Pareto principle

The Pareto principle states that for many outcomes, roughly 80% of consequences come from 20% of causes (the "vital few").[1] Other names for this principle are the 80/20 rule, the law of the vital few or the principle of factor sparsity.[2][3]

In 1941, Management consultant Joseph M. Juran developed the concept in the context of quality control and improvement after reading the works of Italian sociologist and economist Vilfredo Pareto, who wrote in 1906 about the 80/20 connection while teaching at the University of Lausanne.[4] In his first work, Cours d'économie politique, Pareto showed that approximately 80% of the land in the Kingdom of Italy was owned by 20% of the population. The Pareto principle is only tangentially related to the Pareto efficiency.

Mathematically, the 80/20 rule is roughly described by a power law distribution (also known as a Pareto distribution) for a particular set of parameters. Many natural phenomena distribute according to power law statistics.[5] It is an adage of business management that "80% of sales come from 20% of clients."[6]

History

In 1941, Joseph M. Juran, a Romanian-born American engineer, came across the work of Italian polymath Vilfredo Pareto. Pareto noted that approximately 80% of Italy's land was owned by 20% of the population.[7][5] Juran applied the observation that 80% of an issue is caused by 20% of the causes to quality issues. Later during his career, Juran preferred to describe this as "the vital few and the useful many" to highlight that the contribution of the remaining 80% should not be discarded entirely.[8]

In economics

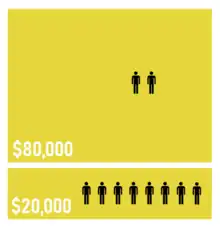

Pareto's observation was in connection with population and wealth. Pareto noticed that approximately 80% of Italy's land was owned by 20% of the population.[7] He then carried out surveys on a variety of other countries and found to his surprise that a similar distribution applied (see concentration of land ownership).

A chart that gave the effect a very visible and comprehensible form, the so-called "champagne glass" effect,[9] was contained in the 1992 United Nations Development Program Report, which showed that the distribution of global income is very uneven, with the richest 20% of the world's population receiving 82.7% of the world's income.[10] However, among nations, the Gini index shows that wealth distributions vary substantially around this norm.[11]

| Quintile of population | Income |

|---|---|

| Richest 20% | 82.70% |

| Second 20% | 11.75% |

| Third 20% | 2.30% |

| Fourth 20% | 1.85% |

| Poorest 20% | 1.40% |

The principle also holds within the tails of the distribution. The physicist Victor Yakovenko of the University of Maryland, College Park and AC Silva analyzed income data from the US Internal Revenue Service from 1983 to 2001 and found that the income distribution of the richest 1–3% of the population also follows Pareto's principle.[13]

In computing

In computer science the Pareto principle can be applied to optimization efforts.[14] For example, Microsoft noted that by fixing the top 20% of the most-reported bugs, 80% of the related errors and crashes in a given system would be eliminated.[15] Lowell Arthur expressed that "20% of the code has 80% of the errors. Find them, fix them!"[16] It was also discovered that, in general, 80% of a piece of software can be written in 20% of the total allocated time. Conversely, the hardest 20% of the code takes 80% of the time. This factor is usually a part of COCOMO estimating for software coding.

Occupational health and safety

Occupational health and safety professionals use the Pareto principle to underline the importance of hazard prioritization. Assuming 20% of the hazards account for 80% of the injuries, and by categorizing hazards, safety professionals can target those 20% of the hazards that cause 80% of the injuries or accidents. Alternatively, if hazards are addressed in random order, a safety professional is more likely to fix one of the 80% of hazards that account only for some fraction of the remaining 20% of injuries.[17]

Aside from ensuring efficient accident prevention practices, the Pareto principle also ensures hazards are addressed in an economical order, because the technique ensures the utilized resources are best used to prevent the most accidents.[18]

Other applications

Engineering and quality control

The Pareto principle is sometimes used in quality control, where it was first created.[19] It is the basis for the Pareto chart, one of the key tools used in total quality control and Six Sigma techniques. The Pareto principle serves as a baseline for ABC-analysis and XYZ-analysis, widely used in logistics and procurement for the purpose of optimizing stock of goods, as well as costs of keeping and replenishing that stock.[20] In engineering control theory, such as for electromechanical energy converters, the 80/20 principle applies to optimization efforts.[14]

The remarkable success of statistically based searches for root causes is based upon a combination of an empirical principle and mathematical logic. The empirical principle is usually known as the Pareto principle.[21] With regard to variation causality, this principle states that there is a non-random distribution of the slopes of the numerous (theoretically infinite) terms in the general equation.

