion. The move has been considered to have formed one of the first "mega-institutions" in the financial industry, beginning a trend in the industry of large-scale bank mergers referred to as the "consolidation movement" during the 2000s.[17] Though while other mega-institutions were composed of one major player and several minor ones, Mizuho was composed of three relatively equal institutions in terms of their size and influence.[18] It remained the largest mega-bank in the world until 2005.[14]

The name "Mizuho" means "new, bountiful, and rich harvest of rice" in Japanese.[19] The original structure saw the founding of the Mizuho Bank, focusing on individuals and SMEs, and the Mizuho Corporate Bank, which focuses on corporate entities.[20] The initial strategy of the company was to expand its lending operations with individuals and SMEs, and begin to offer fee-based services including securitizations, merger and acquisitions support, security-based investment banking, and syndicated loans. At the time, Mizuho controlled about 50% of the syndicated loans market.[21] Mizuho also launched one of the first Internet-based securities products in 2000.[22]

In 2003, Mizuho Financial Group, Inc. took over the operations of Mizuho Holdings.[14] On October 1, 2005, all subsidiaries of Mizuho Holdings were transferred to the direct control of Mizuho Financial Group.[14] Mizuho Holdings, no longer a bank holding company, was then renamed Mizuho Financial Strategy, which now focuses on providing advisory services.[23] Mizuho Financial Group was in turn listed on the New York Stock Exchange under the stock symbol MFG in 2006.[24]

Mizuho, through its operations in New York, became involved in the subprime mortgage crisis and lost seven billion dollars on the sale of collateralized debt obligations backed by subprime mortgages. It is the Asian bank which suffered the most losses due to the crisis.[25] In 2012 Mizuho Financial Group acquired 100% of the assets from the Brazilian bank Banco WestLB do Brasil S.A.[26] In 2014 the company underwent a board of directors reform in order to streamline its corporate culture into a more of a single identity, although its original board founded in 2002 was consistent with Japanese banking protocols.[18] In 2016 they opened their global transactions banking headquarters in Singapore, and have offices for this unit in China, Hong Kong, Tokyo, London, and New York City.[27] That year they also began a partnership with Cognizant, to develop block-chain methods of securing the banks private records.[28]

Senior leadership

Presidents and CEOs

- Katsuyuki Sugita (2001–2002); co-CEO

- Terunobu Maeda (2002–2009)

- Takashi Tsukamoto (2009–2011)

- Yasuhiro Sato (2011–2018)

- Tatsufumi Sakai (2018–2022)

- Masahiro Kihara (since 2022)

Divisions

Mizuho splits its business into four distinct divisions, on a global basis:

Retail Group

Mizuho is active in retail banking with 515 branches and over 11,000 automated teller machines (ATMs).[29] Mizuho Bank is the only bank, other than Japan Post Bank, to have branches in every prefecture in Japan.[30] It serves over 26 million Japanese households,[31] 90,000 SME customers, 2500 corporations,[32] and retail brokerage clients under the name Mizuho Investors Securities nationwide, with $114 billion in retail customer assets under its management as of 2016.[33]

Global Corporate Group

Mizuho predecessors, the Dai-Ichi Kangyo Bank (DKB), the Fuji Bank (Fuji) and the Industrial Bank of Japan (IBJ), had great control over many Japanese companies through keiretsu system. The three banks led the DKB Group, Fuyo Group and the IBJ Group respectively. The Fuyo Group traces its history as far back as the old Yasuda zaibatsu. Even now, seven out of ten companies listed on the Tokyo Stock Exchange have dealings with Mizuho.[34]

Global wealth and asset management

- Mizuho Trust & Banking

- Mizuho Private Wealth Management

- Asset Management One

Asset Management One manages a number of ETFs which are listed in Japan, but some of these ETFs are very illiquid because no market maker was appointed. For example, One ETF Gold (1683:JP) frequently trades at a discount of more than 10% to the NAV.[35][36]

Strategy affiliates

- Mizuho Financial Strategy, formerly Mizuho Holdings, Inc.