All of the terms are independent of each other by definition. Interdependent factors appear as multiplication terms. The Pareto principle states that the effect of the dominant term is very much greater than the second-largest effect term, which in turn is very much greater than the third, and so on.[22] There is no explanation for this phenomenon; that is why we refer to it as an empirical principle.

The mathematical logic is known as the square-root-of-the-sum-of-the-squares axiom. This states that the variation caused by the steepest slope must be squared, and then the result added to the square of the variation caused by the second-steepest slope, and so on. The total observed variation is then the square root of the total sum of the variation caused by individual slopes squared. This derives from the probability density function for multiple variables or the multivariate distribution (we are treating each term as an independent variable).

The combination of the Pareto principle and the square-root-of-the-sum-of-the-squares axiom means that the strongest term in the general equation totally dominates the observed variation of effect. Thus, the strongest term will dominate the data collected for hypothesis testing.

In the systems science discipline, Joshua M. Epstein and Robert Axtell created an agent-based simulation model called Sugarscape, from a decentralized modeling approach, based on individual behavior rules defined for each agent in the economy. Wealth distribution and Pareto's 80/20 principle emerged in their results, which suggests the principle is a collective consequence of these individual rules.[23]

Health and social outcomes

In 2009, the Agency for Healthcare Research and Quality said 20% of patients incurred 80% of healthcare expenses due to chronic conditions.[24] A 2021 analysis showed unequal distribution of healthcare costs, with older patients and those with poorer health incurring more costs.[25] The 20/80 rule has been proposed as a rule of thumb for the infection distribution in superspreading events.[26][27] However, the degree of infectiousness has been found to be distributed continuously in the population.[27] In epidemics with super-spreading, the majority of individuals infect relatively few secondary contacts.

Mathematical notes

Valid application of the rule requires demonstrating not that one can explain most of the variance or that some small set of observations are explained by a small proportion of process variables, but rather that a large proportion of process variation is associated with a small proportion of the process variables.[3]

This is a special case of the wider phenomenon of Pareto distributions. If the Pareto index α, which is one of the parameters characterizing a Pareto distribution, is chosen as α = log45 ≈ 1.16, then one has 80% of effects coming from 20% of causes.[28]

It follows that one also has 80% of that top 80% of effects coming from 20% of that top 20% of causes, and so on. Eighty percent of 80% is 64%; 20% of 20% is 4%, so this implies a "64/4" law; and similarly implies a "51.2/0.8" law. Similarly for the bottom 80% of causes and bottom 20% of effects, the bottom 80% of the bottom 80% only cause 20% of the remaining 20%. This is broadly in line with the world population/wealth table above, where the bottom 60% of the people own 5.5% of the wealth, approximating to a 64/4 connection.

The 64/4 correlation also implies a 32% 'fair' area between the 4% and 64%, where the lower 80% of the top 20% (16%) and upper 20% of the bottom 80% (also 16%) relates to the corresponding lower top and upper bottom of effects (32%). This is also broadly in line with the world population table above, where the second 20% control 12% of the wealth, and the bottom of the top 20% (presumably) control 16% of the wealth.

The term 80/20 is only a shorthand for the general principle at work. In individual cases, the distribution could just as well be, say, nearer to 90/10 or 70/30. There is no need for the two numbers to add up to the number 100, as they are measures of different things, (e.g., 'number of customers' vs 'amount spent'). However, each case in which they do not add up to 100%, is equivalent to one in which they do. For example, as noted above, the "64/4 law" (in which the two numbers do not add up to 100%) is equivalent to the "80/20 law" (in which they do add up to 100%). Thus, specifying two percentages independently does not lead to a broader class of distributions than what one gets by specifying the larger one and letting the smaller one be its complement relative to 100%. Thus, there is only one degree of freedom in the choice of that parameter.

Adding up to 100 leads to a nice symmetry. For example, if 80% of effects come from the top 20% of sources, then the remaining 20% of effects come from the lower 80% of sources. This is called the "joint ratio", and can be used to measure the degree of imbalance: a joint ratio of 96:4 is extremely imbalanced, 80:20 is highly imbalanced (Gini index: 76%), 70:30 is moderately imbalanced (Gini index: 28%), and 55:45 is just slightly imbalanced (Gini index 14%).

The Pareto principle is an illustration of a "power law" relationship, which also occurs in phenomena such as bush fires and earthquakes.[29] Because it is self-similar over a wide range of magnitudes, it produces outcomes completely different from Normal or Gaussian distribution phenomena. This fact explains the frequent breakdowns of sophisticated financial instruments, which are modeled on the assumption that a Gaussian relationship is appropriate to something like stock price movements.[30]

Gini coefficient and Hoover index

Using the "A : B" notation (for example, 0.8:0.2) and with A + B = 1, inequality measures like the Gini index (G) and the Hoover index (H) can be computed. In this case both are the same:

See also

- 1% rule

- 10/90 gap

- Benford's law

- Diminishing returns

- Elephant flow

- Keystone species

- Long tail

- Matthew effect

- Mathematical economics

- Megadiverse countries

- Microtransaction whale

- Ninety–ninety rule

- Pareto distribution

- Pareto priority index

- Parkinson's law

- Peter principle

- Power law

- Price's law

- Principle of least effort

- Profit risk

- Rank–size distribution

- Regression toward the mean

- Sturgeon's law

- Vitality curve

- Wealth concentration

- Zipf's law

References

- Bunkley, Nick (March 3, 2008). "Joseph Juran, 103, Pioneer in Quality Control, Dies". The New York Times.

- Bunkley, Nick (March 3, 2008). "Joseph Juran, 103, Pioneer in Quality Control, Dies". The New York Times. Archived from the original on September 6, 2017. Retrieved 25 January 2018.

- Box, George E.P.; Meyer, R. Daniel (1986). "An Analysis for Unreplicated Fractional Factorials". Technometrics. 28 (1): 11–18. doi:10.1080/00401706.1986.10488093.

- Pareto, Vilfredo (1896–1897). Cours d'Économie Politique (in two volumes). F. Rouge (Lausanne) & F. Pichon (Paris). Volume 1 Volume 2

- Newman, MEJ (2005). "Power laws, Pareto Distributions, and Zipf's law" (PDF). Contemporary Physics. 46 (5): 323–351. arXiv:cond-mat/0412004. Bibcode:2005ConPh..46..323N. doi:10.1080/00107510500052444. S2CID 202719165. Retrieved 10 April 2011.

- Marshall, Perry (2013-10-09). "The 80/20 Rule of Sales: How to Find Your Best Customers". Entrepreneur. Retrieved 2018-01-05.

- Pareto, Vilfredo; Page, Alfred N. (1971), Translation of Manuale di economia politica ("Manual of political economy"), A.M. Kelley, ISBN 978-0-678-00881-2

- "Pareto Principle (80/20 Rule) & Pareto Analysis Guide". Juran. 2019-03-12. Retrieved 2021-02-27.

- Gorostiaga, Xabier (January 27, 1995), "World has become a 'champagne glass' globalization will fill it fuller for a wealthy few", National Catholic Reporter

- United Nations Development Program (1992), 1992 Human Development Report, New York: Oxford University Press

- Hillebrand, Evan (June 2009). "Poverty, Growth, and Inequality over the Next 50 Years" (PDF). FAO, United Nations – Economic and Social Development Department. Archived from the original (PDF) on 2017-10-20.