- Mizuho Research Institute

- Mizuho Information & Research Institute

Offices

.jpg.webp) Former Mizuho Financial Group headquarters (now Otemachi Tower), formerly Fuji Bank head office, in Ōtemachi, Tokyo until 2014

Former Mizuho Financial Group headquarters (now Otemachi Tower), formerly Fuji Bank head office, in Ōtemachi, Tokyo until 2014.jpg.webp) Mizuho Bank head office in Uchisaiwaicho, Tokyo (see also Mizuho Bank Uchisaiwaichō Head Office Building)

Mizuho Bank head office in Uchisaiwaicho, Tokyo (see also Mizuho Bank Uchisaiwaichō Head Office Building) Mizuho Corporate Bank head office, formerly the Industrial Bank of Japan head office, bordering MHFG HQ in Ōtemachi, Tokyo

Mizuho Corporate Bank head office, formerly the Industrial Bank of Japan head office, bordering MHFG HQ in Ōtemachi, Tokyo Mizuho Securities Co. occupies Ōtemachi First Square, bordering MHFG HQ, in Ōtemachi, Tokyo.

Mizuho Securities Co. occupies Ōtemachi First Square, bordering MHFG HQ, in Ōtemachi, Tokyo.

Sponsorship

Mizuho is a sponsor of the Tokyo International Marathon[37] and the 2020 Olympic Games and 2020 Paralympic Games.[38]

Notable employees

- Yoichiro Esaki, member of the House of Representatives

- Rin Ishigaki, poet

- Hirotaka Ishihara, member of the House of Representatives, son of Shintaro Ishihara

- Zenkichi Kojima, mayor of Shizuoka, Shizuoka

- Takeaki Matsumoto, member of the House of Representatives

- Shoichi Nakagawa, Minister of Finance, Minister of State in charge of Financial Services (2008–2009)

- Kei Ogura, singer

- Stanley Praimnath, survivor of the destruction of the World Trade Center on September 11th, 2001

- Mitsu Shimojo, member of the House of Representatives

- Yukio Tomioka, member of the House of Councillors

Controversies

In September 2013, a routine regulatory control unveiled that Mizuho enabled loans of up to $1.9 million to the Yakuza Japanese mafia. It also appeared that loans to the mob had been approved through its affiliate credit company Orient Corp. This scandal led to the resignation of the group's CEO Takashi Tsukamoto.[39][40]

In December 2019, a report named Mizuho as the top private lender to coal developers between January 2017 and September 2019.[41] In March 2020, Japanese NGO Kiko Network filed the first climate related shareholder resolution with a Japanese company proposing Mizuho align its investments with the goals of the Paris Agreement,[42] which was followed by investor support for the resolution.[43] In response, Mizuho has agreed not to finance any further coal projects, and to end all existing loans for coal projects by the year 2050.[44]

References

- "Consolidated Financial Statements for Fiscal 2022" (PDF). Mizhuo Group. 10 July 2023.

- Litterick, David (23 July 2001). "Nikkei at 16-year low". Telegraph.co.uk.

- "The World's Biggest Public Companies". Forbes.com.

- "The Top 100 Banks in the World 2016", Relbanks, 30 June 2016.

- "Forbes The World’s Biggest Public Companies 2016 RANKING.", Forbes, May 2016.

- "Mizuho Financial on the Forbes Top Regarded Companies List". Forbes.com.

- Walton, Gregory (27 November 2015). "Bank employee plunges to death in City of London". Telegraph.co.uk.

- "History of Mizuho". The Oriental Economist. 1966. p. 574.

- Newall, Sir Paul (17 December 2013). Japan and the City of London. A&C Black. ISBN 9781780939537 – via Google Books.

- Connors, Duncan (15 May 2016). A History of Money. University of Wales Press. ISBN 9781783163113 – via Google Books.

- Ogura, S. (18 December 2001). Banking: The State and Industrial Promotion in Developing Japan, 1900-73. Springer. ISBN 9780230598126 – via Google Books.

- Holtfrerich, Carl-L.; Reis, Jaime (5 December 2016). The Emergence of Modern Central Banking from 1918 to the Present. Routledge. ISBN 9781351890779 – via Google Books.

- "A super-bank in the making". The Japan Times.

- Padmalatha, Suresh (1 September 2011). Management Of Banking And Financial Services, 2/E. Pearson Education India. ISBN 9788131730942 – via Google Books.