- Human Development Report 1992, Chapter 3, retrieved 2007-07-08

- Yakovenko, Victor M.; Silva, A. Christian (2005), Chatterjee, Arnab; Yarlagadda, Sudhakar; Chakrabarti, Bikas K. (eds.), "Two-class Structure of Income Distribution in the USA: Exponential Bulk and Power-law Tail", Econophysics of Wealth Distributions: Econophys-Kolkata I, New Economic Windows, Springer Milan, pp. 15–23, doi:10.1007/88-470-0389-x_2, ISBN 978-88-470-0389-7

- Gen, M.; Cheng, R. (2002), Genetic Algorithms and Engineering Optimization, New York: Wiley

- Rooney, Paula (October 3, 2002), Microsoft's CEO: 80–20 Rule Applies To Bugs, Not Just Features, ChannelWeb

- Pressman, Roger S. (2010). Software Engineering: A Practitioner's Approach (7th ed.). Boston, Mass: McGraw-Hill, 2010. ISBN 978-0-07-337597-7.

- Woodcock, Kathryn (2010). Safety Evaluation Techniques. Toronto, ON: Ryerson University. p. 86.

- "Introduction to Risk-based Decision-Making" (PDF). USCG Safety Program. United States Coast Guard. Retrieved 14 January 2012.

- 50MINUTES.COM (2015-08-17). The Pareto Principle for Business Management: Expand your business with the 80/20 rule. 50 Minutes. ISBN 9782806265869.

- Rushton, Oxley & Croucher (2000), pp. 107–108.

- Juran, Joseph M., Frank M. Gryna, and Richard S. Bingham. Quality control handbook. Vol. 3. New York: McGraw-Hill, 1974.

- Shainin, Richard D. “Strategies for Technical Problem Solving.” 1992, Quality Engineering, 5:3, 433-448

- Epstein, Joshua; Axtell, Robert (1996), Growing Artificial Societies: Social Science from the Bottom-Up, MIT Press, p. 208, ISBN 0-262-55025-3

- Weinberg, Myrl (July 27, 2009). "Myrl Weinberg: In health-care reform, the 20-80 solution". The Providence Journal. Archived from the original on 2009-08-02.

- Sawyer, Bradley; Claxton, Gary. "How do health expenditures vary across the population?". Peterson-Kaiser Health System Tracker. Peterson Center on Healthcare and the Kaiser Family Foundation. Retrieved 13 March 2019.

- Galvani, Alison P.; May, Robert M. (2005). "Epidemiology: Dimensions of superspreading". Nature. 438 (7066): 293–295. Bibcode:2005Natur.438..293G. doi:10.1038/438293a. PMC 7095140. PMID 16292292.

- Lloyd-Smith, JO; Schreiber, SJ; Kopp, PE; Getz, WM (2005). "Superspreading and the effect of individual variation on disease emergence". Nature. 438 (7066): 355–359. Bibcode:2005Natur.438..355L. doi:10.1038/nature04153. PMC 7094981. PMID 16292310.

- Dunford (2014), "The Pareto Principle" (PDF), The Plymouth Student Scientist

- Bak, Per (1999), How Nature Works: the science of self-organized criticality, Springer, p. 89, ISBN 0-387-94791-4

- Taleb, Nassim (2007), The Black Swan, pp. 229–252, 274–285

Further reading

- Bookstein, Abraham (1990), "Informetric distributions, part I: Unified overview", Journal of the American Society for Information Science, 41 (5): 368–375, doi:10.1002/(SICI)1097-4571(199007)41:5<368::AID-ASI8>3.0.CO;2-C

- Klass, O. S.; Biham, O.; Levy, M.; Malcai, O.; Soloman, S. (2006), "The Forbes 400 and the Pareto wealth distribution", Economics Letters, 90 (2): 290–295, doi:10.1016/j.econlet.2005.08.020

- Koch, R. (2004), Living the 80/20 Way: Work Less, Worry Less, Succeed More, Enjoy More, London: Nicholas Brealey Publishing, ISBN 1-85788-331-4

- Reed, W. J. (2001), "The Pareto, Zipf and other power laws", Economics Letters, 74 (1): 15–19, doi:10.1016/S0165-1765(01)00524-9

- Rosen, K. T.; Resnick, M. (1980), "The size distribution of cities: an examination of the Pareto law and primacy", Journal of Urban Economics, 8 (2): 165–186, doi:10.1016/0094-1190(80)90043-1

- Rushton, A.; Oxley, J.; Croucher, P. (2000), The handbook of logistics and distribution management (2nd ed.), London: Kogan Page, ISBN 978-0-7494-3365-9.