- Tan, Chwee Huat (1 June 2018). Dictionary of Asia Pacific Business Terms. NUS Press. ISBN 9789971692759 – via Google Books.

- "FE Investegate -Mizuho Holdings Inc Announcements - Mizuho Holdings Inc: Delisting of Stock Timetable". Investegate.co.uk.

- Gaspar, Julian; Bierman, Leonard; Kolari, James; Hise, Richard; Smith, L. Murphy (18 February 2005). Introduction to Business. Cengage Learning. ISBN 9781111808976 – via Google Books.

- Mallin, Christine A. (27 May 2016). Handbook on Corporate Governance in Financial Institutions. Edward Elgar Publishing. ISBN 9781784711795 – via Google Books.

- Grosse, Robert E. (9 February 2009). The Future of Global Financial Services. John Wiley & Sons. ISBN 9781405142403 – via Google Books.

- Tan, Chwee Huat (1 June 2018). Dictionary of Asia Pacific Business Terms. NUS Press. ISBN 9789971692759 – via Google Books.

- Aggarwal, V.; Urata, S. (30 April 2016). Winning in Asia, Japanese Style: Market and Nonmarket Strategies for Success. Springer. ISBN 9781137109262 – via Google Books.

- "みずほフィナンシャルグループ、インターネット専業証券を本年中に設立". internet.watch.impress.co.jp.

- "Mizuho Financial Strategy Co., Ltd.: Private Company Information - Bloomberg". Bloomberg.com. 20 May 2023.

- Mover, The First (31 March 2017). "Mizuho: From Megabank To Global Financial Consultant". Seekingalpha.com.

- Flynn, Finbarr (29 October 2008). "Mizuho $7 Billion Loss Turned on Toxic Aardvark Made in America". Bloomberg. Retrieved 29 October 2008.

- Uranaka, Taiga (20 June 2012). "Mizuho agrees to buy WestLB Brazil unit for $380 million". Reuters.

- "Mizuho Seeks $100 Billion From Overseas Transaction Banking". Bloomberg.com. Bloomberg. 8 August 2017.

- "Mizuho financial group partners enters pact with Cognizant". Times of India.

- "Mizuho Bank gears up for new core banking system go-live". Bankingtech.com. 16 November 2016.

- Cybriwsky, Roman (18 February 2011). Historical Dictionary of Tokyo. Scarecrow Press. ISBN 9780810874893 – via Google Books.

- "Mizuho Bank, LTD. Transforms online and mobile banking systems". Archived from the original on 21 March 2016. Retrieved 1 June 2018.

- "Mida, Mizuho units team up - Business News - The Star Online". Thestar.com.my.

- "Mizuho Seeks to Challenge Nomura as Japan's Top Equity Firm". Bloomberg.com. 19 October 2016.

- IR Presentation at “CLSA Japan Forum 2005” 7 March 2005

- "1683 Quote - One ETF Gold Fund". Bloomberg.com.

- "Listed Issues".

- "Tokyo Will Be Added as Sixth Major Marathon". The New York Times. 2 November 2012.

- "Mizuho and SMFG join Tokyo 2020 Gold Partner Programme|The Tokyo Organising Committee of the Olympic and Paralympic Games". Tokyo2020.jp.

- Otake, Tomoko (13 November 2013). "Mizuho has more loans to the mob". The Japan Times. Retrieved 19 July 2018.

- McLannahan, Ben (26 December 2013). "Mizuho chairman to stand down over yakuza loans scandal". Financial Times. Archived from the original on 10 December 2022. Retrieved 19 July 2018.

- Takahashi, Ryusei (7 December 2019). "Japan's mega-banks named as world's biggest lenders for new coal plants". The Japan Times. Retrieved 30 January 2023.

- "Major shareholder to support first ever climate resolution in Japan". Fossil Free Japan. 16 June 2020. Retrieved 30 January 2023.

- Sheldrick, Aaron (6 April 2020). "Investors line up against Mizuho support for coal". Reuters.

- "Mizuho to stop lending to new coal power projects". Reuters. 15 April 2020. Retrieved 10 July 2023.

Mizuho Financial Group will stop financing new coal power projects and end all loans for coal by 2050, bowing to pressure from a group of leading investors for climate concessions ahead of the bank's annual shareholders' meeting in June.